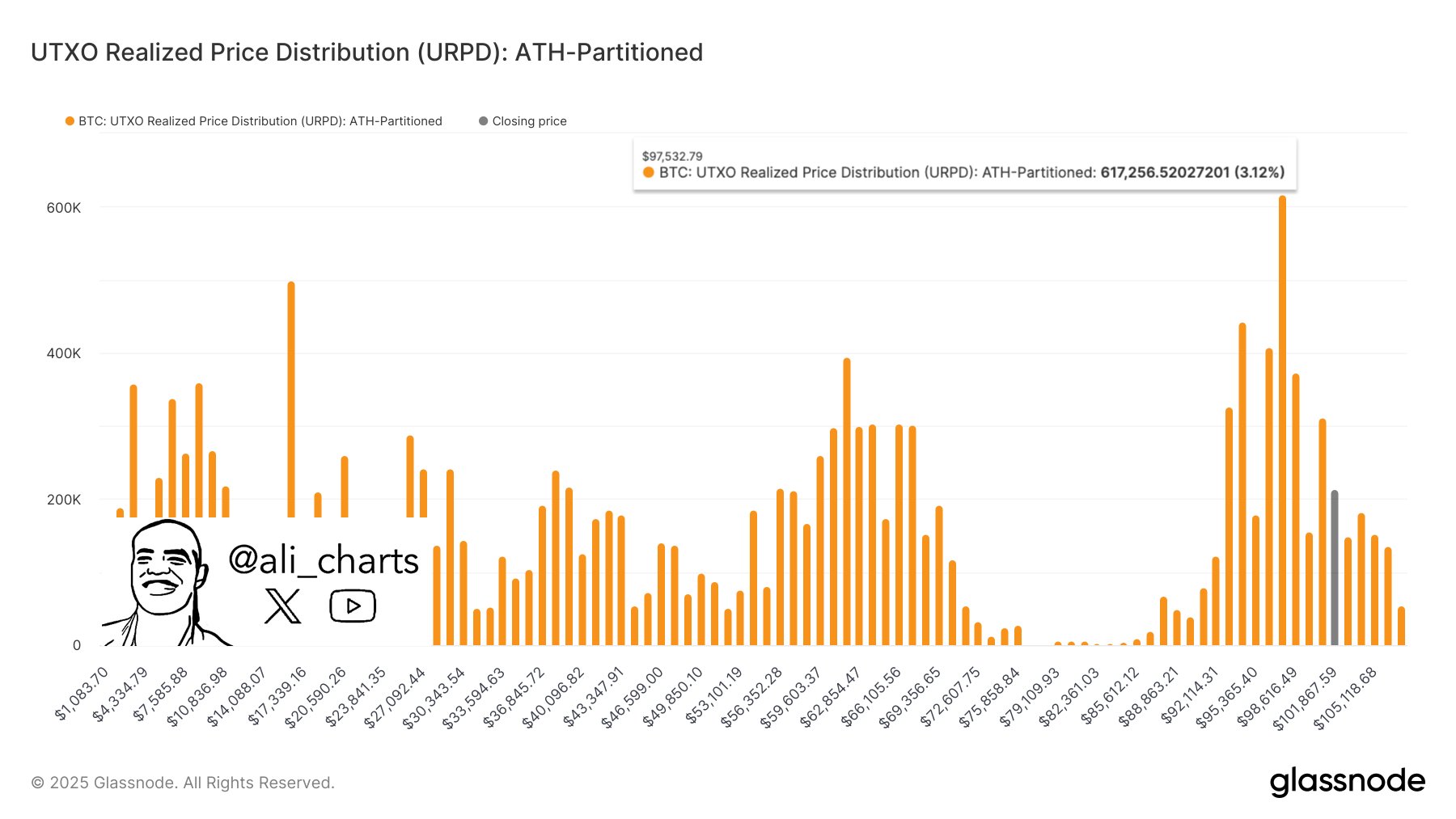

Ali, a crypto -analyst, indicates a potential level of Bitcoin’s support of $ 97,530 as a key in maintaining a current bull impulse. The main level of support that will be controlled for bitcoins is $ 97,530. To remain at this level is crucial for maintaining the current bull impulse afloat, Ali believes.

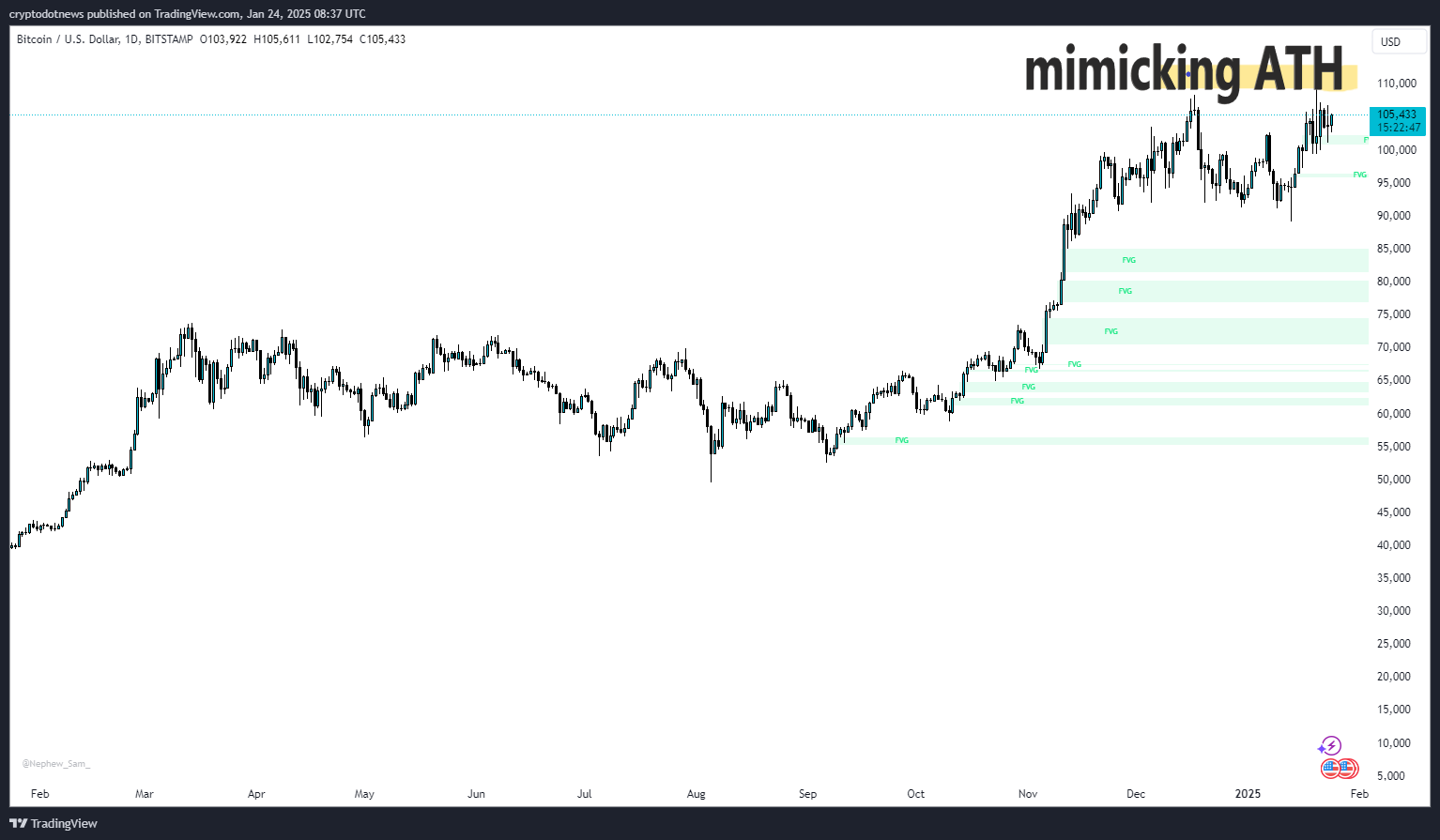

Bitcoin (BTC) is traded in the rigid range since January 20, 2025 reached a new record maximum (ATH) in the amount of $ 109 thousand. The United States is currently quoted in $ 105,128.95 from the previous maximum, according to CoinmarketCap.

Understanding the level of Bitcoin support

In crypto -trade trade, support levels are an important price when the demand for the purchase usually increases. If the BTC remains above this significant threshold, it can continue its trajectory up, while investors feel confident in this bull decision. This level is a key lakmus test on the BTC market during volatility.

As published by the analyst Ali, UTXO has implemented price distribution (URPD) informs traders about where Bitcoin holders acquired their BTC or the latter tolerated their BTC. This indicates the amount of BTC, which last time moved to wallets at a price at various prices.

In US $ 97 530, the URPD diagram shows an activity group, which means that many investors are purchased or sitting on BTC at this level. The strong interest of buyers at this level enhances its role as psychological and technical support.

Bitcoin imitates the past tendency ATH

The behavior of about 97,530 dollars imitates that at the previous stages of ATH consolidation for BTC. As in the case of previous cycles, the price is stabilized near the support zone with potential for growth. This level showed a strong confidence of the buyer, although there are some refusal of the light.

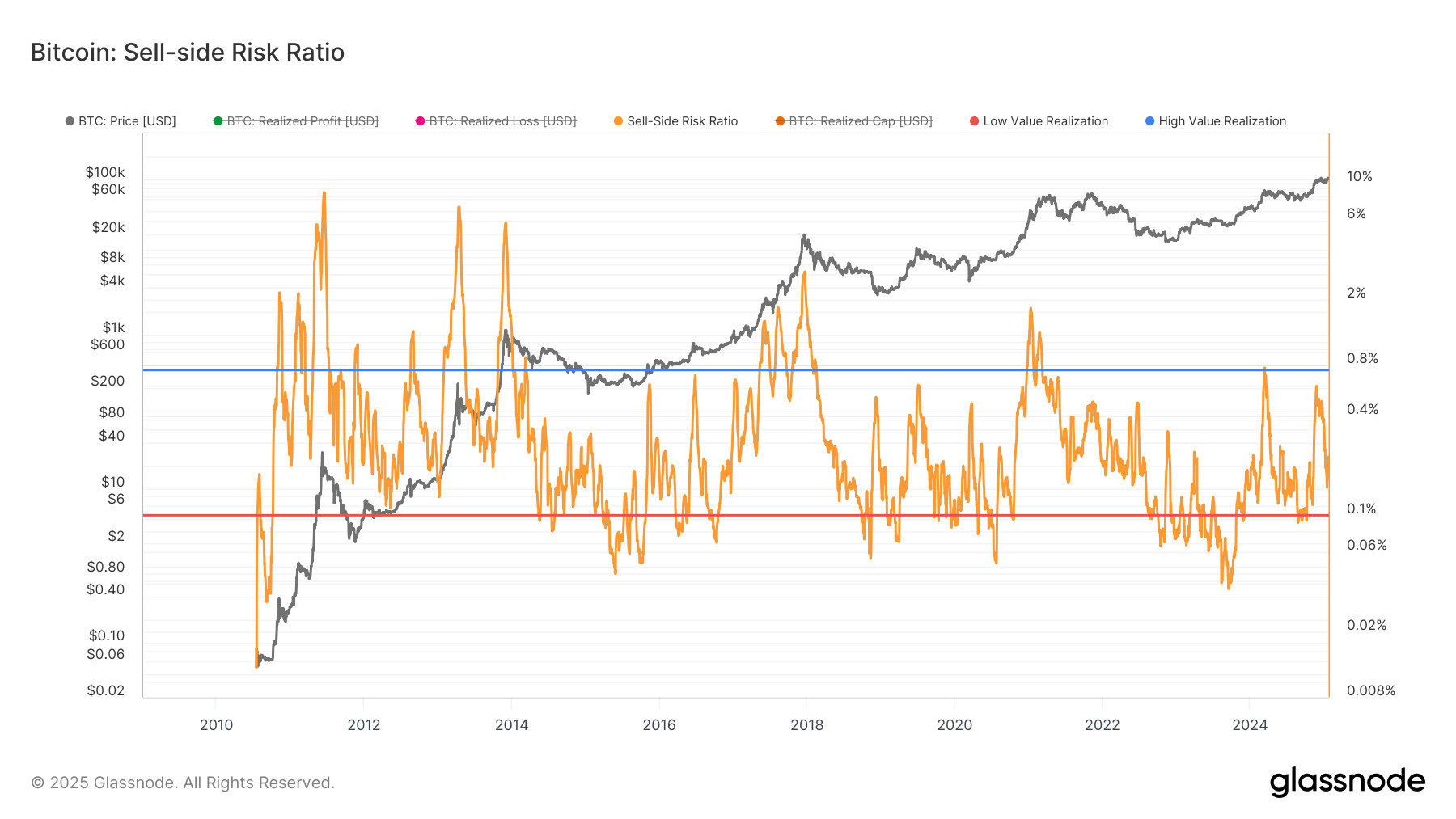

Analysis of sales risk Bitcoin

The risk coefficient on the sales side, which measures the pressure from investors who eliminate the assets, has decreased, since the amount of BTC sent to exchanges for sale fell. This reducing pressure on the sales side supports the current BTC price stability. Glassnode also distinguishes reducing volatility, while the BTC is traded in an exceptionally narrow 60-day price range, which is often the precursor of significant market events.

Will Bitcoin support the bull?

To repeat the crypto, the Ali analyst, the continuing mileage of the bull will largely depend on whether the BTC can maintain its key support level at the level of 97,530 US dollars. The fundamental data on the chain confirm a decrease in pressure on the sales side and consistent accumulation of long -term owners as indicators that the market is in a firm position to maintain upward movement.

Long -term holders #Bitcoin $ BTC have experienced each phase of the market cycle, and now greed is in possession! pic.twitter.com/2rl6clwloz

– Ali (@ali_Charts) January 24, 2025

If this level is stored as support, then the BTC can see a second test and a new market peak to its former record maximum, increasing the continuing bull runs. Nevertheless, the inability to contain 97,530 dollars can represent risks for Bull Run.

Disclosure: This article does not submit investment tips. The content and materials presented on this page are intended only for educational purposes.