The Bitcoin support area for 90 thousand dollars demonstrated its strength, causing a noticeable bull buckthorn. Currently, the price is approaching its maximum of 108 thousand dollars, where a breakthrough can light a short cascade of liquidation, potentially pushing the asset into unknown territory.

Technical analysis

Shayan

Daily diagram

The support zone for 90 thousand dollars turned out to be a reliable floor, holding the price in recent months and demonstrating the confidence of the buyer. This revival of the purchase of interest caused bitcoin above the middle line of the channel trend, positioning it close to ATH of 108 thousand dollars.

This peak level is a significant area of resistance with a concentrated supply and increased sales pressure. Since Bitcoin is approaching this critical threshold, short-term volatility is expected due to the ongoing battle between buyers and sellers.

If the bull impulse continues, the recovery of ATH of 108 thousand dollars can cause a short liquidation cascade, which will probably lead to another surge, since market participants are in a hurry to cover positions.

4-hour table

The lower period of time emphasizes the importance of supporting 90 thousand dollars, which in recent months has constantly stopped the impulse down. This caused an impulsive bull -click, directing Bitcoin to the resistance zone for 108 thousand dollars.

This area not only represents Bitcoin ATH, but also corresponds to the middle border of the ascending channel, which further enhances it as a critical moment. A successful breakthrough and consolidation above this level can pave the way for a sustainable rally to new maximums.

The upcoming price action in the resistance area of 108 thousand dollars will be crucial for determining the following Bitcoin trend, with increased volatility expected in the short term.

Analysis on the chain

Shayan

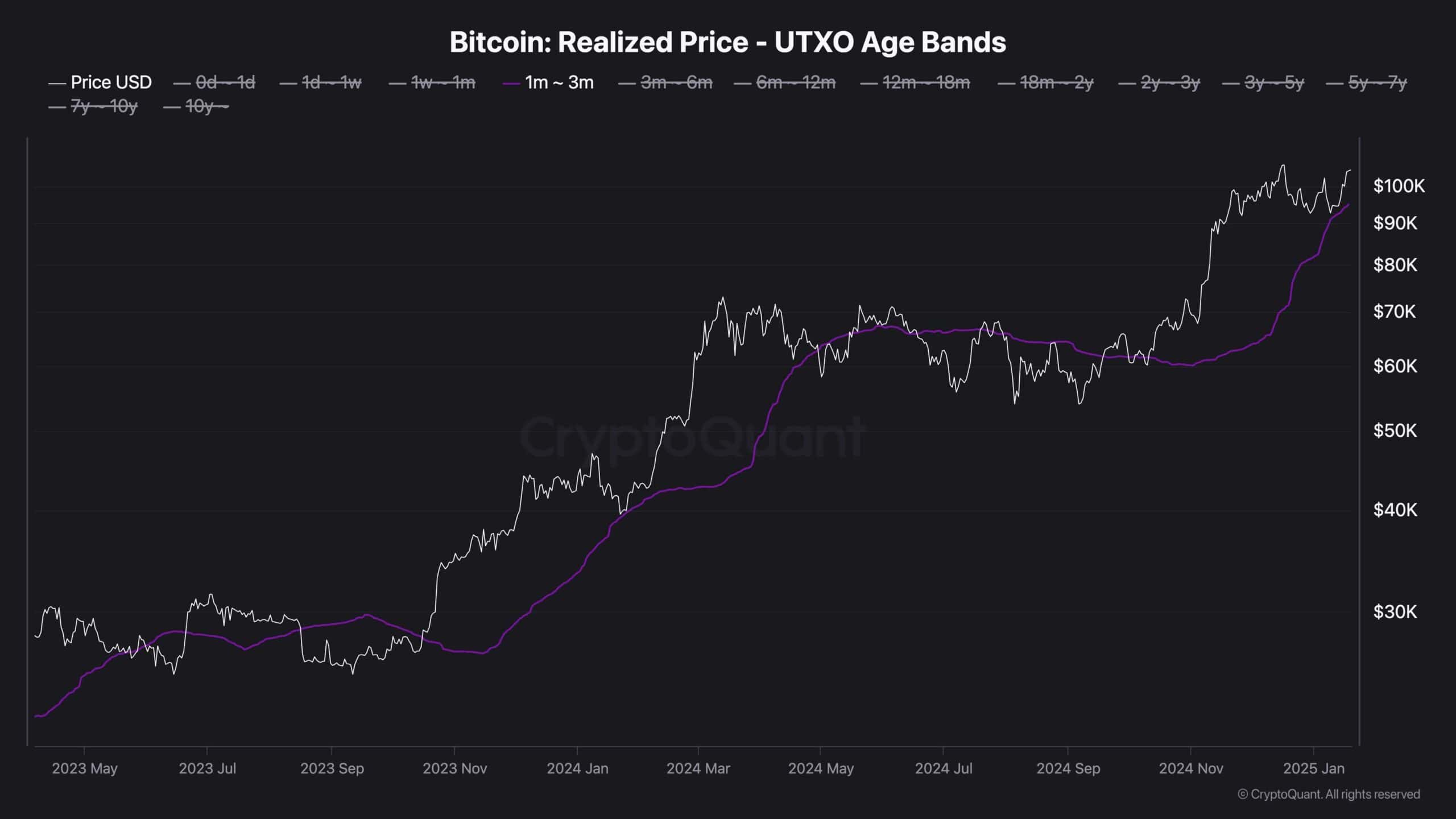

The implemented price of UTXO age bands, especially for a 1-3-month cohort, offers a critical understanding of short-term behavior and wider moods in the market. This indicator represents the average purchase price for recent buyers, acting as a dynamic line of support or resistance, which reflects confidence in the market.

When Bitcoin is higher than the price of this short -term cohort, this signals a growing bull impulse. This indicates that the new buyers are sure of holding their positions, even with increased prices. Conversely, a drop below this threshold involves an increased risk of sales, since these participants are faced with unrealized losses.

The recently realized price for the 1-3-month cohort UTXO in the region for $ 90 thousand. The United States acted as the most important level of support, pushing the asset to its ATH. Bitcoin, holding above this level, signals bull moods in the market, with potential, so that the price continues its trajectory up.

However, if the cryptocurrency breaks below this dynamic support line, market moods can go to a terrible state, increasing the probability of distribution phase.