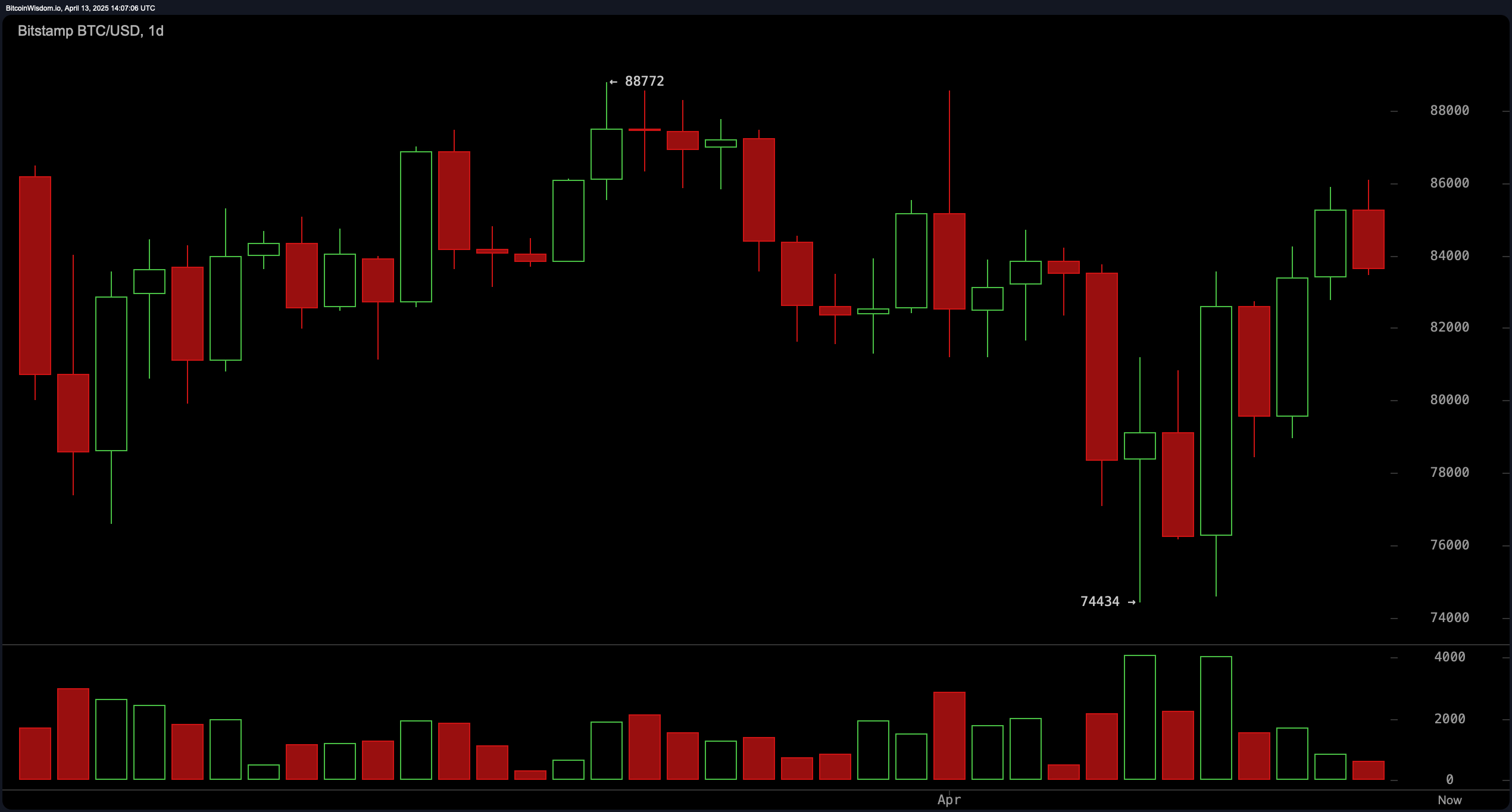

On April 13, 2025, Bitcoin is traded at the level of $ 83,681 with market capitalization of $ 1.66 trillion, 24-hour trading volume is $ 26.01 billion, and the internal price-OO 83,648 US dollars to 85,731 US dollars, since the asset moved as part of the embarrassing technical comfort.

Bitcoin

On the daily diagram, Bitcoin (BTC) continued recovery after a recent rollback, at a low level of about $ 74,434, rising within a certain range limited by resistance at 88,000 US dollars. The market showed moderate pulse growth, but the price action remained largely limited between the support of about 74,000 US dollars and a resistance only below $ 88,000. It is noteworthy that the volume has grown near the lower boundary, a classic signal of potential accumulation or surrender. Traders looking for long notes are recommended to take into account the support group from 80,000 to $ 82,000, while exit strategies should be aiming on the upper border, if the volume of breakthrough is not supported.

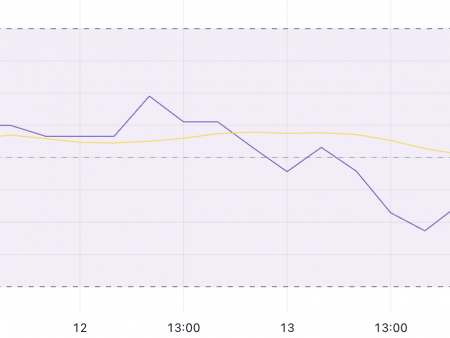

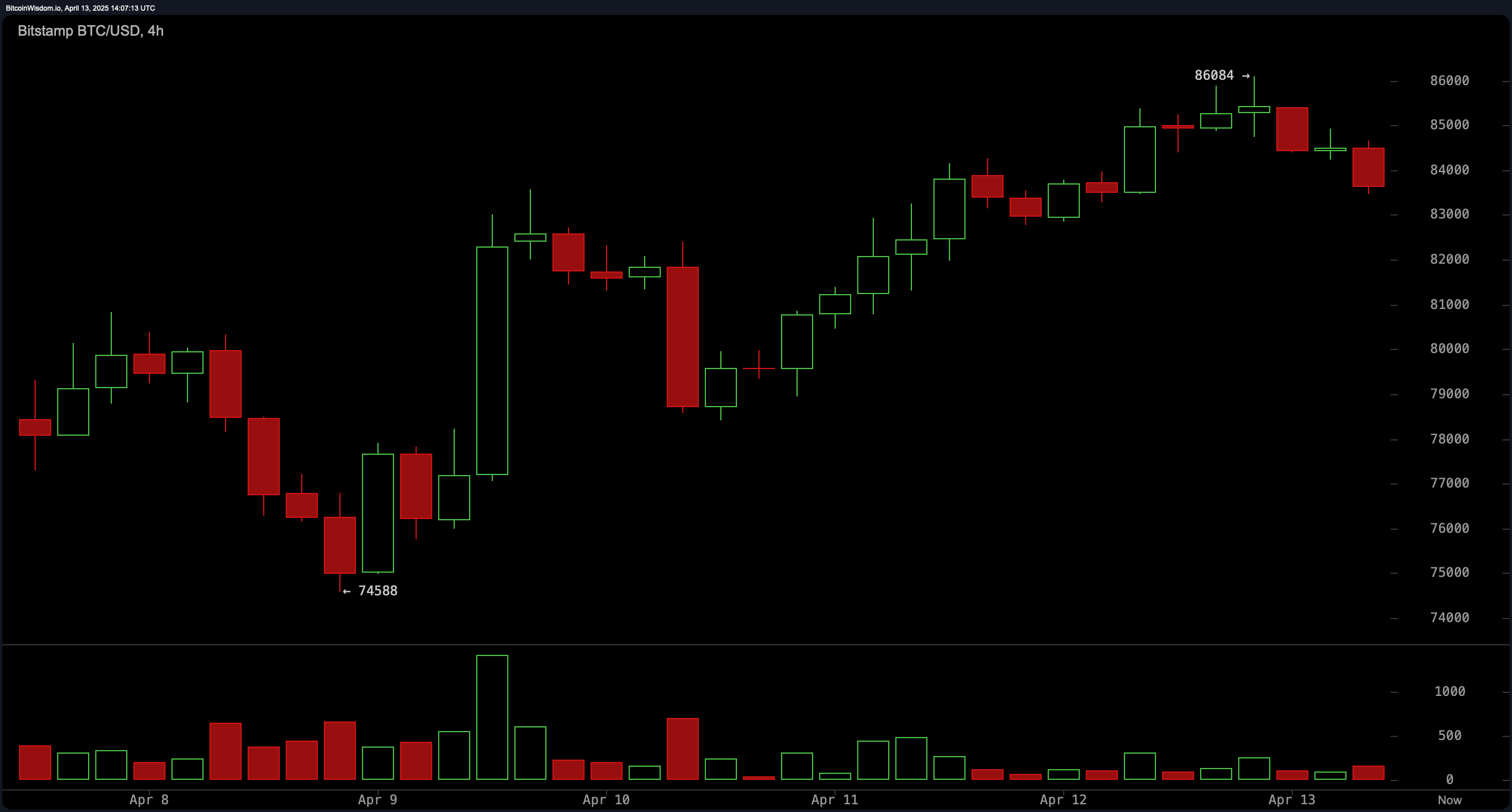

A four -hour schedule showed a rebound of $ 74,588, and a steady increase in reaching to $ 86,084, although recent candles showed a decrease in bull force. Slow down involves making a profit and the appearance of short -term resistance. As the impulse disappears, an area of 82,000–83,000 US dollars stands out as a potential zone of re -entrance corresponding to the previous levels of breakthrough. If price actions are fighting to hold more than 85,000 US dollars, the rollback can aim at lower support levels. The trend remains up, but preliminary, which guarantees close monitoring of the behavior and bursts of the volume of the candlestick.

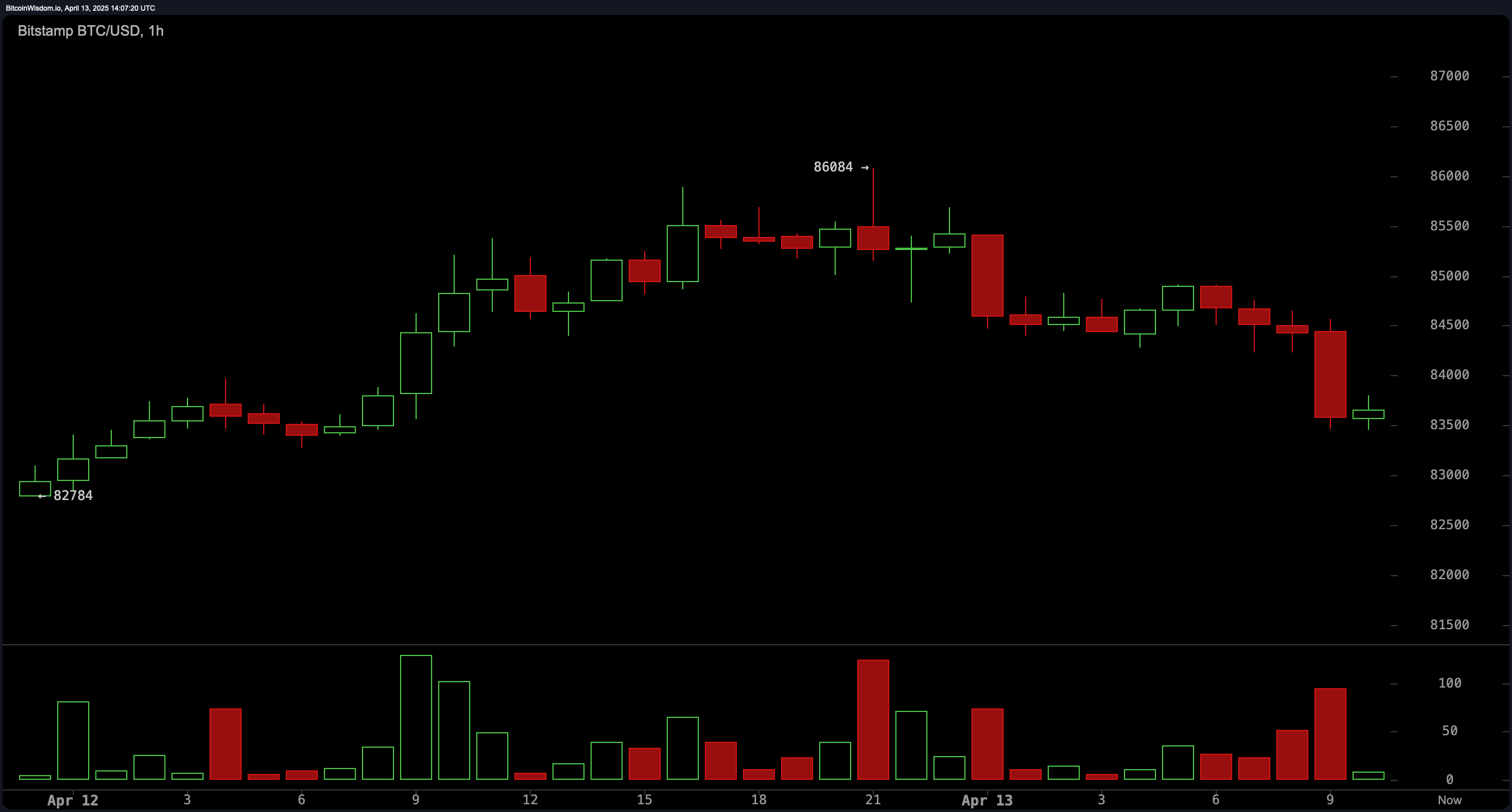

On the watch diagram, BTC was encountered with a local decrease from $ 86,000 to about $ 83,500, accompanied by increased sale of sale, as evidenced by the growing volume of red candles. Direct support was determined about $ 82,784, which notes the previous intraudic minimum. A short -term rebound from this level can apply to a resistance of about $ 85,500. Nevertheless, traders should be prepared for volatility and maintain disciplined stop levels to reduce risk during potential breakdown scenarios.

The oscillators in the daily BTC/USD diagram painted a picture of market indecision, with a relative force index (RSI), a stochastic index of commodity channels (CCI), the average direction (ADX) index and an amazing oscillator located on the neutral territory. However, the pulse oscillator released a bearish signal, while the sliding convergence divergence (MACD) presented an wholesale signal, reflecting the separation in the direction. These conflicting signals confirm the thesis of consolidation, and not a clear directional strength.

The average movements of the Daily Chart (MAS) gave additional confirmation of mixed moods. Short-term indicators, such as exponential sliding average (EMA) and simple sliding average (SMA) for 10, 20 and 30-periodic windows, preferred an optimistic position. On the contrary, more long-term indicators, including 50, 100 and 200-year-old EMA and SMA, all suggest the conditions of sale. This technical divergence emphasizes the presence of short -term optimism against the background of wider structural vibrations, increasing the cautious, based on the range, until the market breaks convincingly in any direction.

Bull’s verdict:

If Bitcoin can hold the range of 82,000–83,000 US dollars and print a bull -free diagram supported by growth in volume, there is a good case to continue resistance in the amount of 88,000 US dollars. The confirmed breakthrough is above this level, especially in the daily diagram, will change the structure decisively optimistic, potentially opening the path to new maximums outside of $ 90,000.

Bear Verdict:

The inability to support the support of about $ 82,000, especially if they are accompanied by an increase in the volume of sale, can cause a deeper correction back to the level of $ 78,000. The breakthrough below this threshold will confirm the short -term change in the trend, increasing the probability of checking a wider support zone of $ 74,000, with a gaining moment, gaining the moment in a higher time period.