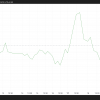

Ethereum gas fee has significantly decreased, with an average transfer cost currently only 0.41 dollars, which is much lower than a peak of $ 15.21 over the past two years.

According to the analytical company in the Santiment chain, low gas boards often suggest a network that is not too overloaded, which can be an optimistic signal for Ethereum (ETH) of the average to a long price.

💸 The average transfer fee for Ethereum is currently worth only 0.41 US dollars, unlike $ 15.21 in the last 2 years. When the Ethereum transaction fees are low, this usually means that the network is not excessively overflowing. When users do not pay high prices to move their ETH … pic.twitter.com/g22qd3etl8

– Santiment (@santumentFeed) February 19, 2025

It is easier for new customers to enter the market when there are lower transaction costs that usually occur during the time of stagnation or negative mood. However, since traders and users try to fight to the transaction, high fees usually signal soaring demand, which often leads to temporary corrections.

In another development, which can additionally reduce the training camp, Ethereum has recently approved a vote to increase the limit of gas to more than 30 million. The gas limit belongs to the maximum gas volume or computing resources that can be used by all transactions in the block

The higher gas limit means that the network will be able to process more transactions to the unit, potentially reducing the congestion and a decrease in fees. The gas limit has reached 35.9 million in the last 24 hours, according to Gaslimit.pics.

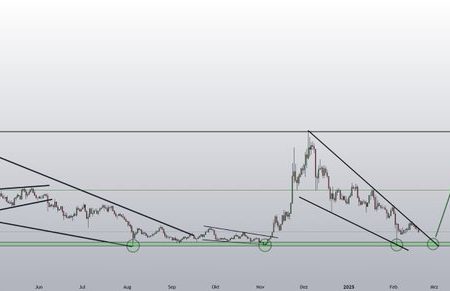

Currently, Ethereum is traded by about $ 2674 after a fall by 2% for the last day. The volume of bidding increased by 10%, despite the fall, which indicates an increase in the percent of investors. Over the past two weeks, Ethereum consolidated from 2565 to 2800 US dollars, but the last fall to the lower part of this range suggests that there may be more reduction.

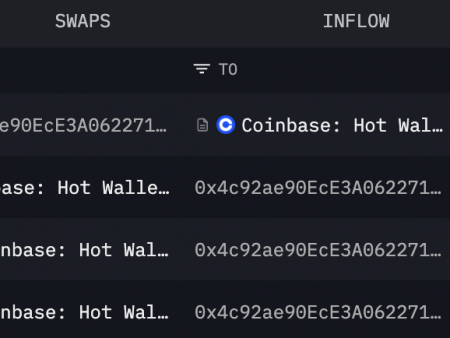

According to Coinglass, in the last day, on the last day, on the last day, an amount of more than 60 million dollars recently, which increases the likelihood that investors have accumulated ETH. Since they involve long -term retention and decrease in sales pressure, metabolic outflows are often interpreted as optimistic indicators.

However, with short positions in the amount of $ 121 million. USA in the amount of $ 2650 and $ 90 million. The United States for long positions of $ 2605, intraday traders are still careful. This indicates a higher level of short -term bear mood.

The SEC resolution on Spot Ethereum ETF with integration for a stable installation is still the greatest possible bull catalyst for ETH. Some analysts believe that the lack of profitability of stability has a limited demand for these ETFs, but approval can stimulate an institutional influx. As of February 18. The total total flow of ETF grew to 3.16 billion dollars. USA, according to Sosovalue.

Meanwhile, the decentralized activity of ETH in exchange activities has grown. DEFILLAMA data show that Ethereum protocols processed 2.62 billion dollars. USA in a 24-hour trading volume of $ 1.1 billion. USA February 16. Ethereum is approaching Solana, which continues to face criticism due to recent stretches of Meme mat.