Altcoins have just transferred their worst sale in recent years, from more than $ 460 billion in a few days. Will liquidity go back, or does the dream of another altsyzone disappear forever?

Table of contents

Altcoins under pressure

On February 3, global financial markets transferred a sharp flash audience after Donald Trump introduced tariffs for China, Canada and Mexico, which caused a sale in world markets. Promotions, goods and cryptocurrencies immediately reacted, and the altcoins received the greatest blow.

At the end of January, the total market capitalization of Altcoin amounted to 1.46 trillion dollars, but by February 3 it fell to $ 1 trillion, which amounted to 31.5% and wiped the market value of $ 460 billion.

Since then, the market has shown some signs of recovery, rising to 1.22 trillion. Doll. USA at the time of writing this article on February 5. However, it remains almost 16% lower than January and 28% the least $ 1.71 trillion since November 2021.

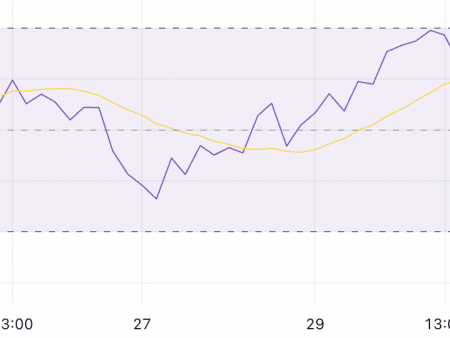

The general mood in the market Altcoin remains weak. One of the key indicators for measuring whether altcoins are exceeding bitcoin is the index of the CMC Altcoin season, which tracks the performance of the 100 best altcoins compared to bitcoins over the past 90 days.

As of February 5, the index is at 36, a sharp fall from 87 in December 2024, when the altcoins grew after Trump’s victory in the elections.

Reading older than 50 involves a soft rally in Altcoin, while above 75 signals signaling the full season of altcoins. At its current level, the index indicates that Bitcoin remains dominant power in the market, and Altcoins are struggling to get traction.

Price performance among the main altcoins also reflects this opinion. Ethereum (ETH) has decreased by more than 18% with the beginning of the year, currently bargaining at about $ 2800. Solana (SOL) has been observing modest growth, which has grown by 5% since the beginning of the year, reaching $ 205.

Meanwhile, Ripple (XRP) was one of the most successful altcoins with great capitalization, having received 21% with the beginning of the year and increased by 360% over the past three months.

Due to the fact that the institutional interest in bitcoins continues to grow, the question remains: will altcoins see a strong rally in 2025, or will Bitcoin dominate? Let’s find out.

Bitcoin growing dominance

Bitcoin’s growing dominance in the market created a narrow place for altcoins, preventing capital in them, as was the case in previous cycles.

As of February 5, Bitcoin is 61.5% of the total market capitalization of crypto, its highest level since the beginning of 2021. This means that for each dollar invested in the crypto, more than 61 cents gets into bitcoins, leaving about 39 cents for thousands of other coins together.

Just two months ago, in December 2024, when Altcoins discovered some support, this number was 54%, emphasizing how quickly Bitcoin restored his retention over the market.

To understand why this is happening, it helps to look at historical trends. Bitcoin dominance has a tendency to grow in indefinite times. FTX rates (FTT) in November 2022 is a vivid example.

When the trust in a wider crypto is weakening, Bitcoin’s dominance was only 40%. However, in the next months, investors increasingly moved their capital to Bitcoin, which recently increasing their market share to 64%.

A similar scheme was played between 2018 and the beginning of 2021. During this period, Bitcoin’s dominance rose from 35% to 63% before the decrease gradually, when the altcoins began to be superior.

But this time there is a key difference – institutions. Since the approval of Spot Bitcoin ETF in January 2024, Bitcoin has absorbed an unprecedented amount of liquidity.

At the time of writing this article, the Spot BTC ETF owns assets in managing more than $ 120 billion, and large financial institutions such as BlackRock, Fidelity and Greyscale.

At the same time, the discussions about the potential strategic reserve Bitcoin in the United States are gaining momentum. If the governments begin to consider Bitcoin as hedging, the capital rotation cycle, which previously eaten at altcoin rallies, can take much more time for implementation.

Unlike previous cycles, where capital ultimately turned into altcoins, institutes currently accumulate bitcoins, maintaining concentrated liquidity and limiting the consumption of capital in altcoins.

What needs to be changed to Altcoin’s rally?

Historically, the capital on the crypto market moved in stages. Bitcoin first absorbs liquidity, leading rallies in the market. As soon as the BTC stabilizes, the funds revolve into altcoins, launching the altcoins season.

This model was obvious in 2017, when Bitcoin’s dominance reached a peak at 70%, laying the path for ETH and XRP in early 2018. A similar trend was played in 2021, when Bitcoin reached $ 69,000 before Altcoin gained traction.

Currently, Bitcoin’s dominance remains strong, forming higher maximums and higher low indicators that liquidity is still concentrated in BTC. In order for the altcoins to gain impulse, Bitcoin needs a long period of stabilization, allowing the rotation of capital.

The fall in the dominance of bitcoins below the support levels of key key investors will indicate an investor change. In addition, catalysts, such as Ethereum modernization, clarity of regulation or wider adoption, can accelerate this transition.

Another factor slowing the rotation of capital is the growing presence of institutional investors. Unlike retail traders, institutions, as a rule, make calculated, long -term investments, which means that they are less likely to chase short -term trends in altcoins, as can be seen from past cycles.

However, if the dominance of bitcoins begins to decline, the rotation process will most likely follow the established sequence: first, altcoins with great capitalization move, followed by medium punishments, and then smaller speculative projects. At the moment, the market remains in the retention scheme.

How speculations on the chain violate the altcoins market

The way the speculative capital in the cryptography market has changed has changed, and this shift can be one of the biggest reasons why the traditional Altcoin season has not yet been realized.

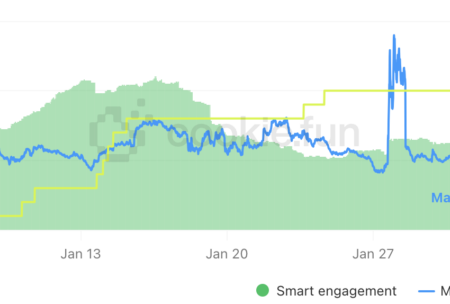

Analyst Miles Doysher emphasizes the role of Pump.Fun, a platform, which, according to him, “directly correlated with the destruction of the Altcoin market against BTC.”

The launch of the pumping entertainment directly correlates with the destruction of the altcoin market against $ BTC. 👇

The reason why we did not see a large “Alt season” in different majorors is that speculative capital, which was once pushed into the 200 best assets, instead decided to jump with a gun and … pic.twitter.com/g04l2scar2

– Miles Doysher (@milesdeutscher) February 4, 2025

He explains that in previous cycles, speculative capital would join the 200 best altcoins on centralized exchanges. Instead, most of this liquidity currently floods tokens with low capitalization on the chain, many of which do not have proper liquidity.

This new trend has created an uneven dynamics of the market. “Early birds and insiders have become insanely rich,” Doysher notes, but he adds that most retail investors who entered the late lost money – just like in the previous altcoin cycles.

However, unlike 2022, when retail losses were mainly limited by relatively liquid altcoins listed on centralized exchanges, this time the capital was blocked in unlick memes, many of which have already retreated by 70–80%.

According to Doysher, this shift made an event of destruction of wealth even worse than what was noticed in early 2022, despite the fact that bitcoins and several main altcoins remaining in the trend of macro.

Deutscher ascribes this shift partially with regulatory uncertainty, claiming that traders were forced to look for alternative methods of speculation from the restrictions on launching Fair Project.

“I do not blame the pump with entertaining, as its launch is in direct response to impudent crypto-regulation, which made it impossible for fair projects.”

He adds that since 2017, the industry has been struggling to find a fair model for new projects, while Airdrops is the closest alternative.

Bitcoin will repair the quiet accumulation of Ethereum

While Altcoins are fighting liquidity, the analyst Bitcoin Therapist believes that the current price of Bitcoin does not reflect its true value.

“Something terribly wrong with the prices of the Bitcoin market. We are easily underestimated in the amount of 50 thousand dollars, ”he says, suggesting that a violent reassessment event may be inevitable.

Something terrible is not so with the prices of bitcoin in the market. We are easily underestimated at 50 thousand dollars. Too many to be optical. There will be a brutal revaluation.

– therapist ₿itcoin (@thebtCtherapist) February 5, 2025

If so, Bitcoin’s dominance can remain increased for much longer than expected. Historically, Bitcoin passed quick revaluation when the institutional demand was ahead of the proposal that could take place now.

However, as Matthew Hylend notes, the recent accident was also the largest liquidation event in the history of crypto, which means that we should not expect quick recovery. “In 2020 and 2022, it took more than two months to take a full recovery,” he notes.

Given that this was the largest liquidation event in the history of #Crypto, probably means that the minimum is in 2020 and 2022, it took more than 2 months to completely restore

Most likely, you will not see these December maximums at most #alts for at least 2 months, if not longer, so … Pic.twitter.com/t5zah7SN6S

– Matthew Heyland (@matthewhyland_) February 4, 2025

Highland warns investors against the expectation of an immediate return to previous maximums, especially for altcoins. Even during the quick rebound of 2020, there were several failures along the way.

“Most likely, you will not see these December maximums for most ALTS for at least two months, if not longer,” he says, adding that previous events of high volatility, such as Covid Crash, Buna Collapse and FTX Fallout, were required months to recover.

Meanwhile, Ethereum quietly sees a large accumulation from major players. The NAIIVE analyst emphasizes that Donald Trump, thanks to his World Liberty Financial project,, according to reports, purchased ETH $ 200 million, while Fidelity and BlackRock accumulated $ 49.75 million and $ 300 million in ETH, respectively.

Donald Trump bought $ 200 million

Fidelity bought $ 49.75 million ETH yesterday

BlackRock bought $ 300 million today

NAIIVE bought $ 69 in ETH today

Whales trembling weak hands

– NAIIVE (@NAIIVEMEME) February 5, 2025

This model suggests that whales strategically shake weak hands, using the advantages of market uncertainty to accumulate at lower prices.

If the institutional accumulation of ETH will continue, Ethereum can act as a leading indicator of wider demand for altcoin. When Ethereum begins to receive from bitcoins, it often signals the early rotation of capital in altcoins with great capitalization, which ultimately can come off the middle and less assets.

But while Bitcoin’s dominance does not show signs of weakening, the recovery of altcoin remains at the waiting stage.

Disclosure: This article does not submit investment tips. The content and materials presented on this page are intended only for educational purposes.