Dogecoin continues to garner significant attention in the cryptocurrency market. This time, it is thanks to on-chain value growth such as whale-level transactions and others, as suggested by the transaction of 10 billion DOGE in a 24-hour period. Let’s break down the data of the current ones. indicators.

Dogecoin continues to garner significant attention in the cryptocurrency market. This time, it is thanks to on-chain value growth such as whale-level transactions and others, as suggested by the transaction of 10 billion DOGE in a 24-hour period. Let’s break down the data of the current ones. indicators.

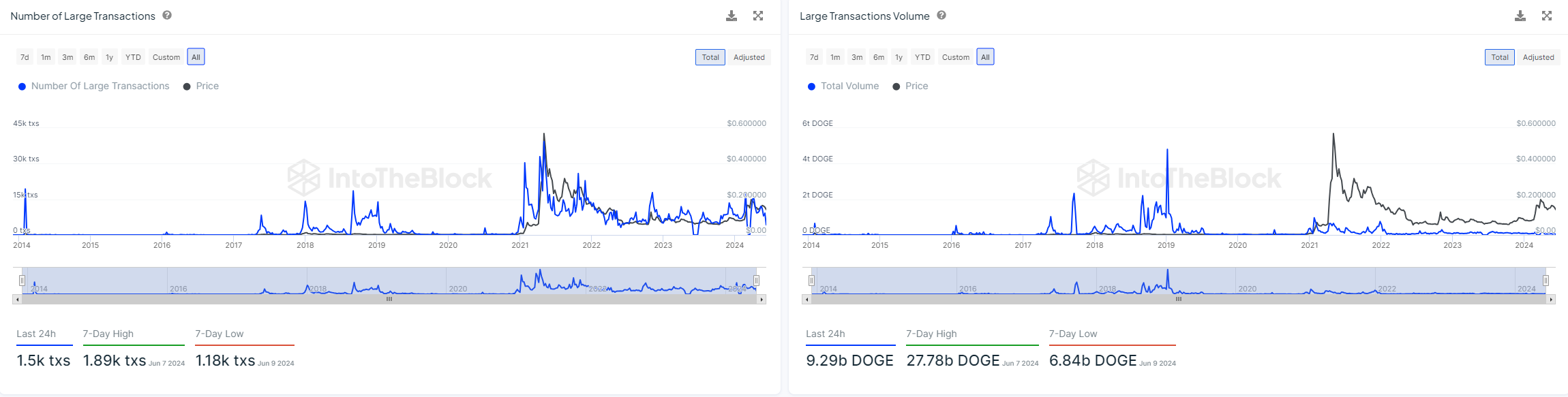

A total of 1.5 thousand transactions were made with Dogecoin in the last 24 hours. While on June 7, 2024, 1.89 thousand transactions were recorded, and on June 9, 2024, only 1.18 thousand transactions. Dogecoin transactions are gaining interest and engagement, as evidenced by this high level of activity. The market as a whole is shifting in tandem with the June 7 peak, possibly due to major news or investor activity.

A total of 9.29 billion DOGE transactions were carried out in the last 24 hours. The seven-day high of 27.78 billion DOGE on June 7, 2024 and the seven-day low of 6.84 billion DOGE on June 9, 2024 are different from this figure. The strong market dynamics are demonstrated by the substantial volume. The critical drop from the seven-day high likely shows profit-taking or reshuffling among wallets, reflecting regular market cycles.

It is also worth highlighting the large volume of transactions in dollars. In the last 24 hours, $1.33 billion worth of DOGE was associated with huge exchanges. On June 7, 2024, the seven-day high for major transactions was $4.2 billion, while the seven-day low was $1.01 billion on June 9, 2024.

These high-level exchanges imply that big players are actively trading DOGE, increasing liquidity and depth of the market. The June 7 spike further emphasizes a period of intense trading, likely driven by strategic moves by large institutions or investors.

Examining these patterns, Dogecoin obviously remains in a climate of dynamic exchange, without facing a stalemate. Both retail and institutional investors are active, as evidenced by their high net volume and significant transaction size. The market is cautious and active, willing to react quickly to new information, as evidenced by the balanced sentiment.

Yuri Molchan

Yuri Molchan