XRP is firmly positioning itself as one of the leaders of the current market cycle, emerging from an extended consolidation below $1. Several key fundamental factors suggest this momentum could continue into the new year.

While XRP is influenced by overall market sentiment, the regulatory framework will be critical. In particular, upcoming leadership changes at the Securities and Exchange Commission (SEC) and ongoing litigation between the regulator and Ripple will be critical in determining whether XRP can make another attempt at all-time highs.

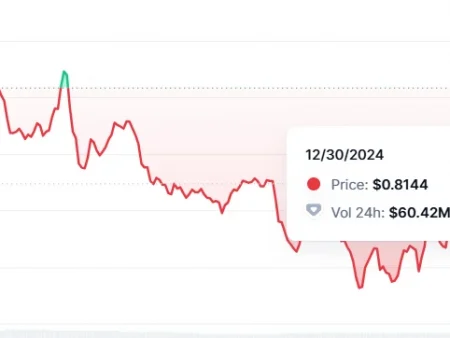

XRP is currently holding above the $2 support level, although market volatility is weakening it.

At the time of publication, the token was trading at $2.24, down 5% over the last 24 hours. On the weekly chart, XRP is also in the red, down 6%.

Despite these recent setbacks, XRP’s post-election breakout has seen the asset surge 260% year-to-date.

XRP Price Prediction for 2025

Regarding the token price forecast for 2025, artificial intelligence (AI) tool OpenAI ChatGPT-4o shared an opinion on what to expect.

ChatGPT’s analysis found that Ripple’s growth and potential wins in ongoing SEC cases could push XRP to between $5 and $7, especially if adoption of cross-border payments accelerates, which is the base case.

On a more optimistic note, the AI platform noted that broad growth in the cryptocurrency market and Ripple’s expanded integration with banks could push XRP above $10. There is even a possibility, although less likely, that mass adoption and favorable regulations could result in the token price exceeding $20 by 2025.

Conversely, ongoing regulatory concerns or a downturn in the broader cryptocurrency market could cause XRP to fall to the $1 to $2 level. While $5 seems like the most reasonable estimate, according to ChatGPT, such a target price would increase XRP’s market cap to nearly $300 billion.

XRP Technical Forecast

On the technical side, analysis by cryptocurrency trading expert Armando Pantoja in X’s Dec. 30 post showed that the token is likely to hit the $3 target.

The analyst noted that while some XRP holders are expressing disappointment at the current consolidation, the charts paint a different picture of strength and potential.

He noted that XRP forms a symmetrical triangle, a bullish continuation pattern that often precedes an upward price move.

XRP stabilized just above the $2 mark, curled tightly inside a triangle. Pantoja noted that a possible breakout could see XRP fluctuate between $3.20 and $4.

On the other hand, XRP exhibits a moderate level of volatility at 7.25%, indicating that potential price fluctuations should be expected. It is trading well above the 50-day simple moving average (SMA) of $1.81 and the 200-day SMA of $0.85, indicating bullish momentum in the medium to long term.

However, the 14-day Relative Strength Index (RSI) is at 46.95, which puts it in the neutral zone – neither overbought nor oversold – which could indicate a period of consolidation before the next move.

Thus, it will be important to watch for a breakout of the $2.10 level or retest the $1.81 support to determine the next price direction.

Featured image via Shutterstock