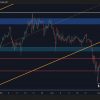

Ethereum (ETH) maintained its position above the critical $3,000 level, currently trading at $3,108.

While Bitcoin (BTC) rose to an impressive $94,902 and altcoins like Solana (SOL) and Dogecoin (DOGE) attracted attention with their sharp gains, Ethereum’s performance was more subdued, recording a modest 5% decline over the last week.

Despite this short-term decline, Ethereum’s fundamentals remain strong. The accumulation of whales and growing decentralized application (dApp) activity are fueling optimism for a potential rally, with ETH projected to reach $3,800-$4,200 by the end of the year.

What influences the Ethereum price forecast?

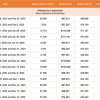

Ethereum’s expanding ecosystem is the cornerstone of its bullish outlook. According to the company, network activity has increased sharply, with the number of daily active addresses (DAAs) rising from 377,065 at the end of October to 417,583 by November 19. Defillama.

This increase highlights the growing adoption of Ethereum and scaling solutions such as Arbitrum (ARB), Optimism (OP) and Polygon (POL, formerly MATIC) on the network.

Daily transaction volumes reflect this growth, increasing to 1.22 million by November 19, as reported by Defillama.

This surge is primarily driven by the growing use of Ethereum-based dApps in sectors such as decentralized finance (DeFi), gaming, and NFTs.

Meanwhile, Ethereum’s total value locked (TVL) in DeFi protocols has jumped 19% over the past month to $59.8 billion, further cementing its position as a leading blockchain platform.

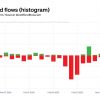

Bullish sentiment from whales and smart money

Institutional players and Ethereum whales are showing significant confidence in the asset. In the last two weeks alone, whales have amassed 430,000 ETH worth $1.4 billion.

Additionally, the sentiment data shows a stark contrast between everyday investors and institutional participants. While overall crowd sentiment towards ETH remains neutral at 0.06, smart money sentiment is at a bullish 2.28 on a scale of -5 to 5.

This growing institutional confidence is consistent with forecasts of a breakout to the upside as whales and other large investors prepare for the next surge in Ethereum prices.

The broader cryptocurrency market is also seeing strong momentum, with Bitcoin leading the way. However, Ethereum’s slowdown may be temporary as its growing utility and network upgrades suggest a breakout to the upside.

AI price forecast for Ethereum at the end of the year

For detailed analysis, Finbold provided ChatGPT-4o with market forecasts for year-end ETH price forecast.

Using historical price trends, network activity and sentiment analysis, artificial intelligence tools predict that Ethereum could end the year with a price between $3,800 and $4,200. Key factors contributing to this include sustainable ecosystem growth and increasing distribution.

While Ethereum may face resistance near the $3,500 level, breaking through this hurdle could pave the way for a retest of the 2021 all-time high of $4,800 in early 2025.

Thus, Ethereum fundamentals, supported by growing network activity and strong whale confidence, suggest an imminent breakout.

With a year-end target of $3,800 to $4,200, ETH remains an attractive asset for investors looking to make significant profits amid a booming cryptocurrency market.

Featured image via Shutterstock