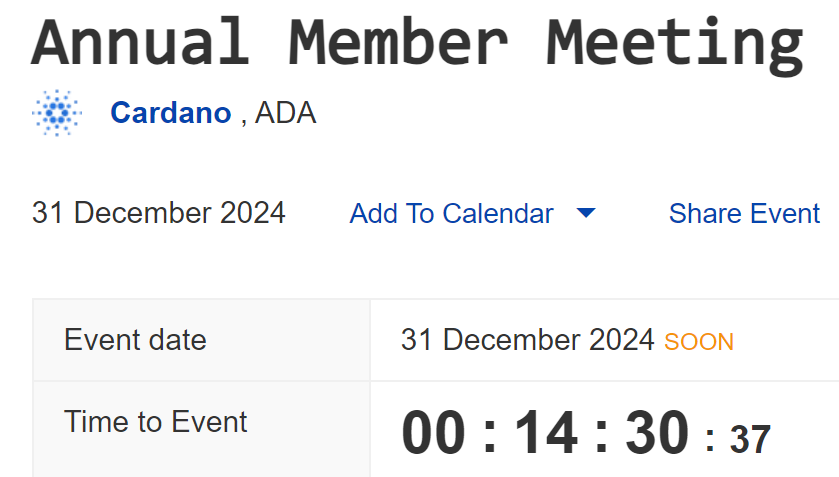

Cardano (ADA) remains on investors’ radar as it closes out 2024 with its annual membership conference scheduled for tomorrow, December 31st.

The event will highlight strategic decisions for the coming years, including the 2025 budget.

Such sentiments are likely to renew investor interest in Cardano’s future potential.

Analysts believe bullish statements during the meeting will trigger an uptrend for ADA, potentially bringing back the psychological $1 zone.

However, the $0.85 support barrier remains critical to Cardano’s price trajectory.

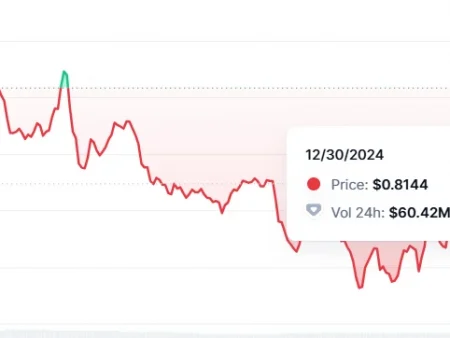

The altcoin is trading at $0.8672 after losing 2.48% of its value over the past 24 hours.

The upcoming annual conference could keep ADA afloat in the coming sessions, helping it stay above key support at $1.85.

This will be crucial for the exchange rate to quickly recover to $1.

However, continued selling pressure will likely see the token fall below $1.85, leading to a rapid fall towards the $0.77 pivot.

What the indicators say

According to technical analysis, ADA price shows medium-term bearish sentiment.

Alternatively, we could see buying activity fading ahead of a bullish rally, perhaps in the first half of 2025.

The daily chart shows that Cardano has formed a likely head and shoulders pattern after touching the top of a multi-month consolidation.

Given the bearish divergence on the 24-hour relative strength index, ADA remains poised for price declines in the coming sessions before recovering in the first quarter of 2025.

Moreover, Cardano’s price has repeatedly closed below its 50-day moving average, confirming significant weakness in bullish momentum.

Increased momentum could push the alt towards support at $0.77. failure to hold this zone could trigger a sell-off to $0.68.

The Future of ADA

Meanwhile, investors are showing confidence in Cardano. For example, large players have accumulated significant amounts of ADA over the past few days.

Highlighting Santiment’s data, analyst Ali Martinez highlighted that crypto whales have purchased more than 20 million tokens.

Whales bought more than 20 million #Cardano$ADA in the last 48 hours!

This highlights a buy-the-dip strategy following ADA’s latest drop, reinforcing belief in the altcoin’s potential recovery.

Moreover, the circulating supply of ADA has been gradually declining recently, with over 21.8 billion tokens at stake to improve the security of the blockchain.

Meanwhile, the Cardano platform has emerged as a lucrative environment for online activities.

The company has a Total Value Locked (TVL) of over $545 million and a stablecoin market capitalization of $22.9 million (data from DeFiLlama).

The blockchain attracted more users after adopting decentralized governance through the Chang CIP-1694 hard fork.

Charles Hoskinson recently questioned the current structure of the Cardano Foundation, saying it undermines community oversight.

Hoskinson believes the platform should move to an MBO (membership-based organization) to (adequately) involve the community in governance decisions.

My problem has always been that the board should be subject to community oversight and control. The organization must be an MBO. It would solve so many problems that people have been complaining about for years: who does social coordination, who advocates…

This could address ecosystem issues by advocating for increased liquidity, developer participation, and encouragement of exchange listings.

According to him, MBO

This would solve so many problems that people have been complaining about for years: who is responsible for social coordination, who is the protector of developers, who helps with liquidity and listings, as well as practical problems such as oversight of payments and the duty to be the binding authority for development contracts .

Post-ADA Price Analysis: Key Levels to Watch During Cardano’s Annual Membership Meeting appeared first on Invezz