On January 31, on Friday, the cryptocurrency market became a witness to the difficulty recovery, since the price of Bitcoin struggled to surpass the record high resistance of $ 108,000. While overhead costs limited the main altcoins from the key breakthroughs, the price of AAVE shows the potential for a sustainable rally against the background of the growing interest of whales.

According to Coingecko, the AAVE coin has a market capitalization of $ 5.06 billion, and 24 hours of trading $ 830 million.

Key basic points:

- A sample of a cup and handle leads to the current price of the AAVE restoration trend

- The ongoing rally may witness overhead costs at the level of $ 343,343, and then $ 400.

- Data on the chain emphasizes the surge of whale activity, enhancing the potential of $ for long -term growth.

AAVE dominates in deficiency as whale activity grows

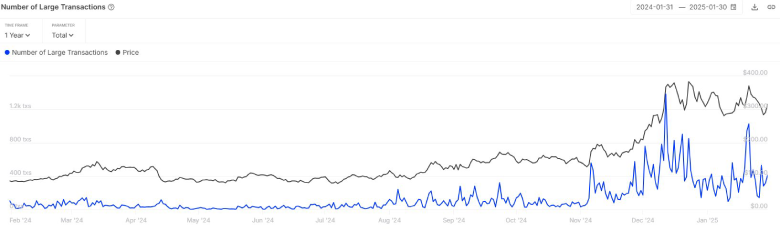

The decentralized financing sector (Defi) observes growing institutional interest, and AAVE becomes the dominant force among the lending protocols. According to the analysts of OnChain Intotheblock, the AAVE network experiences a surge of whale activities and supports its share and market position among leading digital assets.

Historically, large transactional activity coincided with the main market movements, which indicates the potential of AAVE to extend its ascending trend.

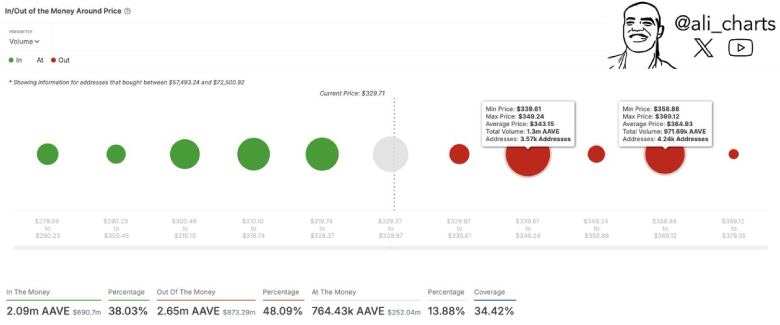

Nevertheless, the expected recovery of AAVE price may encounter a serious resistance of 343 and 365 US dollars in horizontal levels, as they are baked in supply of 1.3 million and 971.68 thousand AAVE transitions.

AAVE Price The upcoming breakthrough from the cup and handle processing

On a three -day rally, the AAVE price increased from 282 to 334 dollars, which amounted to an increase of 18.7%. With stable purchases, Altcoin can grow by another 18%to challenge many years of resistance of $ 396.

A weekly analysis of the diagram shows that this mentioned resistance is the past of the traditional change scheme called CUP and Renge. The installation of the diagram consists of a long U-shaped recovery indicating the trend of accumulation, after which a temporary rollback follows to restore the exhausted bull impulse.

A potential breakthrough with weekly closure above 396 US dollars will increase the pressure on the purchase and set the AAVE target at $ 752.