From the very beginning of the year, the delivery of GHO AAVE has reached only a 20% increase from the beginning of the year.

Meanwhile, AAVE experiences a surge in supply as technical indicators that predict that AAVE is approaching a critical level of support, and AAVE can start a model of bull analysis and accept it.

Key support zone and risk management

AAVE is traded at the level of $ 294.12 during the press, 1.95 percent over the past 24 hours and 17.66 percent over the past week.

Analysts have found a key support zone in the amount of $ 240.91, which should attract a strong percentage of purchase.

This embodies a turning point for the price of AAVE CRYPTO and can serve as expensive for bull -change.

Currently, traders hope to soften the risk, looking for a stop of $ 204.12, which is located below the support zone.

The purpose of this strategy for stopping the loss is to take care of the loss of traders in relation to the fact that if the support level is not held, and trade is reduced.

The combination of the support zone and the location of the stop reflects thorough risk management for those who consider long -term positions in the current installation.

The goals indicating a potential bull impulse For AAVE CRYPTO

Analysts expect that token can push important resistance if AAVE bounces $ 240.91 from the support level.

It is expected that traders will encounter some sales pressure at first at 410.23 dollars, which is the first resistance. The further growth potential, if the bull impulse is held in hold, is $ 467.31 as the next goal for AAVE.

The price can increase from the support level to 532.63 US dollars, which is 120% higher than the current structure, which can be a high level in the next period of constant bull movement.

Bear indicators are preserved in the short term

AAVE long -term bullish potential is ignored, despite the technical indicators reporting the bear pulse.

The alligator indicator shows that the price of token is below three average keys: the jaw of 313.15 US dollars, teeth of $ 320.79 and lips – 322.12 US dollars.

It also means that the pressure in this market is reduced, while the narrow distribution between sliding averages, according to the visible, implies the period of consolidation before the pressure worsens.

The discrepancy with the convergence of the sliding medium (MACD) also indicates bear mood. Continuing a negative histogram with continuing sales pressure, the MACD line is now with a signal line.

The relative force (RSI) index is 42.91, below the neutral level of 50, but has not yet been resold. Buyers and changes can be caused by a fall in the conditions of resold conditions.

AAVE CRYPTO Market Sentiment and Outlook

The support zone of $ 240.91 attracted the attention of the traders around AAVE, and the bull change is still possible.

Despite this, the current bear indicators emphasize the meaning of this level as a critical testing of the price action for AAVE.

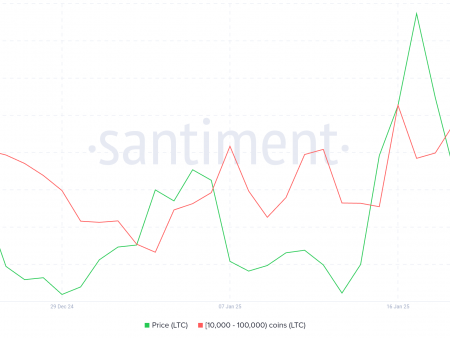

The traders closely monitor the breakthrough that could see how GHO deliveries are growing rapidly in what would be positive for the price action.