Bitcoin Fall

Following a significant crash on Thursday, Bitcoin bulls continue to grapple with preventing further declines in the leading cryptocurrency. The question remains: Is this the end of the line, or is there more to come?

Table of Contents

A Swift Descent

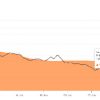

The cryptocurrency market had been gripped by palpable unease in the preceding week. All eyes were fixated on Bitcoin as it continued its downward trajectory within its bullish flag pattern. Many anticipated that the primary cryptocurrency would finally break out upwards, confirming the continuation of the bullish trend.

However, the bears had different plans.

Thursday evening marked a critical turning point, as Bitcoin suddenly recorded a sharp 9.6% hourly decline. It plummeted to the $25,000 price level, where eager bulls awaited to buy the asset. Remarkably, within the same hour, it rebounded to $26,250.

A Necessary Correction

Approximately 12 hours later, Bitcoin has settled into a sideways movement, with the market eagerly awaiting the next clear direction. Presently, Bitcoin finds itself supported around $26,500, just above the 0.786 Fibonacci level. The next robust support rests at $24,250.

Both the upward trendline and the 200-day moving average, crucial pillars for Bitcoin’s bullish momentum, have been breached. However, it’s worth noting that the weekly candle won’t close for another couple of days, potentially allowing bulls to regain the 200-day moving average at $27,250.

Taking a closer look at the charts, it appears that Bitcoin has revisited the lower boundary of a range it entered back in March, with $25,000 marking the lower limit and $31,000 the upper boundary.

So far, this appears to be a healthy correction, given Bitcoin’s remarkable ascent since the beginning of the year. Even in the event of a further decline, $25,000 remains a substantial support level to underpin the price.

Rank: 1

Bullish Momentum Persists

For those investors who missed the significant leap out of the bear market, this correction, or even a return to $25,000, presents favorable opportunities to initiate positions.

For investors feeling jittery, it’s essential to consider the limitations of other available assets, many of which are entangled with the conventional monetary system. Even traditional assets like gold and silver can be influenced by the paper futures market.

Bitcoin may have experienced a correction, but there’s no reason for panic. Phase 1 of the bull market remains firmly intact, and Phase 2 could potentially kick off next year once Bitcoin surpasses the $31,000 mark.