Bitcoin, Ethereum and Polygon are experimenting a notable increase in large-scale transactions, also known as “whale transactions.”

In particular, Bitcoin has seen an 80% increase in transactions valued at more than $100,000.

Similarly, large Ethereum transactions have skyrocketed by 170%, while Polygon has witnessed an unprecedented surge of over 3,800% compared to their respective volumes just 30 days ago.

Big transactions

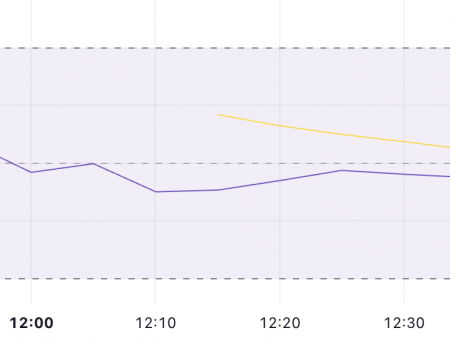

Last week’s data highlights the magnitude of this increase in high-value transactions. Bitcoin recorded 16,410 transactions in the last 24 hours, reaching a high of 22,570 transactions on November 9. The minimum was 12,810 transactions on November 5.

In terms of transaction volume, Bitcoin recorded $24.4 billion in the last 24 hours, with a high of $39.02 billion and a low of $18.1 billion in the same week. The sheer number of Ethereum transactions stood at 3,560 in the last 24 hours, hitting a seven-day high of 7,590 transactions and a low of 3,040.

Its trading volume echoed this trend, with $2.91 billion in the last 24 hours, a high of $6.59 billion and a low of $2.47 billion.

For Polygon, the number of large transactions reached a seven-day high of 209 transactions, the same as its count in the last 24 hours, with a low of 34 transactions. Transaction volume reflected this increase, with $194.42 million recorded in the last 24 hours, a seven-day high of $357.59 million and a seven-day low of $28.81 million.

Renewed institutional demand

The significant increase in whale transactions in these cryptocurrencies is largely attributed to renewed institutional interest. The cryptocurrency market is abuzz with anticipation for the launch of Bitcoin spot ETFs by January 2024, a development that is expected to further drive institutional demand.

Additionally, BlackRock’s plans to introduce an Ethereum spot ETF have added to this enthusiasm. Institutional demand plays a crucial role in the cryptocurrency market as it not only brings substantial capital but also brings credibility and stability to the digital currency ecosystem.

The entry of large financial players and the creation of more accessible investment vehicles, such as ETFs, are seen as key factors for the long-term growth and widespread acceptance of cryptocurrencies.