Bitcoin (BTC) price soared to a high of $37,774 on the Bitstamp exchange today.

This marks a significant increase of almost 5% for the largest cryptocurrency by market cap.

This bullish trend comes amid the backdrop of the US Securities and Exchange Commission (SEC) delaying its decision to convert the Bitcoin futures ETF into a spot one.

Optimism persists despite ETF delays

Leading ETF analyst James Seyffart recently aware on X about the SEC’s delay in approving applications for three spot Bitcoin ETFs, including those from Hashdex, Franklin, and GlobalX.

These postponements seem to be expected and Seyffart remains optimistic.

The top analyst continues to cite “pretty good chances” of approval with a 90% chance by January 10, 2024.

He states that these delays should not be considered an impediment to the high chances of approval of a Bitcoin ETF.

A closer look at market sell-offs

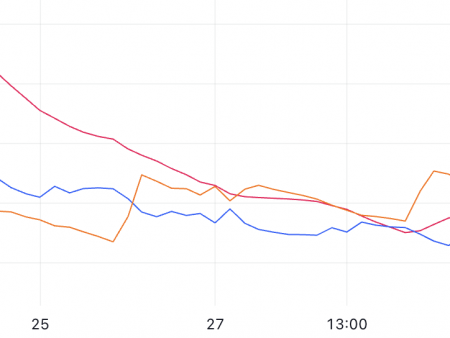

The last 24 hours have seen notable market movements with total liquidations amounting to $127.69 million, according to data from CoinGlass.

This includes $30.49 million in long positions and a significant $97.20 million in short positions.

Regarding the exchange rate, Binance faced liquidations worth $51.64 million, with a 71.45% bias towards short positions.

Similarly, OKX experienced liquidations worth $37.49 million, again predominantly in short positions (78.47%).