.jpg)

Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is for informational purposes only. U.Today is not responsible for any financial losses incurred when trading cryptocurrencies. Do your own research by contacting financial experts before making any investment decisions. We believe all content is accurate as of the date of publication, but some offers mentioned may no longer be available.

The Shiba Inu cryptocurrency (SHIB) is at a critical moment, according to recent technical analysis. After a formidable rally, SHIB price is retesting key support levels that could determine its trajectory in the near term. The SHIB/USDT daily chart indicates that the meme coin is consolidating above the 200-day exponential moving average (EMA), an important dynamic support level that has historically driven prices higher following a successful retest.

The consolidation around this critical support level at around $0.0000084 has been perceived by some as a springboard for further gains, with predictions of a bullish continuation that could result in a 12% rise in the coming weeks. This is further supported by SHIB trading above the 50-day and 100-day moving averages, suggesting a strong uptrend with potential for further growth.

SHIB price persistence above these moving averages and the formation of a possible “golden cross” (a bullish signal where the 50-day moving average crosses above the 200-day moving average) reinforces the prospect of an imminent rally Of the prices. The golden cross is usually a lagging indicator, but investors consider it a confirmation of a strong bull market on the horizon.

In addition to the bullish sentiment, stable Relative Strength (RS) and increased trading activity have been highlighted as favorable conditions for SHIB’s potential price rally, suggesting that the coin is demonstrating compelling signs of a bullish breakout that could trigger a substantial increase, it is estimated. about 12%.

Technical patterns and support levels suggest that SHIB may be preparing for a significant upward move. While the meme coin market is notoriously volatile and unpredictable, current indicators offer a cautiously optimistic outlook for SHIB. Investors and traders will be watching for a confirmed break above the 200-day SMA, which could signal the start of the expected rally.

Ethereum rally on pause

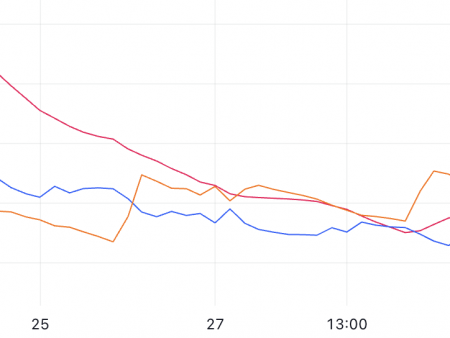

Ethereum (ETH)’s recent price movements have caught the market’s attention, with its rally halting momentarily after surpassing the $2,000 mark. The ETH/USD chart on Kraken reflects this setback in what has been a notable rise, with the price stabilizing around $1,994.50.

The price stabilization comes as Ethereum encounters resistance at $2,136, a critical level where profit-taking by Ethereum whales has been observed. This selling pressure hints at a possible correction, but is offset by positive developments in the market, such as the introduction of an Ether spot ETF by BlackRock, which could significantly strengthen Ethereum’s position in the market.

Despite current doubts in the rally, Ethereum’s fundamental outlook remains strong. The asset has successfully held a level above the main resistance at $2,008.08, and analysts suggest that the bulls are gathering strength for a second rally. If the bulls dominate the bears at the $2,195.87 resistance, Ethereum could see a substantial rally, potentially reaching $3,000.27, given the lack of major resistance levels in between.

Additionally, recent involvement from investment giants like BlackRock has contributed to Ethereum’s year-to-date high of $2,139, indicating bullish sentiment in the market that could push the price to $3,100. Technical analysis reveals that ETH is trading between its immediate support and resistance levels at $2,014 and $2,112, respectively, further suggesting that the rally could gain momentum once again if these levels are broken to the upside.

The key takeaway from the current price action and market sentiment is that Ethereum is in a consolidation phase, gaining strength for its next move. While there is caution due to the pause of the recent rally, the overall market sentiment is leaning towards optimism, with several factors lined up that could act as catalysts for Ethereum’s growth.