Bitcoin (BTC) market dominance has traditionally been seen as a key indicator of its market strength. Currently, the metric is at a multi-year high above 51%.

However, closer analysis suggests that the concept of “Bitcoin dominance” might not be as informative as it seems, especially considering the broader dynamics of the cryptocurrency market.

Domain: A misleading BTC indicator?

The term “Bitcoin dominance” refers to BTC’s share of the total market capitalization of all cryptocurrencies. While on the surface it appears to reflect the strength of the Bitcoin market, this metric largely represents trading activity between Bitcoin and Ether (ETH), the second-largest cryptocurrency and the largest altcoin by market cap.

This dynamic can distort the perception of Bitcoin dominance, especially when major changes occur within the ETH/BTC trading pair.

Related: Ethereum’s Losing Streak Against Bitcoin Hits 15 Months: Can ETH Price Reverse Course?

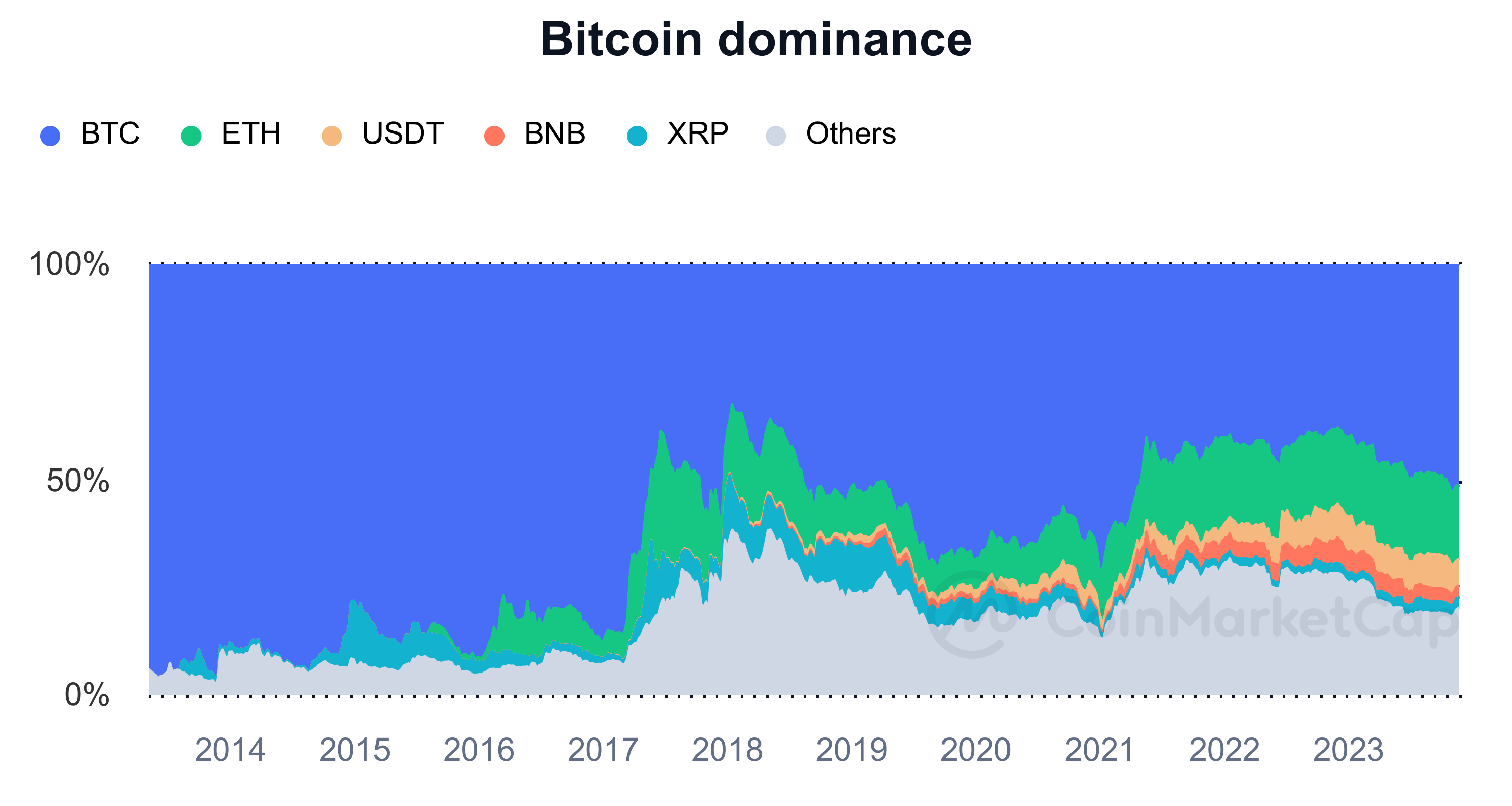

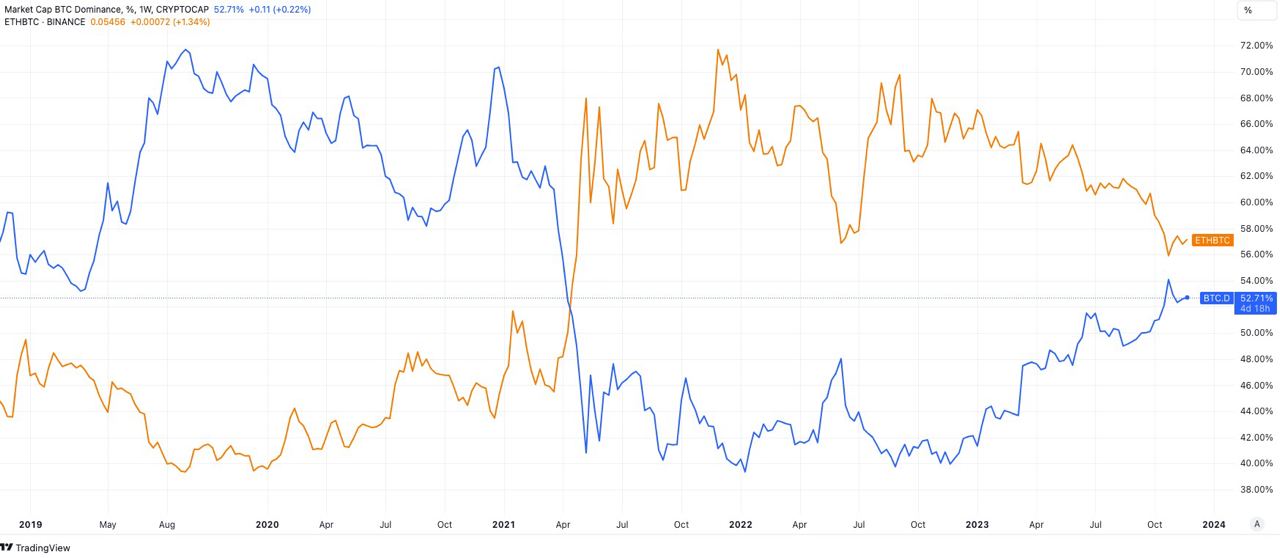

That said, ETH’s “dominance” or share of the cryptocurrency market has remained relatively stable over the past few years at around 17%, while the seemingly inverse relationship between BTC.D and ETH/BTC is clearly visible in the following graph.

The role of stablecoins and “marginalized” capital

Adding complexity to the interpretation of Bitcoin’s dominance is the role of stablecoins like Tether (USDT), the second largest “altcoin” by market dominance at around 6.3% today.

The growth in USDT market capitalization is often not a direct result of cryptocurrency market activity, but rather an influx of what can be called “margin” capital: funds that are essentially in dollars and that are often They hope to enter the market sooner or later.

Therefore, the growing market capitalization of stablecoins like USDT does not necessarily reflect an investment in cryptocurrencies, but rather the readiness of investors to commit or hedge their exposure to cryptocurrencies.

Meanwhile, the share of everything else other than Bitcoin, ETH or USDT is only around 25% and is falling from multi-year highs of 35% in 2022.

Bitcoin’s “strength” or Ethereum’s market dynamics?

Throughout 2023, the narrative around Bitcoin dominance has fluctuated. While it appeared to regain dominance at the beginning of the year, this was more a reflection of ETH/BTC trading dynamics than an aggregate market movement.

Similarly, times when Bitcoin’s dominance appeared to decline, as seen with the Shapella update that affected ETH prices, were more indicative of Ethereum market movements than a decline in “strength.” overall Bitcoin market.

Ultimately, the dominance chart may not be the definitive metric for understanding Bitcoin’s position in the market. Heavily influenced by the ETH/BTC trading pair and synthetic dollars, it offers a narrow view of the market.

It is important to consider a more nuanced approach to market metrics that encompasses the multifaceted nature of cryptocurrency investments and movements.

This article does not contain investment advice or recommendations. Every investment and trading move involves risks, and readers should conduct their own research when making a decision.