Crypto markets were subject to a large dose of volatility on November 21 when the United States Department of Justice (DOJ), the Commodity Futures Trading Commission (CFTC) and the US Treasury announced a $4.3 billion deal with Binance and former Binance CEO Changpeng Zhao. He will plead guilty to a felony charge as part of a settlement of criminal and civil cases with the cryptocurrency exchange.

United States Attorney General Merrick Garland announced that the Department of Justice has reached a $4.3 billion settlement with Binance and CZ. The agreement required CZ to plead guilty to willfully violating the Bank Secrecy Act.

In addition to the financial sanctions, Garland stated:

“In the future, Binance must file suspicious activity reports as required by law. The company must review past transactions and report suspicious activities to federal authorities. “This will advance our criminal investigations into malicious cyber activities and terrorist fundraising, including the use of cryptocurrency exchanges to support groups like Hamas.”

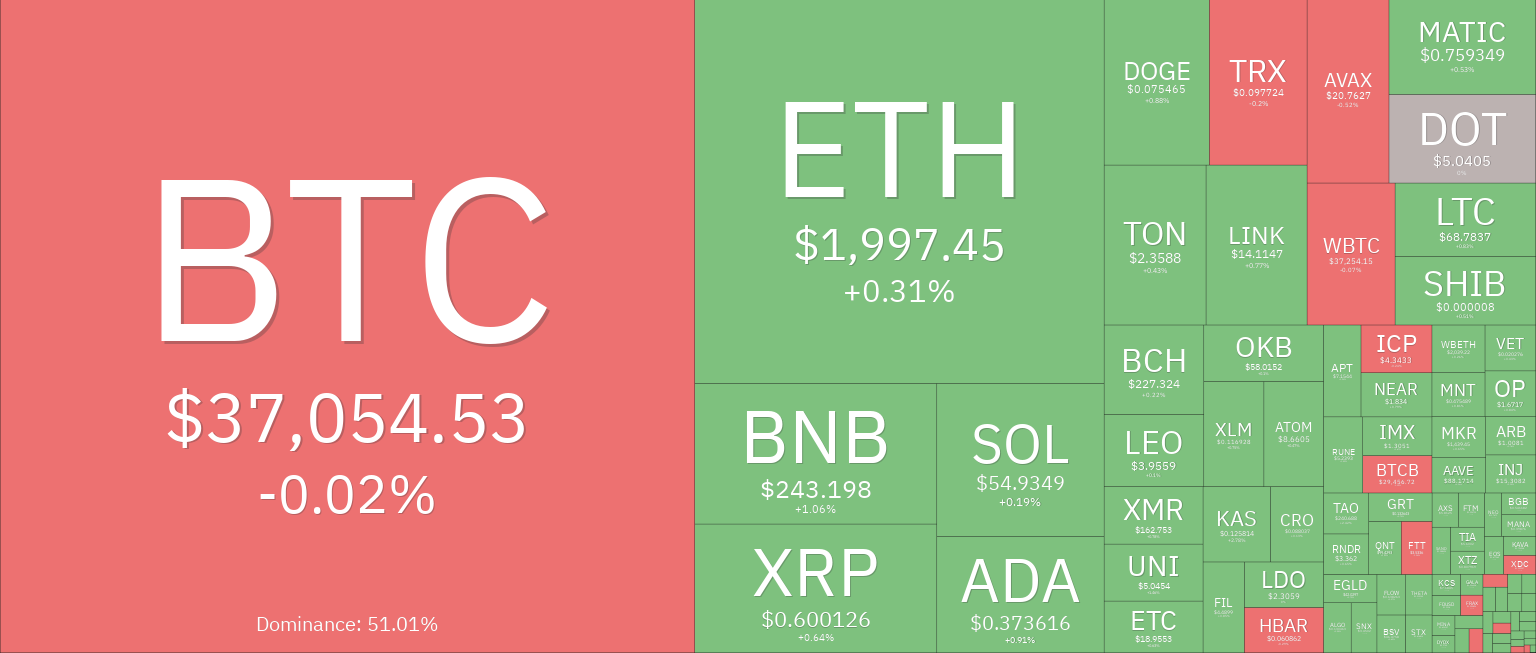

At press time, price action within the cryptocurrency market continues to fluctuate, with Bitcoin (BTC) recording a 1.79% loss while trading near $36,700 and altcoins reflecting a slight recovery from their intraday losses.

The price action in the market reflects market participants’ attempt to digest the details of the November 21 US enforcement action against the cryptocurrency industry.

While the cryptocurrency market does not have an opening bell like Wall Street, market participants and traders were widely aware of the deal, and prices had already reacted ahead of Garland’s press conference, with Binance Coin (BNB) rising to a 5 month price. high before retracing most of its gains and before the press conference even occurred.

Related: BNB price rises and then falls, following the news of the agreement between the DOJ and Binance

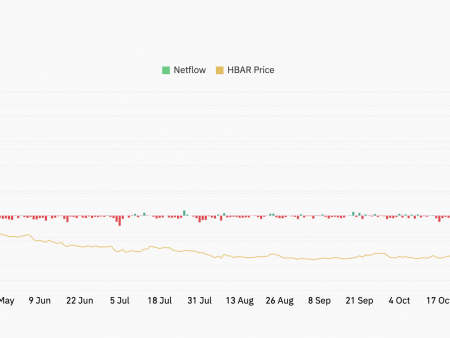

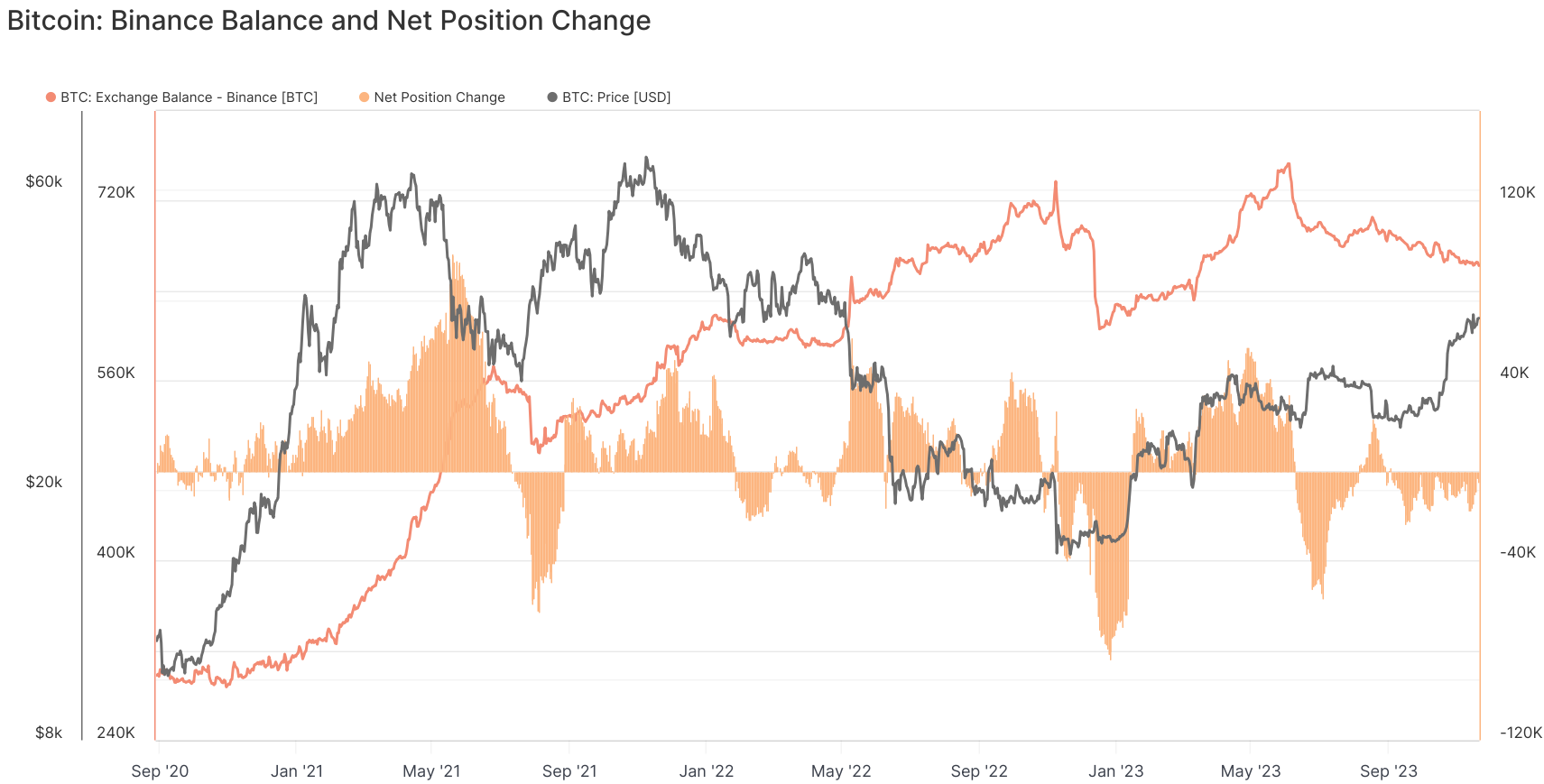

Despite the negative news about Binance, exchange users are not rushing to exit the platform or centralized exchanges in general. According to Glassnode, Bitcoin’s net position change on Binance is well below the January and July figures.

Despite the negative reports, the crypto community applauds the decision as it closes a chapter and is hopeful that the entire industry can move forward in a positive manner.

Binance de-risking is one of the biggest catalysts we could have in the cryptocurrency space.

+ Cryptocurrencies are a “real” industry after a $4 billion deal

+ CZ takes a much-needed vacation in Miami, Arthur style

+ Market soars, ETFs approved in January

+ Republican Party wins 2024 elections and cryptocurrency laws passedC.Z.

— Ryan Selkis (f/acc) (@twobitidiot) November 21, 2023

Binance Exchange, which named Richard Teng CEO on Nov. 21 following CZ’s resignation, reiterated the crypto community’s sentiment about moving forward.

We are pleased to share that we have reached a resolution with several US agencies related to their investigations.

This allows us to turn the page on a challenging but transformative chapter of learning that has helped us become a stronger, safer and even more protected platform.

-Binance (@binance) November 21, 2023

This article does not contain investment advice or recommendations. Every investment and trading move involves risks, and readers should conduct their own research when making a decision.