Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is for informational purposes only. U.Today is not responsible for any financial losses incurred when trading cryptocurrencies. Do your own research by contacting financial experts before making any investment decisions. We believe all content is accurate as of the date of publication, but some offers mentioned may no longer be available.

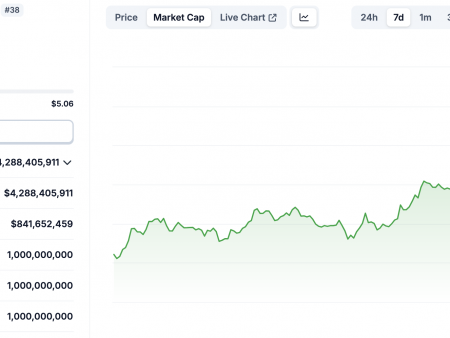

Cardano (ADA) recently exhibited a golden cross, a technical chart pattern often interpreted as a bullish signal, where the 50-day moving average crosses above the 200-day moving average. However, despite this typically optimistic indicator, ADA has since entered a correction phase, losing a significant portion of its value. This development raises the question of the usefulness of the golden cross as an indicator in the current market context for ADA.

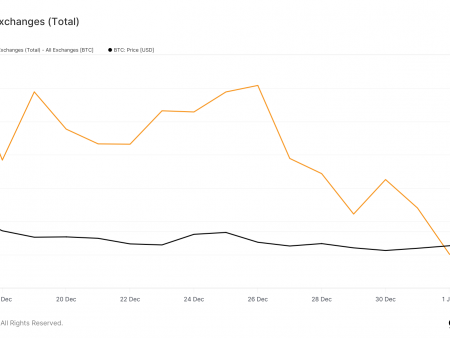

ADA price dynamics have been influenced by several factors. After a period of upward momentum over the past month, ADA encountered a substantial resistance level, triggering a strong bearish response. This resistance and subsequent selling pressure hint at the possibility of further declines. However, as ADA/USDT approaches critical support levels, there is also a possibility of a bounce if the bullish sentiment persists.

This recent reversal in ADA price after the golden cross may reflect broader market consolidation trends. With significant selling pressure building up, the short-term outlook for ADA presents both bullish and bearish possibilities.

The fundamental support level to watch is $0.368, lining up with the 10 EMA. If ADA price can sustain above this level, it may indicate the continuation of an uptrend. On the contrary, a decline towards the 50 EMA at $0.31 could indicate a weakening of the bullish stance and a possible further correction.

In this context, the recent golden cross may not be the bullish trigger investors were hoping for, as market conditions and sentiment play a bigger role in ADA price action than this single technical pattern. For a complete analysis, investors should continue to monitor market trends, on-chain data, and broader economic factors influencing the cryptocurrency market.