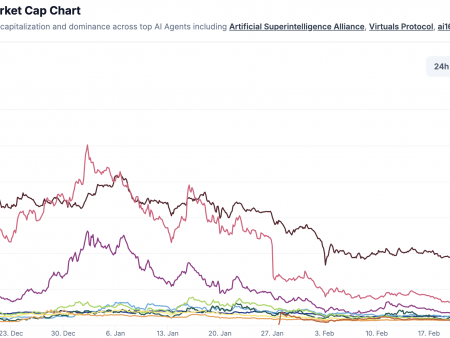

In recent research, digital asset manager CoinShares attempted to predict how capital inflows into Bitcoin-based exchange-traded funds (ETFs) in the United States could affect BTC price dynamics.

Bitcoin (BTC) Could Soar to $265,000 After ETF: CoinShares Model

The price of Bitcoin (BTC) could rise more than $141,000 in the first 12 months following the approval of Bitcoin spot ETFs in the United States. This calculation is based on the fund flow model published by CoinShares head of research James Butterfill.

The model itself is based on a conservative assumption: according to the Galaxy report, spot Bitcoin ETFs could represent a $14.4 trillion market. If only 10% of the holders of these funds invested 1% of their wealth, entry into the segment would exceed 14.4 billion dollars.

This approach hints at a potential 300% rally for Bitcoin (BTC) that could be recorded in the first 12 months after the SEC gives the green light to the Bitcoin ETF:

If we take the aforementioned $14.4 billion of inflows, the model suggests it could push the price up to $141,000 per Bitcoin.

So, a $31 billion entry into the segment could lead to a new rally and take the price of the largest cryptocurrency to a whopping $265,000.

At the same time, the forecast’s authors added that “it is very difficult to determine how big the potential wall of demand will be once a spot ETF is launched.”

CoinShares secures option to acquire Valkyrie crypto ETF unit

CoinShares itself manages $3.46 billion in assets under management.

As U.Today previously reported, almost all of the major US asset management heavyweights have submitted applications for Bitcoin Spot ETF approval to the SEC.

Some analysts are confident that at least one of these applications could be approved by the SEC by the end of 2024.

Yesterday, November 16, 2023, CoinShares obtained an exclusive option to acquire Valkyrie, an American digital asset manager. The option is valid until March 31, 2024.