Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is for informational purposes only. U.Today is not responsible for any financial losses incurred when trading cryptocurrencies. Do your own research by contacting financial experts before making any investment decisions. We believe all content is accurate as of the date of publication, but some offers mentioned may no longer be available.

According to the on-chain analysis firm In the block, Ethereum, the second-largest cryptocurrency by market value, has seen significant outflows from exchanges in recent weeks. Over $1 billion worth of ETH has been removed from crypto exchanges during the said period.

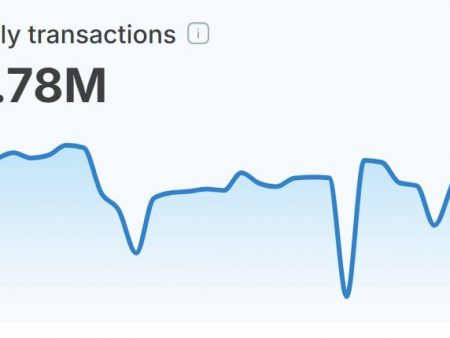

Ethereum has seen $320 million in currency outflows this week and over $1 billion in the previous three weeks. Currency outflows often indicate that investors are moving funds from centralized exchanges to private portfolios.

A prominent argument in favor of increasing currency outflows is that long-term investors are withdrawing assets to hold them for a longer period. This can be seen as a vote of confidence in the long-term prospects of the cryptocurrency.

ETH is down 1.39% in the last 24 hours to $1,938 at the time of writing. According to IntoTheBlock, Ethereum fees have increased along with market volatility and DeFi volumes.

Fidelity Files for Ethereum ETF

According to Bloomberg analyst James SeyffartMoney management giant Fidelity has entered the Ethereum ETF spot competition by filing a 19b-4 with CBOE.

Fidelity will be the seventh entity to apply for an Ethereum spot ETF, according to Seyffart.

According to a filing on Friday, Fidelity is looking to launch an exchange-traded fund that owns Ethereum’s ETH, joining rival BlackRock in driving cryptocurrency adoption.

The Fidelity Ethereum Fund would be listed on a Cboe Global Markets exchange, but the SEC must decide whether to authorize the Ethereum ETF, as it would others, including one from BlackRock.

In the latest development, the Securities and Exchange Commission delayed making a decision this week on whether to approve the Hashdex Nasdaq Ethereum ETF, which seeks to hold both Ethereum spot and futures contracts.

The SEC stated that it needed additional time to act and would make a decision by January 1, 2024.