The recent parabolic rise in the price of the Solana coin (SOL) hit a local high at a 19-month high of $68.2. Following this, the altcoin has suffered a minor correction amid the current uncertainties in the cryptocurrency market, resulting in a 15.6% drop to its current trading price of $57.00. However, is this correction a temporary phase or will it extend further?

Also read: Solana (SOL) “FOMO has recovered in a big way”

Will SOL Recovery recover $70?

- The formation of a rounded bottom pattern hints at the first signs of a trend change

- The break of $48.3 has set SOL price for a rally to $78.

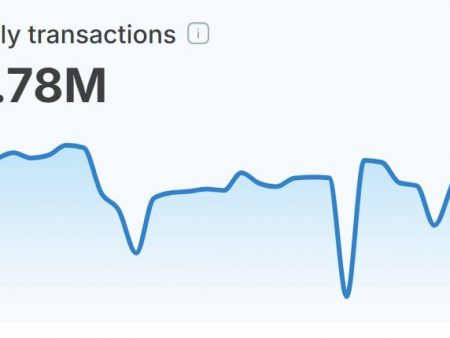

- The 24-hour trading volume of the Solana coin is $1.93 billion, indicating a gain of 4%.

Source-Tradingview

Source-Tradingview

The current correction in Solana price is testing the support around the 23.6% Fibonacci retracement level at around $36.1. The daily candle, showing a rejection of the low price at this level, suggests an active accumulation of buyers.

Corrections of this nature are often considered normal and healthy within a bull market as they provide opportunities for the market to consolidate and build bullish momentum. Notably, during its recovery phase, SOL price has not fallen below the 50% Fibonacci level.

In the event of an extended correction, the 38.2% and 50% Fibonacci levels, at $48.3 and $42.2 respectively, will serve as crucial support zones. If buyers sustain the price above these levels, SOL is likely to resume its bullish trajectory, potentially following a rounded bottom pattern.

This pattern could lead to a prolonged recovery with potential targets at $78.22, $100, $121, and $143.

SOL Performance vs. BTC

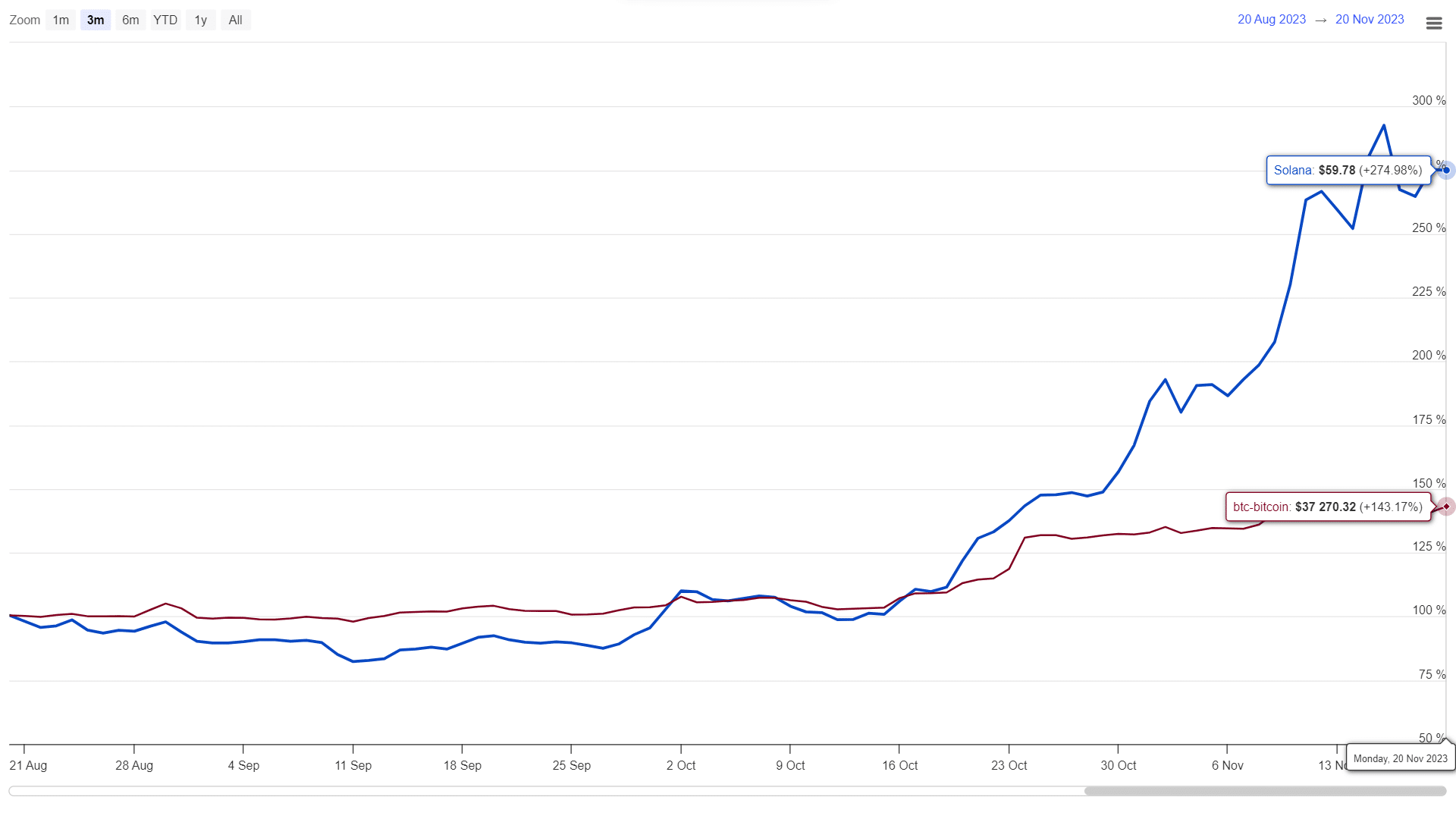

Source: Coingape| Solana Price vs. Bitcoin

Source: Coingape| Solana Price vs. Bitcoin

Compared to Bitcoin, SOL has shown stronger performance in the October-November rally. The aggressive rally characterized by brief pullbacks suggests strong buyer conviction about sustainable growth. Even the current correction appears to be a healthy pullback, which is likely to support the continuation of the recovery rate.

- Moving Average Convergence and Divergence (MACD): A possible bearish crossover between the MACD line and the signal line could indicate increasing bearish momentum in the market.

- Exponential Moving Average (EMA): The 20-day EMA, currently around the $52 mark, may provide early support during the ongoing correction.