Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is for informational purposes only. U.Today is not responsible for any financial losses incurred when trading cryptocurrencies. Do your own research by contacting financial experts before making any investment decisions. We believe all content is accurate as of the date of publication, but some offers mentioned may no longer be available.

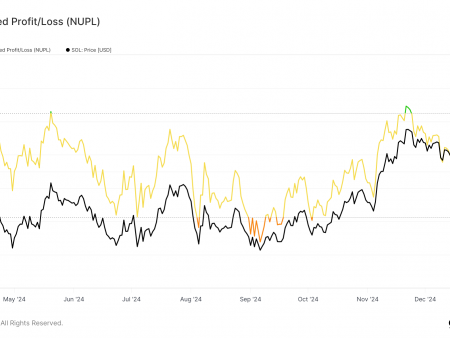

Long-term investors have reached a milestone: the amount of Bitcoin held by these steadfast supporters hit a new all-time high this week. This development is a significant indicator of bullish market sentiment, especially in the face of a year that has seen its fair share of volatility.

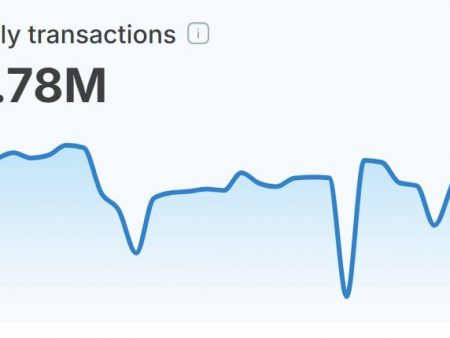

The growing HODLer balance suggests that Bitcoin’s long-term value proposition remains attractive, as more investors choose to hold on to their coins rather than sell them. This trend may decrease the supply available on the market, which could drive up the price as demand continues to grow.

In the crypto space, the behavior of long-term investors, often referred to as “HODLers,” is closely monitored. Their commitment to holding onto their investments through multiple market cycles is considered a measure of underlying confidence in the future of the asset.

While short-term traders typically react to price movements and immediate news, consistent accumulation by long-term investors points to a collective expectation of future profits. The implications of this for the Bitcoin market cannot be understated. A high HODLer balance typically indicates a reduction in selling pressure, which could set the stage for a bullish phase. This is particularly important as Bitcoin approaches key technical resistance levels.

However, it is crucial for market participants to consider a multitude of factors when interpreting such metrics. While a high HODLer balance is a positive sign, the cryptocurrency market is influenced by a complex interplay of market dynamics, including institutional adoption, regulatory developments, and macroeconomic factors.

As Bitcoin continues to carve out its place in the financial landscape, the rise in long-term holdings may also reflect a broader recognition of its role as a store of value and hedge against inflation. As we move forward, the actions of long-term Bitcoin investors will continue to be an indicator of the health and trajectory of the market.