Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is for informational purposes only. U.Today is not responsible for any financial losses incurred when trading cryptocurrencies. Do your own research by contacting financial experts before making any investment decisions. We believe all content is accurate as of the date of publication, but some offers mentioned may no longer be available.

As Ethereum (ETH) approaches the pivotal $2,000 mark, investors are closely monitoring its potential to maintain or reverse current momentum. The importance of the $2,000 level lies not only in its psychological impact but also as a technical indicator that has historically acted as support and resistance.

In the current context, Ethereum’s price resistance can be partly attributed to the network’s declining supply. With the implementation of EIP-1559, a portion of transaction fees are “burned,” effectively removing ETH from circulation. Recent data shows that a substantial amount of ETH is being burned, with an estimated annual burn rate of 1,273,000 ETH. This deflationary mechanism is juxtaposed with supply growth of 0.35% annually, presenting a compelling narrative of scarcity-driven value appreciation.

Ethereum’s supply dynamics are complemented by its ever-growing ecosystem, where DeFi and NFTs continue to create demand for ETH. However, it is essential to consider that while supply indicators are encouraging, demand must keep pace for positive price action to be sustained. The overall health of the asset is strong, with fundamentals supported by continued development and anticipation of the full transition to Ethereum 2.0.

Investors should consider Ethereum’s broader role in the blockchain ecosystem, its technical advancements, and the macroeconomic factors influencing the crypto market as a whole. As ETH retests the $2,000 threshold, its ability to hold above this level could be a bullish sign, but if it fails to do so, the asset could look for support at lower levels. Therefore, investors would do well to keep an eye on market trends, on-chain metrics, and global economic indicators that could influence Ethereum’s trajectory.

Shiba Inu attacks a key resistance

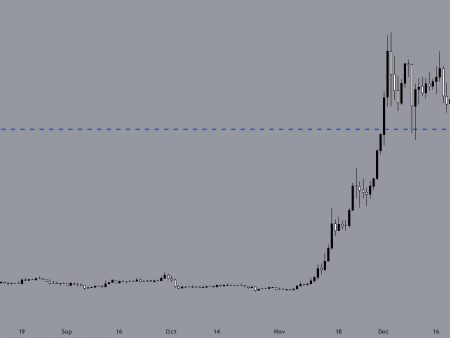

The Shiba Inu meme coin (SHIB) has been making headlines in the cryptocurrency market, not only for its community-driven initiatives but also for its price action, which has recently shown signs of recovery. Technical analysis of SHIB/USDT on the daily chart indicates that SHIB is currently testing a critical resistance level which, if broken, could indicate an uptrend.

As of now, SHIB is hovering around the 0.00000850 mark. For SHIB to confirm a bullish breakout, it would have to consistently close above this level and maintain bullish momentum. The coin has been making higher lows, which is a positive sign for investors looking for a possible continuation of the uptrend. On the contrary, if SHIB fails to overcome this resistance, it could suffer a pullback to lower support levels.

Broader sentiment in the cryptocurrency market, particularly around meme coins, can be fickle and heavily influenced by social media and market trends. The strong community support for Shiba Inu and the recent increase in burn rates have added a deflationary aspect to the token’s economics, but the overall impact on the price remains to be seen.

Investors are advised to closely monitor volume changes and market sentiment indicators to assess the potential for SHIB price movement. Shiba Inu’s transition from a meme-based asset to one with real utility is underway, as evidenced by partnerships such as the Manny Pacquiao Foundation, which aims to use the Shibarium blockchain for charitable initiatives.

These developments paint a bullish picture for SHIB, suggesting that its current market price could offer a lucrative opportunity for investors keeping an eye on the next bull run, with the ambitious $0.01 price target being a focal point for the community.

While the direct impact of the burn rate on the price remains a topic of debate, these concerted efforts by the SHIB community reflect a strategic approach to fostering both demand and the long-term value of the token.