Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is for informational purposes only. U.Today is not responsible for any financial losses incurred when trading cryptocurrencies. Do your own research by contacting financial experts before making any investment decisions. We believe all content is accurate as of the date of publication, but some offers mentioned may no longer be available.

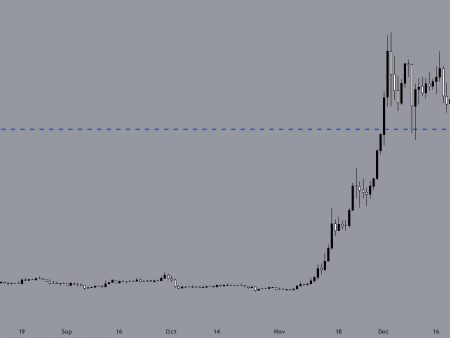

XRP has recently shown signs of recovery, rebounding from recent lows to challenge a key resistance level. The positive momentum has brought cautious optimism to the market, hinting at a possible long-term reversal of the bearish trend that has been seen on longer-term charts. However, this budding optimism has a major drawback.

Even though the advance above a descending trend line indicates a possible change in market sentiment, XRP’s upward journey requires a substantial influx of purchasing power to regain its previous position in the market. The asset’s recovery is still in a precarious phase, on the verge of a true reversal or a false dawn. Recent gains could quickly unravel without sustained demand and increased investor confidence to support further price increases.

Furthermore, the broader market context cannot be ignored. Cryptocurrency markets are influenced by a wide variety of factors, including regulatory news, technological advances, and changes in investor sentiment. For XRP, a clear path to recovery involves navigating through these complex market dynamics and emerging with strong buying interest from retail and institutional investors.

As the market watches the development of XRP price action, it is clear that for a genuine recovery to take hold, it will take more than just a technical breakout. It needs strong, sustained momentum, potentially driven by positive developments within Ripple’s ongoing legal challenges or impactful new partnerships that could trigger a new wave of adoption.