BTC Price Rebounds to 1-Week Lows as Bitcoin Whales Sell Off to $35,000

Bitcoin drops $1,000 in just one hour as a cascade of liquidations greets late Bitcoin longs.

Market update

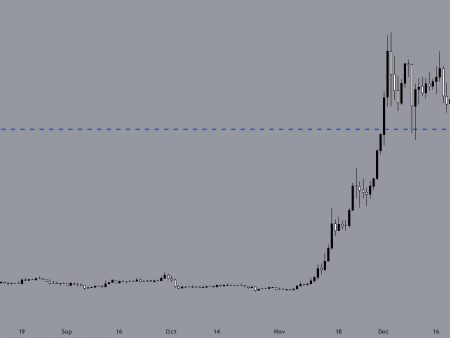

Bitcoin (BTC) tested $35,000 support at the daily close on Nov. 14 as sell-side pressure caused multi-day lows.

BTC price loses $1,000 in one hour

Data from Cointelegraph Markets Pro and TradingView tracked a rapid pullback in BTC price action, which fell over $1,000 in a single hourly candle.

The largest cryptocurrency found support at the $35,000 mark, forming a springboard to recover to around $35,600 at press time.

The volatility came hours after what initially seemed like positive news for Bitcoin and cryptocurrencies, with US inflation slowing beyond expectations.

At the same time, however, analysts noted that beyond small retail investors, there was little appetite to buy BTC at previous levels, around 18-month highs.

$BTC

once again spot buying on long liquidations and deleveragingOverall, I still want to see more spot premiums.

Spot premium and spot-driven uptrend is what you want to see pic.twitter.com/VoXrWQDGMc

— Skew Δ (@52kskew) November 14, 2023

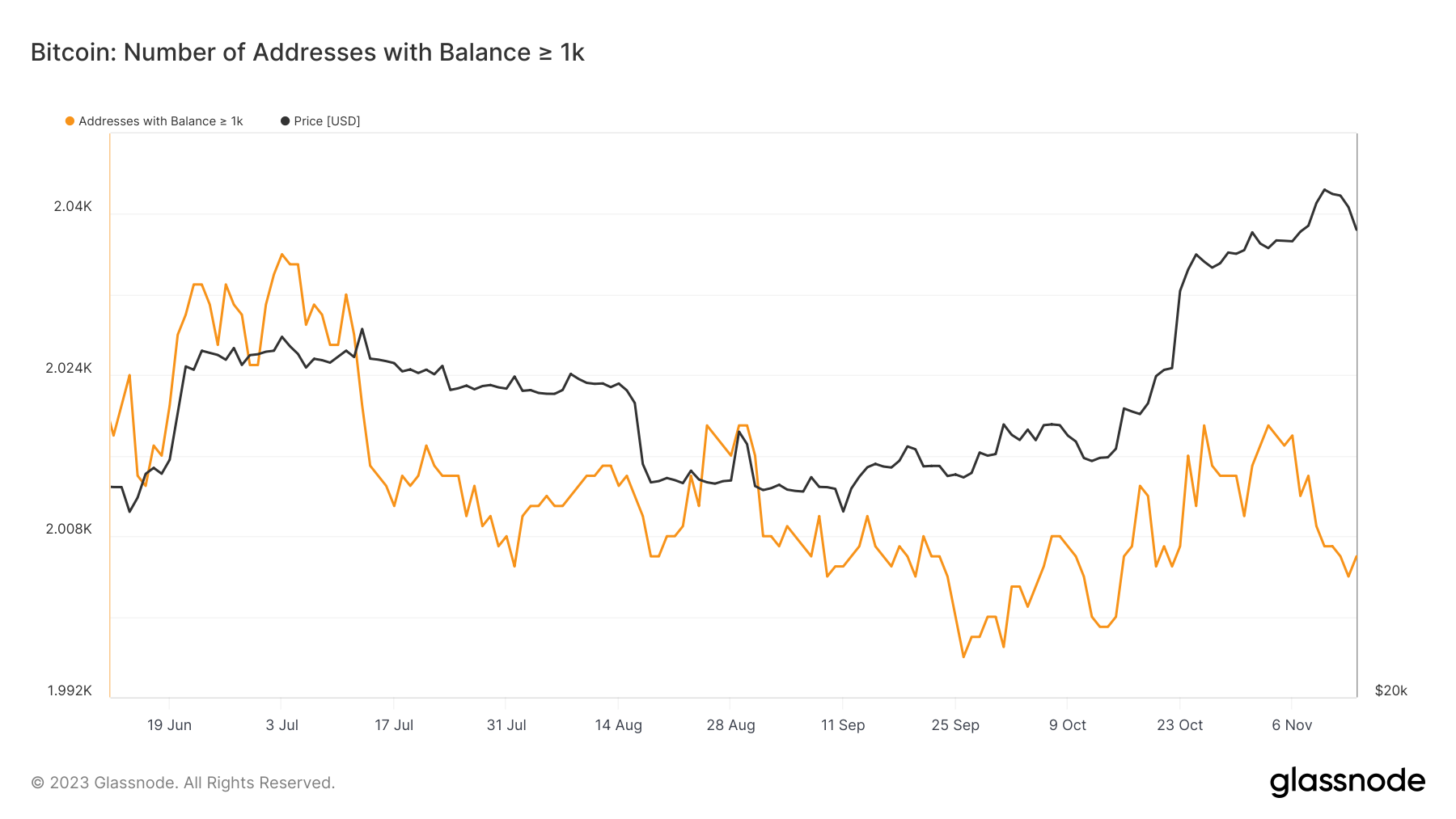

“On November 3, Bitcoin whales started booking profits as the price of $BTC rose from $35,000 to almost $38,000,” noted one such take by popular social media commentator Ali.

“More than 15 wallets with more than 1000 BTC sold or redistributed their holdings.”

An accompanying chart from on-chain analytics firm Glassnode showed that the whale wallet cohort is now at its lowest number in about a month.

Meanwhile, uploading prints of Binance’s BTC/USDT order book to Bitcoin.

“It seems like the market liked the core inflation report, but don’t let that fool you into thinking ‘just going up’ will be sustainable,” part of the above comment. read.

“There are no straight lines. The market is testing your patience and conviction.”

A subsequent release showed supply support approaching the spot price ($33,000 to $34,500) while whales were selling off.

#FireCharts shows all types of sales orders #BTC as the price falls below the $35.5K range.

Meanwhile ~9 million dollars in #BTC The liquidity of the offer has just risen from $33,000 to $34,500. pic.twitter.com/DIfayNHYC7

— Material indicators (@MI_Algos) November 14, 2023

Long-term settlements hit highest level in months

The traders themselves seemed unaware of the BTC price reversal.

Related: $48,000 is now “reasonable” BTC price target – Filbfilb by DecenTrader

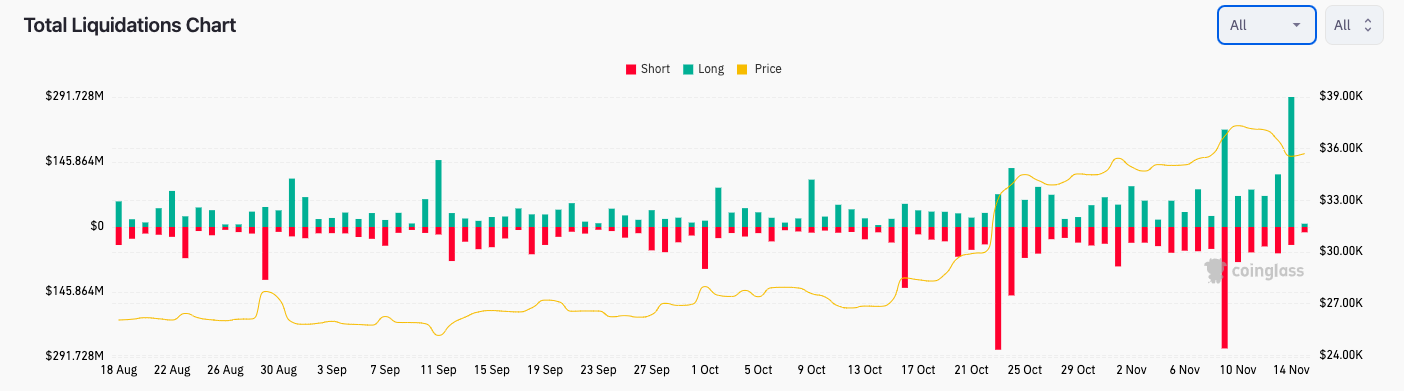

Data from on-chain monitoring resource CoinGlass showed the highest volume of daily BTC long liquidations in several months.

These totaled $120 million by November 14, roughly equal to the BTC short liquidations, which accompanied Bitcoin’s rise to $38,000 last week.

Longs between cryptocurrencies were liquidated to the tune of almost $300 million.

This article does not contain investment advice or recommendations. Every investment and trading move involves risks, and readers should conduct their own research when making a decision.

Add reaction