Solana (SOL), Avalanche (AVAX), and dYdX Produce Double-Digit Gains as Bitcoin Reclaims $37,000

SOL, AVAX, and DYDX are among the best-performing altcoins this month. Cointelegraph investigates what is behind this measure.

Altcoin Monitoring

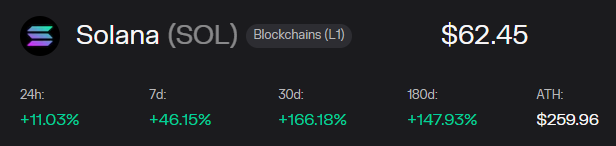

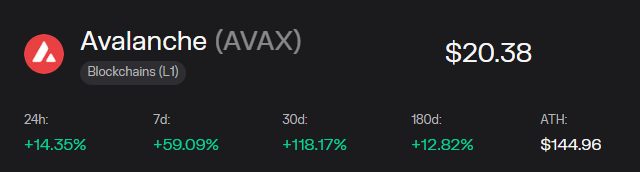

On November 15, several altcoins continued to show strength alongside Bitcoin (BTC), which hit an intraday high of $37,400. Heading into the week, Solana’s DYDX, SOL (SOL), and Avalanche’s AVAX (AVAX) are currently reflecting double-digit gains, with each chasing new year-to-date highs.

Sustained bullish altcoin price action has led some analysts to declare the arrival of an altcoin season and, at the time of writing, the total market capitalization of the altcoin market has reached a 2023 high of 659 .5 billion dollars.

Altcoin price rallies typically involve a number of factors, some based on sentiment and others based on project fundamentals. Let’s take a look at some of the major players in this week’s market to see what catalysts underlie their growth.

dYdX rate change increases price

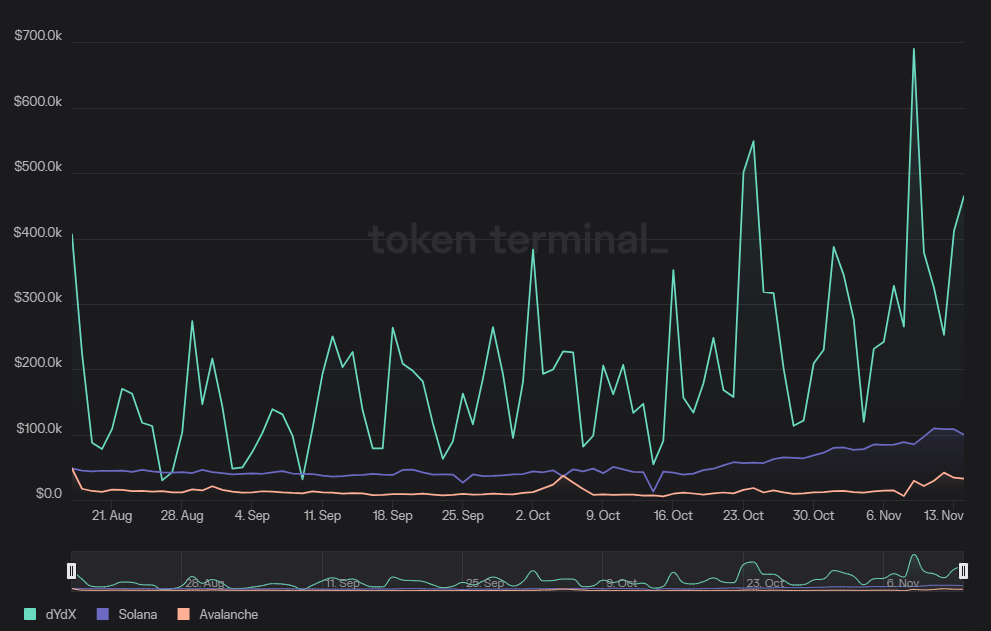

The platform behind the DYDX token is dYdX, a decentralized exchange that offers futures contracts on Ethereum Virtual Machine blockchain tokens such as Ether (ETH). On October 27, dYdX launched its layer 1 blockchain with the creation of its genesis block, which operates using native DYDX tokens. The launch enabled on-chain distribution of all fees received to validators and stakers. The protocol upgrade has been fantastic for DYDX price, lifting it over 110% in the last 30 days.

Related: Exclusive: 2 years after John McAfee’s death, widow Janice is broke and needs answers

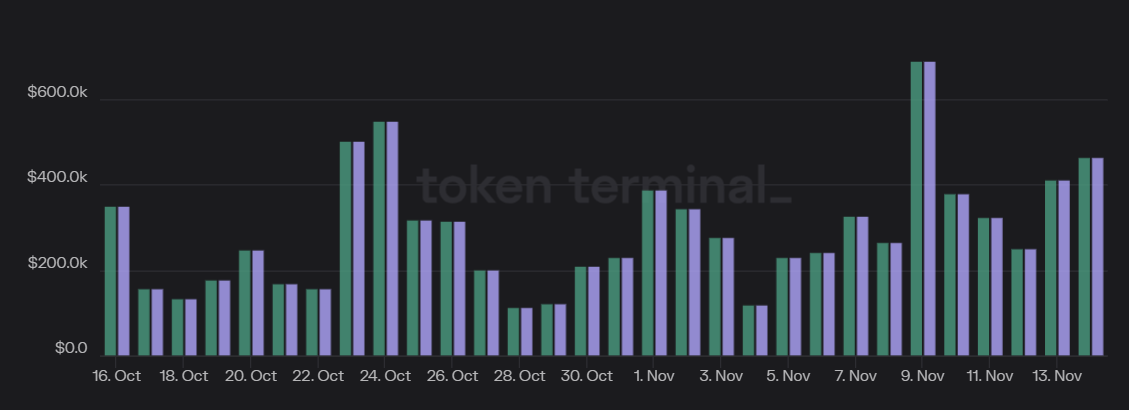

In addition to token price appreciation, the dYdX platform is seeing substantial numbers of users, including increased fees and revenue. Both metrics have witnessed increases of 77.5% to $8.67 million in 30 days. Annualized, this could mean $105.5 million in fees for validators and stakers.

SOL price hits another high in 2023

Solana’s SOL token has had an impressive 30-day return profile, gaining over 166%. Despite hitting a 2023 high on November 10, Solana’s price is still more than four times below its all-time high of $259.96.

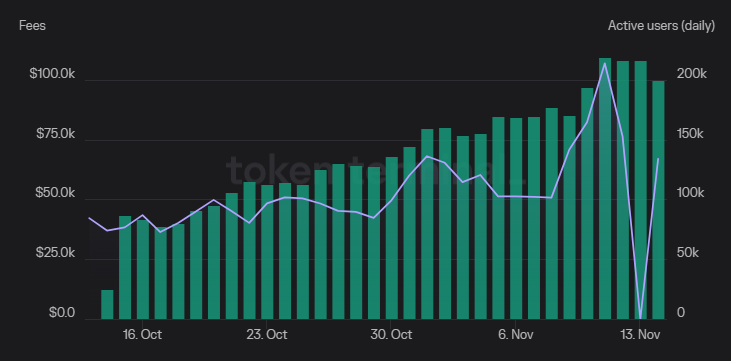

Solana’s price growth has been driven by an increase in user numbers, led by the highest-performing decentralized application on the blockchain, Jito, a liquidity staking platform. Solana’s daily active users also hit a 2023 high on November 10, reaching 200,000. Coinciding with the increase in users, Solana’s revenue has exceeded one million dollars in 30 days, registering an increase of 78.2%.

Avalanche’s AVAX token gains momentum

Avalanche is a layer 1 blockchain similar to Solana, where validators process transactions and receive tokens. Compared to Solana and dYdX, Avalanche generates less revenue, but that hasn’t stopped its token from hitting a double-digit streak this week.

Despite being relatively smaller, AVAX has performed well. In the last seven days, AVAX achieved gains of over 59% and achieved an impressive 118% growth in 30 days. AVAX price remains more than 7 times below its all-time high.

Related: Is it high season? Altcoin 30-day performance and total market cap are bullish

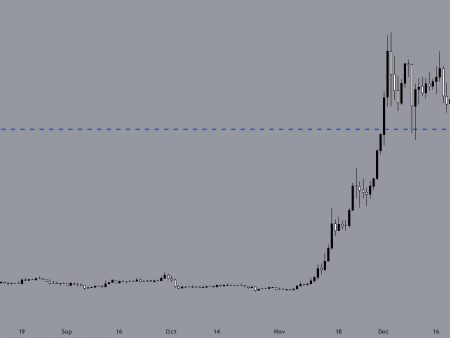

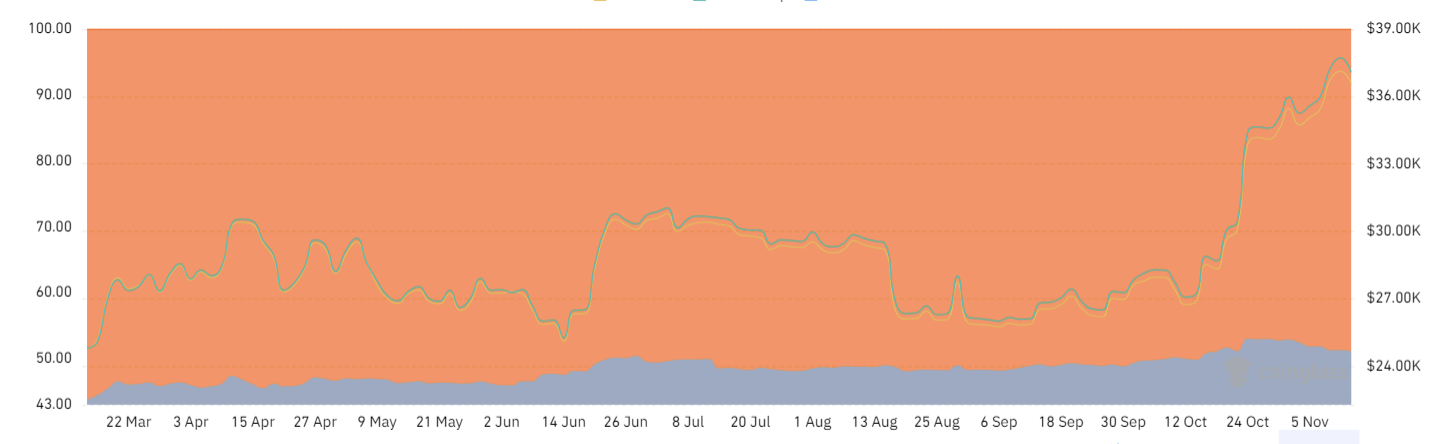

While these three altcoins are performing well, Bitcoin continues to dominate the overall market, with its dominance rate above 50% since October 16. When Bitcoin dominance declines, those funds typically flow into altcoins, which is typically the start of an altcoin season.

This article does not contain investment advice or recommendations. Every investment and trading move involves risks, and readers should conduct their own research when making a decision.

Add reaction