Bitcoin found support for $ 80 thousand dollars. The USA, which caused a bull bouncer. Nevertheless, the 200-day sliding average currently acts as a significant resistance, which implies that the probability of consolidation in the range is 80 thousand to 87 thousand dollars. USA in the short term.

Technical analysis

Shayan

Daily diagram

Bitcoin recently printed a bull bouncer after finding strong support in the range of 75 thousand US dollars. This area has historically acted as a psychological and technical floor, and the bull divergence between RSI and at a price confirmed a slowdown in a bear impulse, signaling the updating of the buyer’s interest.

Nevertheless, the current rally approaches a critical level of resistance, a 200-day sliding average of 87 thousand dollars.

This MA serves as a dynamic resistance zone and can limit the price in the short term. As a result, Bitcoin will probably continue to consolidate in the range of 75 thousand dolds -year up to 87 thousand dollars. The United States until a decisive breakthrough occurs. If the bulls manage to advance above the 200-day ma, the next main goal is at the psychological level of $ 100 thousand. USA.

4-hour table

In a lower period, Bitcoin discovered strong support on the midline of the descending channel, which caused an impulsive surge, a potential accumulation signal at these levels. Currently, the price checks the upper border of the channel about 84 thousand dollars.

A confirmed breakthrough over this trend line and the previous high swing will cancel the bear structure, opening the path to the key resistance zone for 90 thousand dollars. USA.

Conversely, the inability to break through above this level will strengthen the current bear structure of the market, which will probably lead to an updated low pressure in the medium term.

Analysis on the chain

Shayan

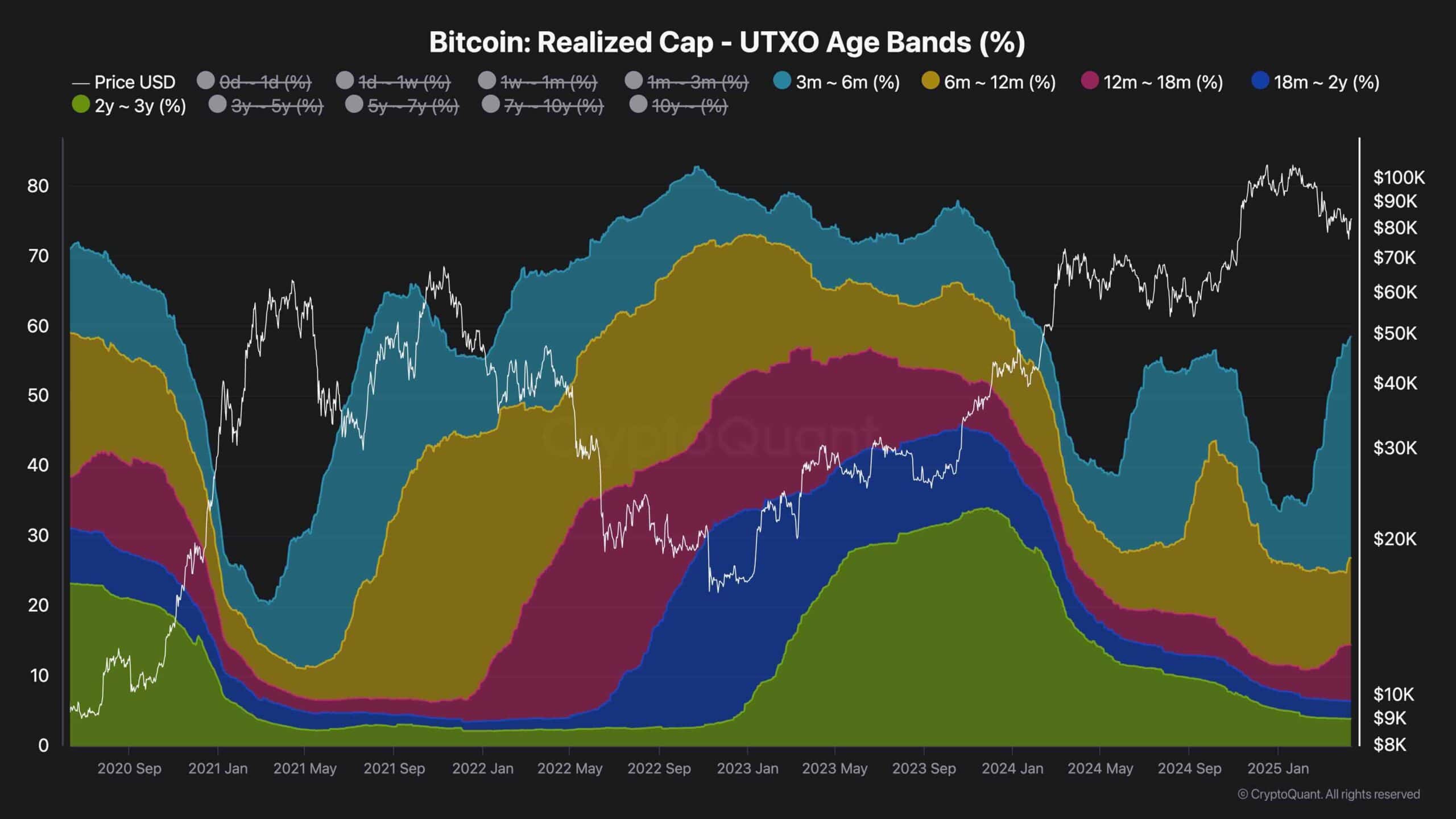

Realized CAP UTXO age bands (%) are a powerful metric on the chain that destroys the Bitcoin Cap realized UTXOS (unhealthed transactions), offering an idea of investors’ behavior based on the dedication duration.

According to the latest data, the share of coins belonging to 3-6 months and 6-12 months is steadily rising. This rise carefully reflects the accumulation models observed during a long correction in the summer of 2024, reflecting the growing condemnation among holders.

This behavior indicates the Kodling trend, where investors retain their coins, despite the continuing market correction, refraining from sale even in the face of volatility. As more and more coins move into the hands of long -term holders, an affordable circulating supply is reduced, increasing the deficiency of bitcoin.

Historically, such supplies restrictions, when they are satisfied with updated demand, were catalysts for strong price rallies. This dynamics often lays the ground for detecting prices and new maximums for all the time.

Consequently, the current structure on the chain indicates that the ongoing subsidence is less likely to become the beginning of a bear market and, most likely, a healthy correction in a wider bull cycle.