Trader and analyst of Rekt Capital, popular on Twitter, shared a disappointing analysis.

He expressed the opinion that closing the week at a level below $26,000 will confirm the relevance of the double top pattern on the weekly bitcoin chart.

According to the Cryptovizor cryptocurrency screener, which determines the price of BTC/USD based on the results of trading on spot exchanges, the weekly candle closed at $25,843.

Only a few hours until the new Weekly Close for #BTC

— Rekt Capital (@rektcapital) September 10, 2023

Weekly close below ~$26,000 likely confirms the Double Top breakdown$BTC #Crypto #Bitcoin

WEEKLY BITCOIN CHART. SOURCE: CRYPTOVIZOR

Earlier, Rekt Capital analyzed the value of the gaps of the Chicago Mercantile Exchange (CME). It is known that the gaps on the chart of this exchange, trading bitcoin with a break for the weekend, most often act as magnets and are filled with subsequent price movement. The analyst drew attention to the fact that the June gap of 2022 currently acts as resistance, while previously it acted as support (red rectangle on the chart).

GAP ANALYSIS ON THE BITCOIN CHART. SOURCE: REKT CAPITAL

Now there is an unfilled gap at the level of $20,000, testing of which Rekt Capital considers likely as a consequence of a double top on the weekly bitcoin chart.

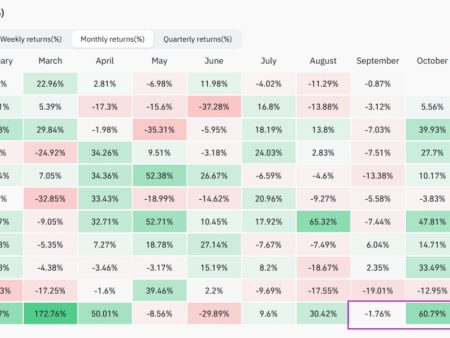

After hearing this forecast, Material Indicators analysts published the current heat map of bitcoin orders on the Binance exchange. They wrote:

Bulls should prevent a lower low (LL) by defending the $24,750 level to keep the hope of another pump alive. By printing out a new LL, you buy a ticket to bear paradise.

Meanwhile, it’s going to be a hot week. On September 14 (15:30 MSK), data on the US consumer price index (CPI) for August will be released. This index is known as an excellent catalyst for the movement of the bitcoin price, as it affects market expectations about what decision the US Federal Reserve will make on the interest rate.

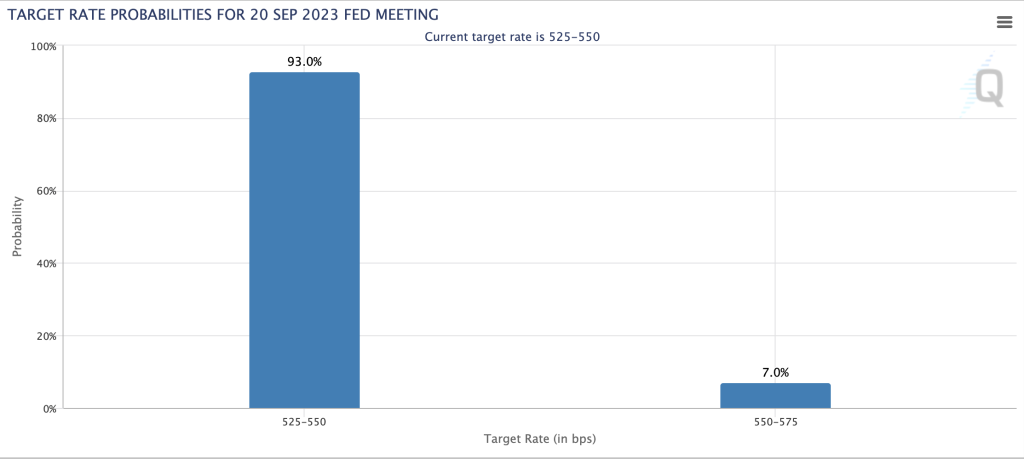

Speaking of expectations. According to the FedWatch tool, on September 20, the Fed will not change the current rate at the level of 5.25-5.5%. In any case, 93% of experts think so.