The introduction of Smart Contracts BitVM marked a significant milestone in the scalability and programmability of bitcoins. Strengthened in the original BITVM protocol, the Bitlayer’s Finalty bridge is the first version of Protocol Live on Testnet, which is a good starting point for implementing the promises of the Bitcoins era or Season 2.

Unlike the earlier BTC bridges, which often required dependence on centralized entities or dubious assumptions of Trust, the ending bridge uses a mixture of BITVM intellectual contracts, evidence of fraud and evidence of zero knowledge. This combination not only increases safety, but also significantly reduces the need for trust in third parties. We are not at a reliable level that Lightning provides, but this is a million times better than the current structures of the side moves, claiming that these are Bitcoin layers 2S (in addition to a significant increase in the design space for Bitcoins applications).

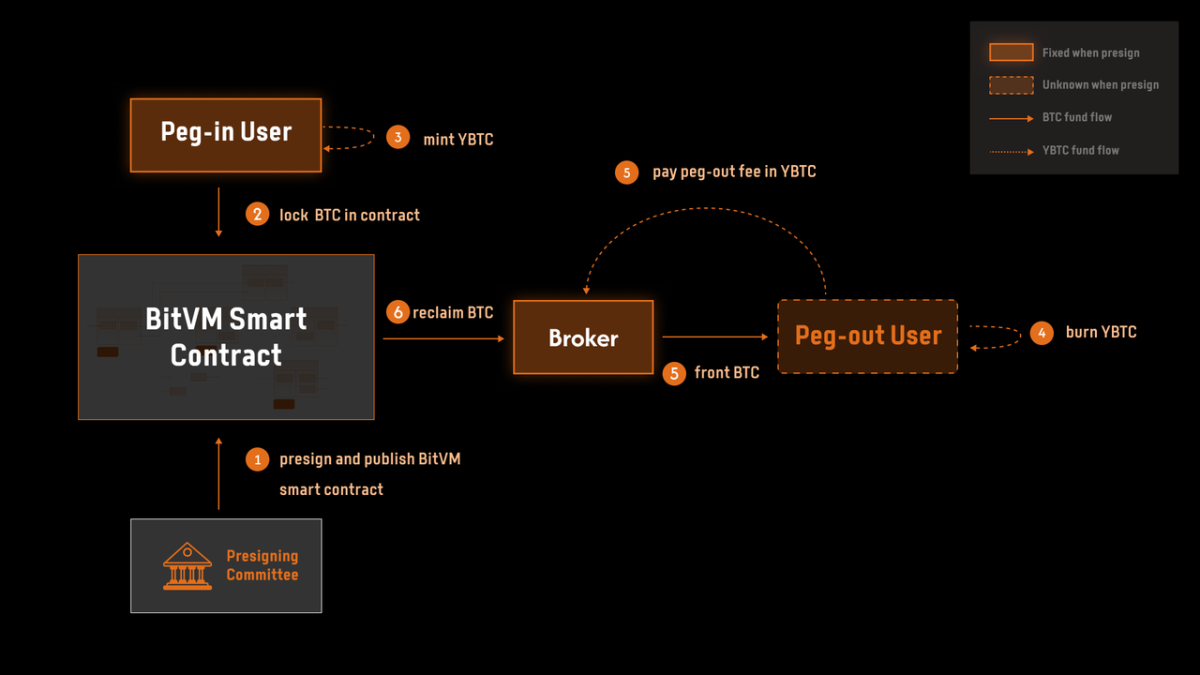

The system works according to the principle in which the products are securely blocked in addresses adjusted by the BITVM smart contract, functioning in accordance with the fact that at least one participant in the system will be honest. This setting by its nature reduces trusting requirements, but should introduce additional difficulties with which Bitlayer seeks to control this version of the bridge.

Mechanics of trust

From a practical point of view, when Bitcoin is blocked in the BitVM intellectual contract through the ending bridge, users are issued by YBTC – token, which supports a strict pegs of 1: 1 with bitcoins. This peg is not just a promise, but is also provided by the basic logic of a smart contract, guaranteeing that each YBTC is a real, blocked bitcoin on the main chain (without fake “repeated” BTC metrics). This mechanism allows users to participate in Defi such events as lending, borrowing and processing agriculture in the Bitlayer ecosystem without prejudice to ensure security and settlement that Bitcoin provides.

While some in the community can find these actions undesirable, this type of architecture allows users to get some guarantees that they could not hope for the traditional designs of lateral goals, with an additional bonus, that we do not need to “change” Bitcoin to do this (although the designs of this bridge will completely make this design of the bridge). To obtain more information about various risks associated with the designs of riders, take a look at the assessment of bitcoins of the Bitlayer layers here.

However, until such achievements are implemented, the Bitlayer final bridge serves as the best implementation of the BITVM 2 paradigm. This indicates that it is possible after a “brain leak” from centralized chains back to Bitcoin. Despite all the problems that BITVM chains are faced with, I remain an exclusively excited prospect of Bitcoin, who fulfills his fate as the final chain of settlements for all economic activity.

This article TakeThe field of pronounced opinions are completely the author and does not necessarily reflect the opinions of BTC Inc or Bitcoin Magazine.

Guillaume articles, in particular, can discuss topics or companies that are part of the investment portfolio of his company (Utxo Management) Expressed views are exclusively his own and do not represent the opinion of his employer or his branches. He does not receive financial compensation for these oaks. Readers should not consider this content as a financial consultation or approval of any particular company or investment. Always conduct your own research before making financial decisions.