Hot, what was expected, these inflation, released on Wednesday morning, used descending pressure on both traditional and crypto markets.

Inflational fears are pushed by Bitcoin below $ 96,000.

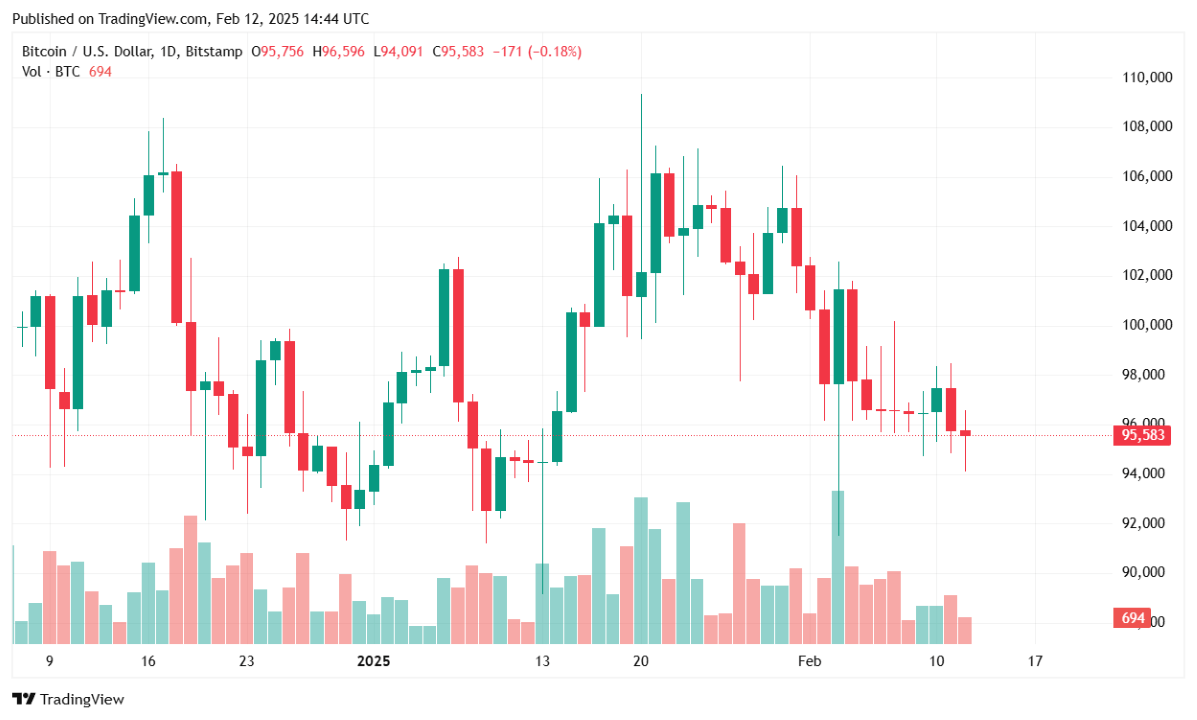

Bitcoin (BTC) is struggling to support the impulse, trading $ 95,580.74 at the time of reporting. The leading cryptocurrency has decreased by 1.55% over the past 24 hours and decreased by 3.55% over the past week, since macroeconomic problems weigh risk assets. Over the past 24 hours, BTC ranged in the range from 94,101.20 to 97,298,13 US dollars, since traders react to the growing economic uncertainty.

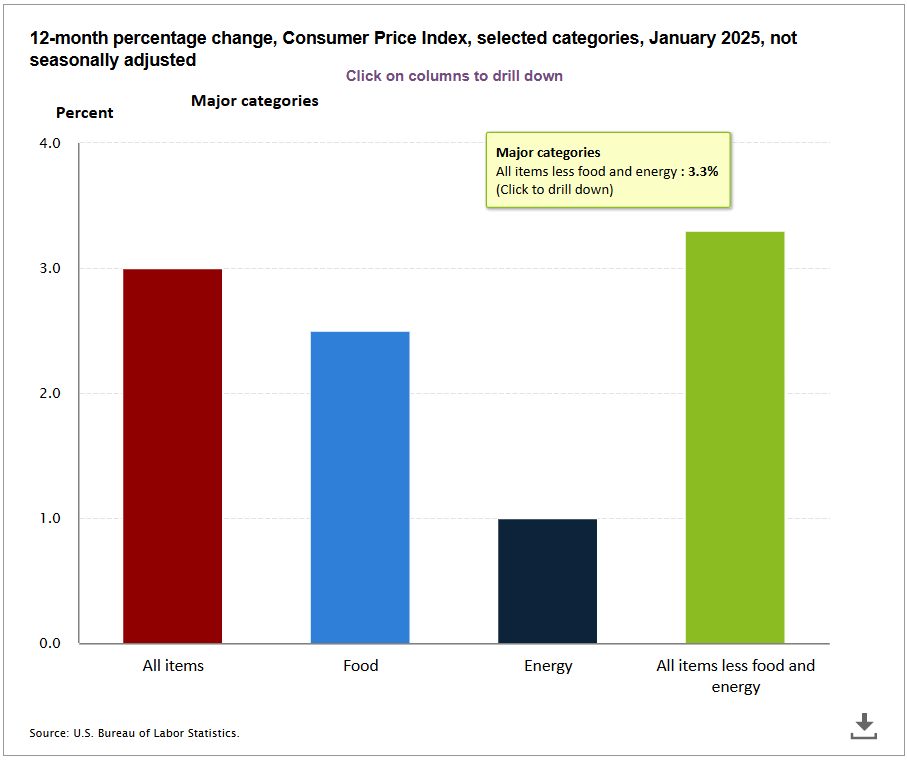

CPI sparks report inflation of inflation care

Macroeconomic obstacles affect the price effect of BTC, with the data of the consumer price index (CPI) higher than expected, consumer prices (IPCs). Inflation increased by 0.5% per month, which caused an increase in shelter, insurance, medical care and tariffs. The main inflation was 3.3% in the annual calculus, increasing the fears that inflationary pressure remains constant.

Higher inflation data caused a sale in traditional markets, and the futures for the DOW fell by almost 400 points, while the treasury profitability intensified when investors were preparing for long high interest rates. The data aroused doubts about the temporary scale of the federal reserve system for potential rates of bets, adding the uncertainty of financial markets, including crypto.

Reduction in market capitalization with a higher sales

The 24-hour trade volume of bitcoins jumped 38% to 43.48 billion dollars, possibly due to a temporary sale. The market capitalization of the asset decreased by 1.84% to 1.88 trillion dollars, which led to a decrease in the trust of investors, as the risk mood prevails.

BTC dominance acquires the struggle of altcoins

Despite the decrease in BTC prices, the dominance of bitcoins has grown by 3.18% over the past 24 hours, at present by 60.4%. This suggests that investors continue to consolidate in Bitcoin, since other digital assets are faced with more severe losses in the conditions of market uncertainty.

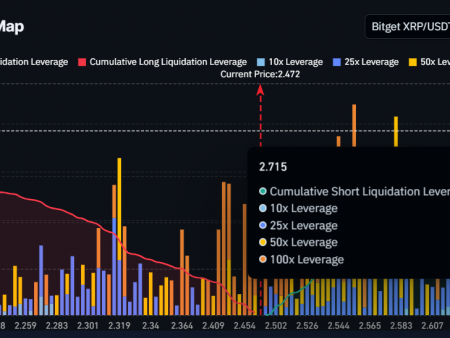

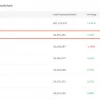

The futures activity of the market and liquidation

BTC Futures Open interest increased by 0.97% to 60.46 billion dollars. The USA, which suggests that traders position potential steps of price. Nevertheless, the data on liquidation reveal constant volatility, and over the past 24 hours 71.91 million dollars. USA in the last 24 hours. It is noteworthy that long liquidation accounted for 59.03 million dollars. The United States, which was significantly ahead of short liquidation of $ 12.88 million. The United States, which indicates that bull merchants were taken by surprise of the recent rollback of BTC.

Market prospects

Bitcoin faces complex short -term prospects, with problems with inflation and changes in the expectations of the Fed’s policy, which increases the pressure for risky assets. The key level of resistance remains $ 97,500, and BTC needs a strong break above $ 98,000 to restore bull impulse. On the other hand, if the sale continues, the BTC can check the support zone in the amount of $ 94,000, while the break below this level can open the door to further reduce to $ 92,500.

Investors will carefully monitor macroeconomic events, especially the political signals of the Fed, since the BTC continues to trade within the framework of a fragile market environment.