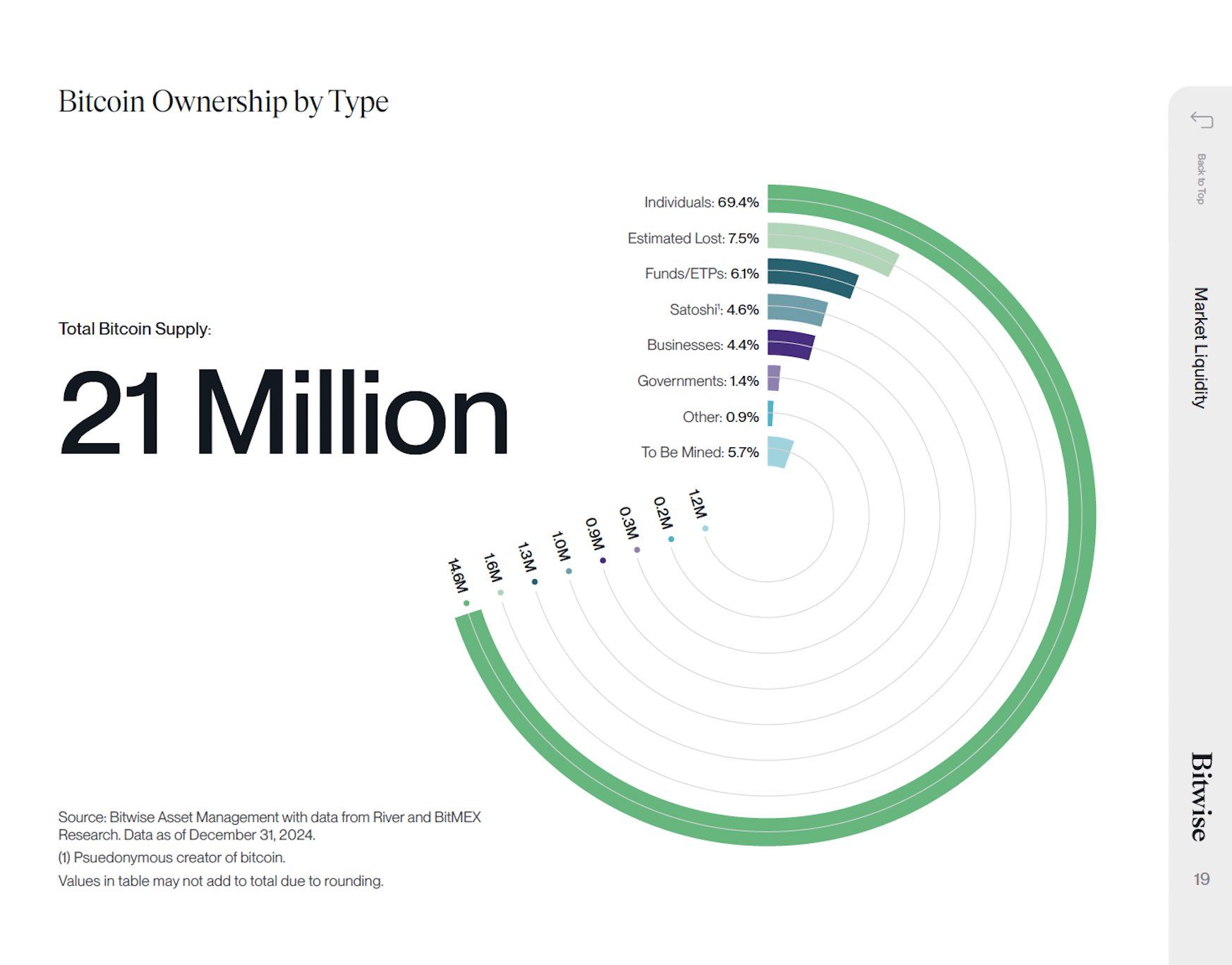

According to the Bit management of assets, individual holders control most of the general offer of Bitcoin (BTC). 69.4% of the 21 million BTC in circulation belong to private investors.

Given this concentration of ownership among people, large institutions and governments seeking to acquire bitcoin may encounter problems.

Institutions are faced with a shortage when the supply of bitcoins decreases

In a recent post X, the intended distribution of bitcoins from the total supply of sentences beat. In addition to individual holders, approximately 7.5% of bitcoins are considered lost. Funds and exchange products (ETPS) Control 6.1%.

The wallet associated with Satoshi Nakamoto, Bitcoin’s pseudonyms, has 4.6%. Moreover, only 5.8% of bitcoins own governments and enterprises in conjunction.

The asset manager emphasized that if companies and governments want to purchase bitcoin, they mainly need to purchase it from people who want to sell it.

“This market dynamics between buyers and sellers can become very interesting,” the report said.

Hunter Khorsley, General Director of BitWise, also noted that, despite the constant purchases from corporations and ETF, the price of Bitcoin was still faced with reduced pressure. He also emphasized that most of the value of Bitcoin remains in the hands of individual holders.

“Each new buyer must find a seller. Obviously, it is important, as always, ”Khorsley added.

Is Bitcoin blow come?

Meanwhile, only 5.7% of bitcoins have yet to be mined. In addition, over -the -counter (over -the -counter) markets work low on bitcoins. Crypto -analyst emphasized that only 140,000 BTC remain in the OTC market.

“There is almost no bitcoin left even for institutions,” he said.

The analyst explained the ETF in conjunction acquired 50,000 BTC last month. However, price movements remained muffled. This assumes that institutions are looking for Bitcoin with OTC Markets, not exchanges to avoid starting the price of prices.

Nevertheless, this strategy can no longer be viable with an inappropriate source of supply.

“Each billion dollars entering the BTC raises its price by 3-5%. That is why over -the -counter drying is so crazy, ”the analyst said.

He added that if the microprosthetia (now the strategy) continues its aggressive acquisitions or ETF to maintain their January accumulation at the level, Bitcoin Bitcoin can be exhausted. A similar scenario unfolded if the United States and the States began to buy bitcoins as part of its reserves.

The strategy has retained a consistent plan for the acquisition of bitcoins. On February 10, the company acquired 7,633 BTC for about $ 742.4 million. USA. This marked its fifth purchase of bitcoins only in 2025. According to Saylor Tracker, the company now has 478 740 BTC, worth $ 47.12 billion.

Institutions such as BlackRock also increase the pressure on the supply. The asset manager reportedly purchased BTC in the amount of $ 1 billion in January. In fact, he bought 227 BTC today, according to Arkham Intelligence.

Nevertheless, as deliveries are reduced, institutions may be forced to buy directly on exchanges, which potentially raises the price of bitcoins much higher.

This threat of shock of the sentence is loosened as the adoption of bitcoins accelerates. In the previous report, BlackRock noted that the cryptocurrency reached 300 million users faster than the Internet and mobile phones.

Brian Armstrong, CEO of Coinbase, also weighed a comparison of adoption.

“The adoption of bitcoins should reach several billion people by 2030 at the current rates,” Armstrong predicted.

He added that the comparison depends on how someone determines the official starting points for bitcoins, the Internet and mobile phones. Nevertheless, Armstrong admitted that the general trend is still accurate, despite these variables.