After a sharp decline at the beginning of this month, against the background of the wider market turbulence of Litecoin (LTC), it was very restored. Cryptocurrency rose by almost 10% per day, bargaining by 119 US dollars during printing, since growing speculations regarding the potential exchange fund (ETF) leads to the renewal of the interest of investors.

With a growing regulatory impetus, analysts and traders closely monitor the next step of Litecoin, since the expectation is growing around its potential for further profit.

CHATGPT Sets Litecoin Price for 1 quarter 2025

In order to evaluate the potential of Litecoin in early 2025, Finbold analyzed the market data and consulted with the modern Catgpt-4O Openai model for understanding.

According to CatgPT-4O, by the end of the first quarter of 2025, Litecoin will be traded from 130 to 135 dollars, provided that market conditions remain favorable.

Nevertheless, the AI model notes that the delays in the approval of the ETF or wider market weakness can delay the impulse, preserving LTC below the key resistance levels.

Key factors that control the pulse of Litecoin

Most of the recent Litecoin price impulse is associated with growing expectations that ETF Litecoin can be approved in the coming months.

NASDAQ officially submitted 19B-4 applications to the US Securities and Exchange Commission (SEC) for the transfer and trade of CoinShares Litecoin ETF, as well as a similar fund for XRP.

Analyst Bloomberg ETF Eric Balchunas suggested earlier this year that Litecoin could be one of the first crypto -tf who received approval in accordance with the next administration.

Moreover, Polymarket is currently setting 80% of the probability of obtaining Litecoin ETF, which has been approved this year, emphasizing the growing confidence of the traders in potential launch.

ChatGPT-4O emphasizes that ETF approval can push Litecoin to the upper end of its predictable range of $ 135.

The clarity of regulation and institutional interest

Litecoin benefits from a clear regulatory status, unlike many other cryptocurrencies facing control.

The Commission for Trade Futures (CFTC) classified LTC as a product in its trial against Crypto Exchange Kucoin, which means that it is not subject to SEC securities.

ChatGPT-4O notes that this normative clarity makes Litecoin a more attractive investment option for institutional players.

Nevertheless, the AI model also indicates that although regulatory stability helps to reduce the risks of decrease, it may not be enough in itself to increase significant price growth if it is not accompanied by a large institutional influx.

Derivatives of data by increasing bull moods

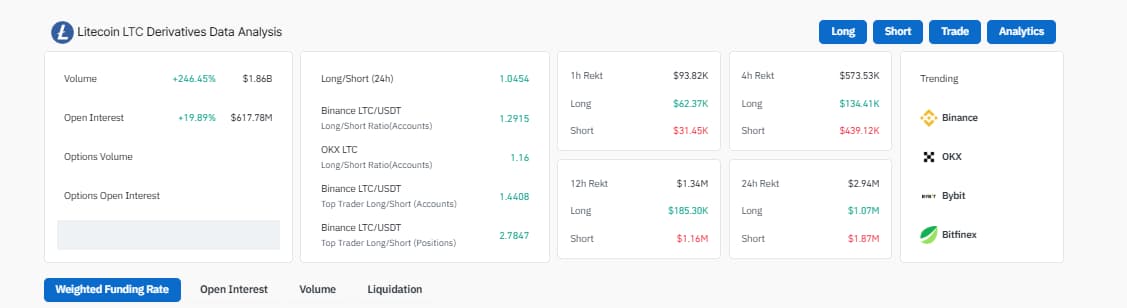

When the additional data of the derivatives from CoinglassThe AI model notes that Litecoin long -term prospects seem to be more and more optimistic.

The volume of trading increased by 246.45% to $ 1.86 billion. The United States, while open interest increased by 19.89% to 617.78 million dollars. USA, which indicates increased market activity and the growing share of investors. A long/short ratio on Binance and OKX remains higher than 1, which indicates a stronger displacement in the direction of long positions.

Conclusion

While ChatGPT-4O forecasts reflect the growing optimism associated with the potential approval of ETF, with reliable data of derivatives and clarity of regulation, adding to the bull views of Litecoin, wider market conditions and macroeconomic factors will ultimately determine whether these purposes can materialize.

Investors must carefully monitor these key developments in the ecosystem in order to evaluate whether Litecoin can support its rally in the direction of the predicted range from 130 to 135 to the first quarter of 2025.

Shown image through Shutterstock