This is a segment from the newsletter 0XRESEARCH. To read full publications, SubscribeField

Decentralized finances today are still largely Uroboros, as Vitalik once indicated.

Revenues from the protocol and fees are real, and they prove that technological work. It is important! But these income flows are still largely the last result of speculative capital, which passes between traders in a circular, self-improved cycle.

The protocols, such as Pendl, watched this state of affairs, refused to make a judgment, and then simply built the best product in order to benefit from this economy similar to uroboros.

Want a fixed yield? Buy Pendle Princeal (PT) tokens. Do you prefer farm glasses with the expectation of large air shots? Buy yield tokens (YT). It is so simple.

What Pendl created is not new. This is a trade equivalent of bonds with a zero coupon, interest rates or forwarding agreements.

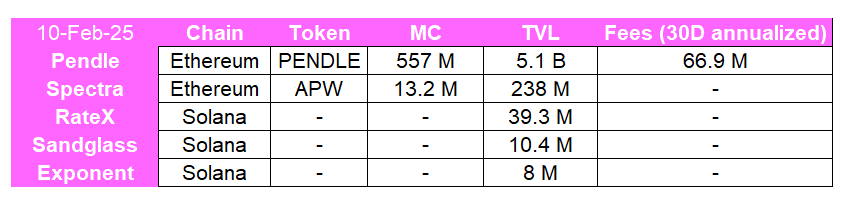

But Pendl very well imitated these traditionally structured products in Defi. In 2024, Pendle increased its TVL levels to $ 4.4 billion. USA and average daily trading volumes up to $ 96 million. The USA is an increase by 20 times and 100 times, respectively.

Pendle is so successful that it actually became de -factor Token -launch, akin to ICO, but better.

For example, within a few weeks preceding Airdrop from Brachain, the Brachain Pendle markets have accumulated more than a billion TVL from users who want to get trading on Brachain assets and gaming air flows.

Pendla Perspective for 2025

The co -founder of Pendle TN Lee announced last week the big plans of the protocol for 2025.

There are many minor partial updates, for example, dynamic fees for yield trade and improvement in the VEPENDLE tokens bribes system.

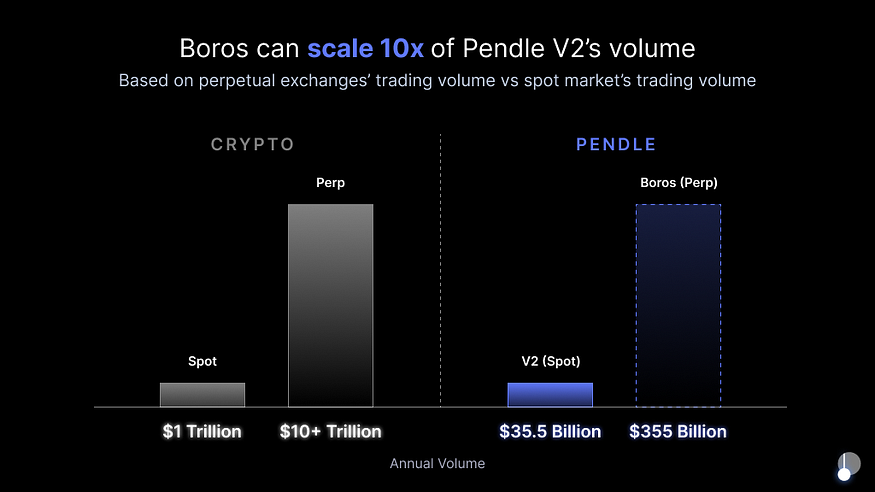

But the most noticeable update is looking at Pendl’s plans aimed at aiming the most profitable productivity source in crypto -tariffs: PRPS.

Within the framework of this initiative, “Boros” (play in Uroboros?) Pendl will allow traders to change in order to bring trade rates of permanent financing.

This would allow protocols such as ethenes to block the predictable yield of financing, which entails fixed APY for SUSDE holders.

In the markets of hyper-vlatile perns, such as Memecoins, Long Traders will also be able to hedge their PERP position, fixing the predictable, fixed level of financing.

Pendl also plans to expand on nets that do not have EVM Solana, Hyperilique and Ton. Solan already has a growing market of profitability, although it is still small compared to Pendl.

Finally, Pendl goes to Tradfi. The field is simple: “Why adhere to 8% of the profitability for a 5-year corporate bond, when you can get 17% of the profitability of WBTC PT?”

This is part of the KYC’D product production team for regulated organizations, as well as Islamic funds for access to cryptographic income.

The Pendla pendul is swinging and, it seems, the next year it swings even more. Thanks to the planned extensions for targeted chains of non-EVM and Tradfi liquidity, these movements radically expand the target addressable Pendla market outside the spa markets for Ethereum and the wider crypto sector.