The weekly price action of SUI retains a position above the critical level of support, currently located about $ 3.00.

This stability has proposed the potential for the upward SUI trend may lead to 7 US dollars if there is a change.

In recent weeks, Sui checked this level of support several times, without violating below, which usually indicates a strong percentage of the buyer at these prices.

If this trend remains, and the buyer’s impulse is strengthened, SUI can see a rally to 7 dollars, especially if it breaks past the intermediate resistance at the level of $ 5.50.

And vice versa, if SUI cannot maintain this level from the mood of moods, there is a risk of its fall below support.

Potentially, this will lead to a lower price of about $ 4 or even $ 3.50.

This can happen if the general market becomes a bear or if specific adverse events affect the altcoins market.

The chances of SUI have reached $ 7 to maintain current support and violation of subsequent levels of resistance.

Conversely, the risk of decrease will increase if these supports are violated.

The probability of any scenario largely depends on the wider market trends and the trust of investors in the Altcoin sector.

Monitoring of volume and market moods will be crucial for the exact forecasting of these movements.

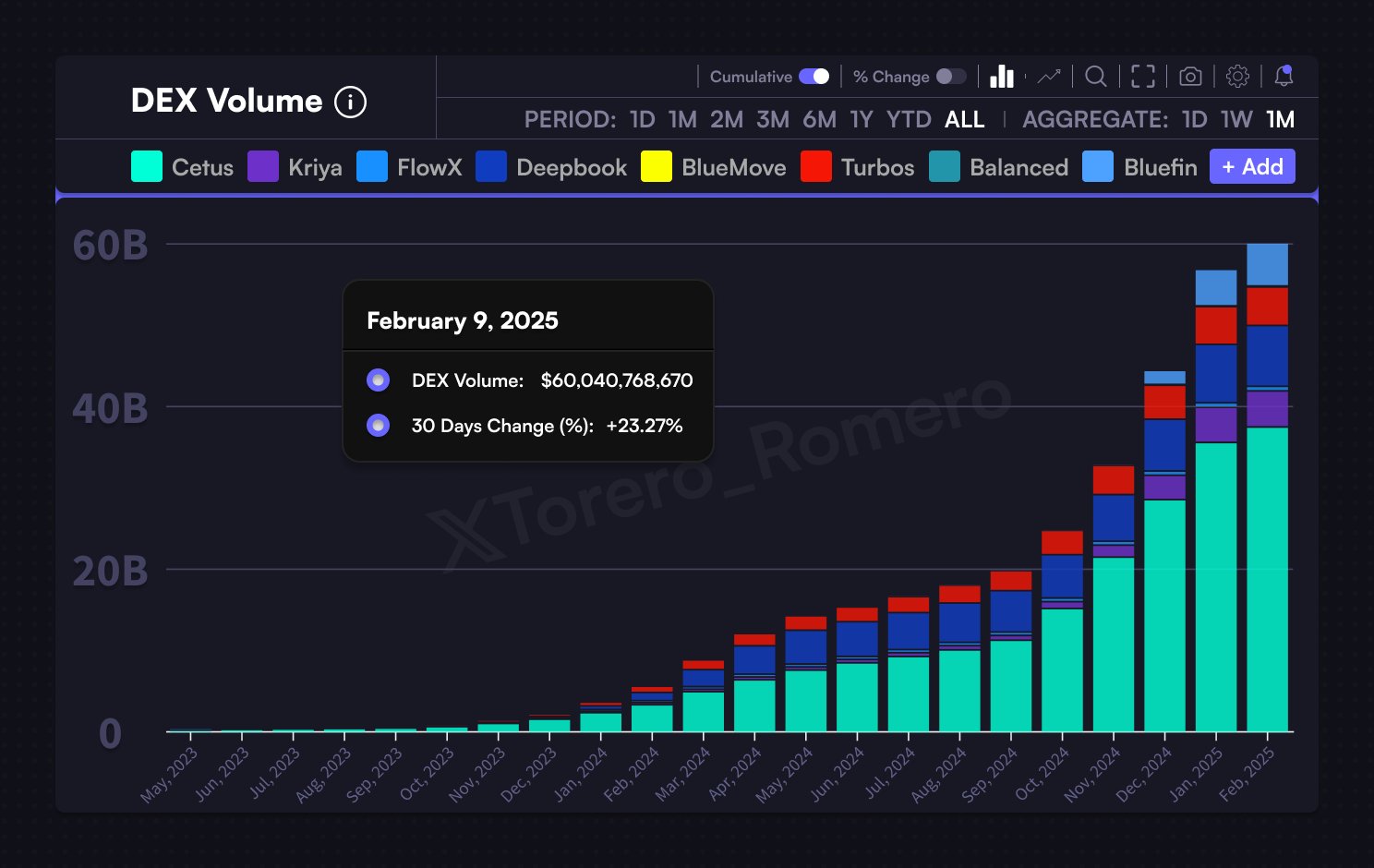

Monthly Dex Sui Crypto on steroids

The SUI trade volume on decentralized exchanges (DEX) saw growth, the total volume reached $ 60 billion, which notes an increase of 23.27% over the past 30 days.

This growth reflects increased activity and can signal the strengthening of confidence.

This ascending trend in the DEX volume began around January 2024, when the volumes soared about $ 9 billion.

A consistent increase in February 2025 suggests that more users interact with the SUI ecosystem, possibly attracted by new developments or an increase in the utility in the network.

However, although this surge in the DEX volume can raise the SUI price, there is also a scenario in which this may not directly lead to a long -term increase in prices.

If the surge of the volume is due to short -term trade or speculative percentage, and not by steady adoption, SUI can see temporary price fluctuations without long -term profits.

If the volume continues to grow, it can push SUI to new maximums.

Conversely, the inability to preserve this impulse or shift in market conditions can see how volumes and prices refuse.

Therefore, for potential and current investors, it is extremely important to control not only the volume, but also the context of these transactions in order to evaluate the possible future Sui trajectory.

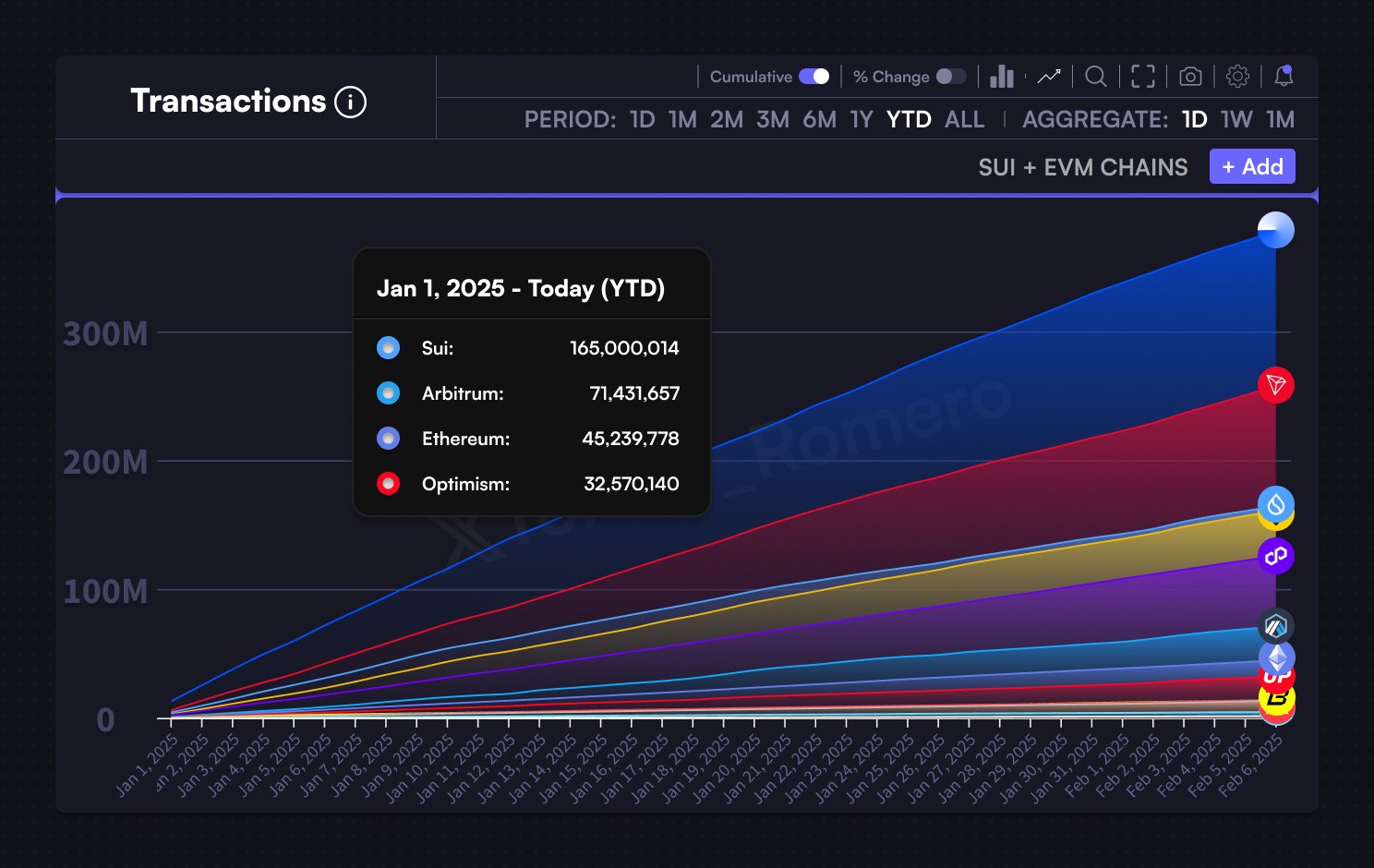

It is believed that SUI transactions exceed ETH, ARB and OP

In addition, SUI transactions surpassed the combined amount of referee, etherium and optimism in 2025.

SUI processed an impressive total amount of 21 million transactions in comparison with 15 million Ethereum, Arbitrum 3.5 million and 2.5 million. Optimism for the same period.

This increased transactional activity on SUI involves reliable use and adoption of the network, potentially positioning SUI as a dominant player in the blockchain space.

However, this burst of transactions does not guarantee a proportional increase in price.

If the market perceives these transactions as a low cost or if increased activity does not lead to a greater creation of economic value in the SUI ecosystem, the impact on the price may be muffled.

While the current high volume of transactions sets a positive forecast for SUI, potential investors should take into account both growth potential and volatility risks.

A constant increase in significant transactional activity can withstand a bull tendency for SUI cryptography, while any signs of a decrease or lack of transfer of cost on the network can hint at possible corrections.