Bitcoin struggled to regain a mark of 100 thousand dollars, faced with severe volatility and pressure from the weekend. The market remains uncertain, as the bulls are trying to protect key levels of support, while bears are striving for deeper correction. Despite this, Bitcoin continues to demonstrate stability, holding above important price zones, which can determine the next big step.

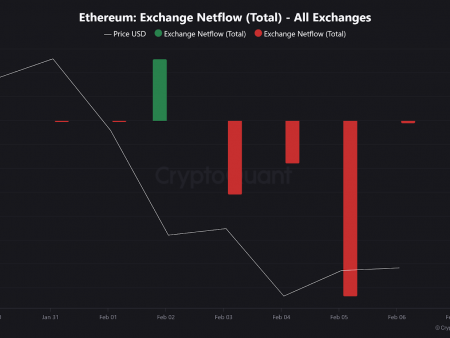

Leading analyst Axel Adler exchanged a key understanding of X, showing that as of February 6, 2025, the most critical support level for BTC is $ 90.6 thousand. The United States, based on the short -term owner (STH), the price of price metric. In addition, another large level of support was found at 97.2 thousand dollars. The United States, calculated from the short -term owner from one month to a three -month fee. These levels indicate where the recent buyers are located, which makes them decisive for Bitcoin stability in the current phase of consolidation.

As the market digesting recent volatility, Bitcoin’s ability to keep above these support levels can prepare the soil for an updated rally. If the BTC remains strong, and demand is gaining momentum, a gap is higher than $ 100 thousand. The United States can cause an impetus to the record maximum. However, the loss of these levels can lead to further pressure down. Investors and analysts are closely monitored to see whether Bitcoin can restore a bull impulse in the coming days.

Bitcoin metrics distinguish liquidity levels

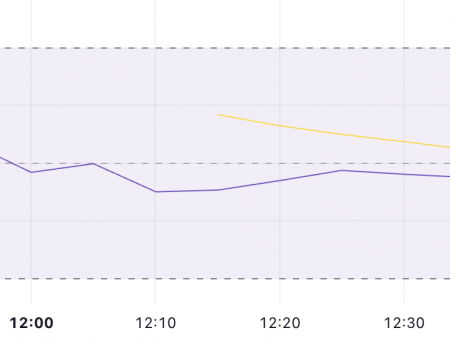

Bitcoin experiences strong volatility from the weekend, when the price action takes place between key levels. After a sharp fall up to 91 thousand dollars. USA, BTC quickly recovered above 100 thousand dollars. USA, and then registered about 98 thousand dollars. Market moods remain fragile, since the fears of the trade war continue to form prices. The uncertainty related to global markets and economic policy led to an increase in speculation, while investors carefully monitored the ability of Bitcoin to keep the most important zones of support.

Leading analyst Axel Adler shared the understanding of X, highlighting the key technical levels that can determine the short -term trend of bitcoin. As of February 6, 2025, the main level of support is $ 90.6 thousand. The United States, based on a short -term owner, a price implemented metric. This level is a critical price when the short -term owners acquired BTC, which makes it a strong area of demand. In addition, another key support zone is 97.2 thousand dollars. The USA, which is a realized price of a short -term owners for a month up to three months.

As for the resistance, Bitcoin is faced with significant supply pressure of 100.6 thousand dollars. USA, level when recent buyers concentrated their notes. This range, determined through a short -term holder from one day to a week and a week to one month, realized the price metric, acts as a key barrier, preventing BTC interruption. If Bitcoin manages to regain himself and stay over this level, the next goal will be 105 thousand dollars. USA or higher, opening the door for another attempt to detect prices.

At the moment, BTC remains at the stage of consolidation, and both Bykov and bears are fighting control. If Bitcoin holds above its key support levels, an updated bull phase may appear, which will push the price to new maximums. Nevertheless, the loss of these zones can cause another round of sales pressure, potentially sending BTC to lower levels of demand. The next few days will be crucial for determining the direction of the market.

The price consolidates at the levels of demand: can BTC resist?

Bitcoin is trading at $ 99,000 after several days of troubled pricing, with all his might, trying to restore the mark of 100 thousand dollars. The market remains at the stage of consolidation, when the bulls are trying to restore control, while bears strive for further shortcomings. Despite the high demand at lower levels, the BTC has yet to set a solid breakthrough above the key resistance zones.

The most important level of support for bulls is 98 thousand dollars. USA. Maintaining this level can prepare the ground for a rally, as it turned out to be a strong area of demand at the latest sessions. Successful protection 98 thousand dollars. The United States will give customers the confidence necessary to increase the price of 100 thousand dollars. The USA, the psychological and technical level that must be restored to change the impulse in favor of the bulls.

Nevertheless, the inability to hold more than 98 thousand dollars will detect BTC to increase sales pressure. If the price loses a mark of 96 thousand dollars, a deeper correction in the zone with lower demand becomes likely, which potentially reduces BTC to the $ 92K – 94 thousand dollars. USA. At the moment, traders are closely monitoring these levels, since Bitcoin remains at the decisive point when determining whether the next move will be above the maximums for the entire time or the continuation of the rollback in the zones of lower support.

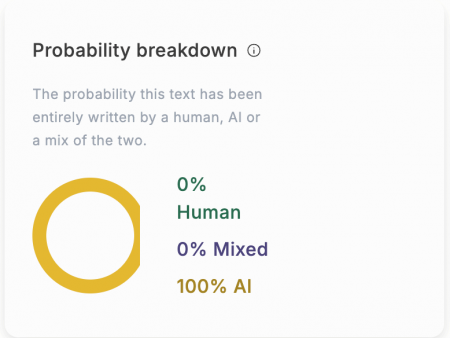

Dall-E shown image, TradingView diagram