The host Altcoin Ethereum has encountered a series of meetings over the past few days. Due to the increased volatility of the market and significant liquidation, ETH remains under bear pressure.

Nevertheless, a bull divergence appeared in his daily schedule, suggesting that the coin can be prepared for a rebound and a possible level above $ 3,000.

Ethereum traders bet on growth potential as the purchase pressure increases

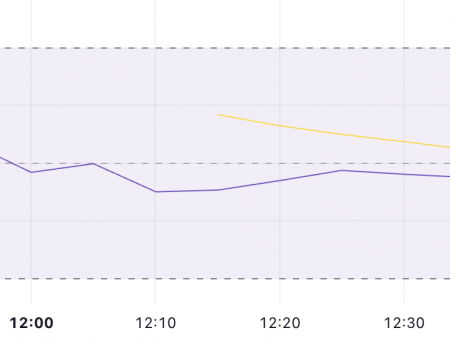

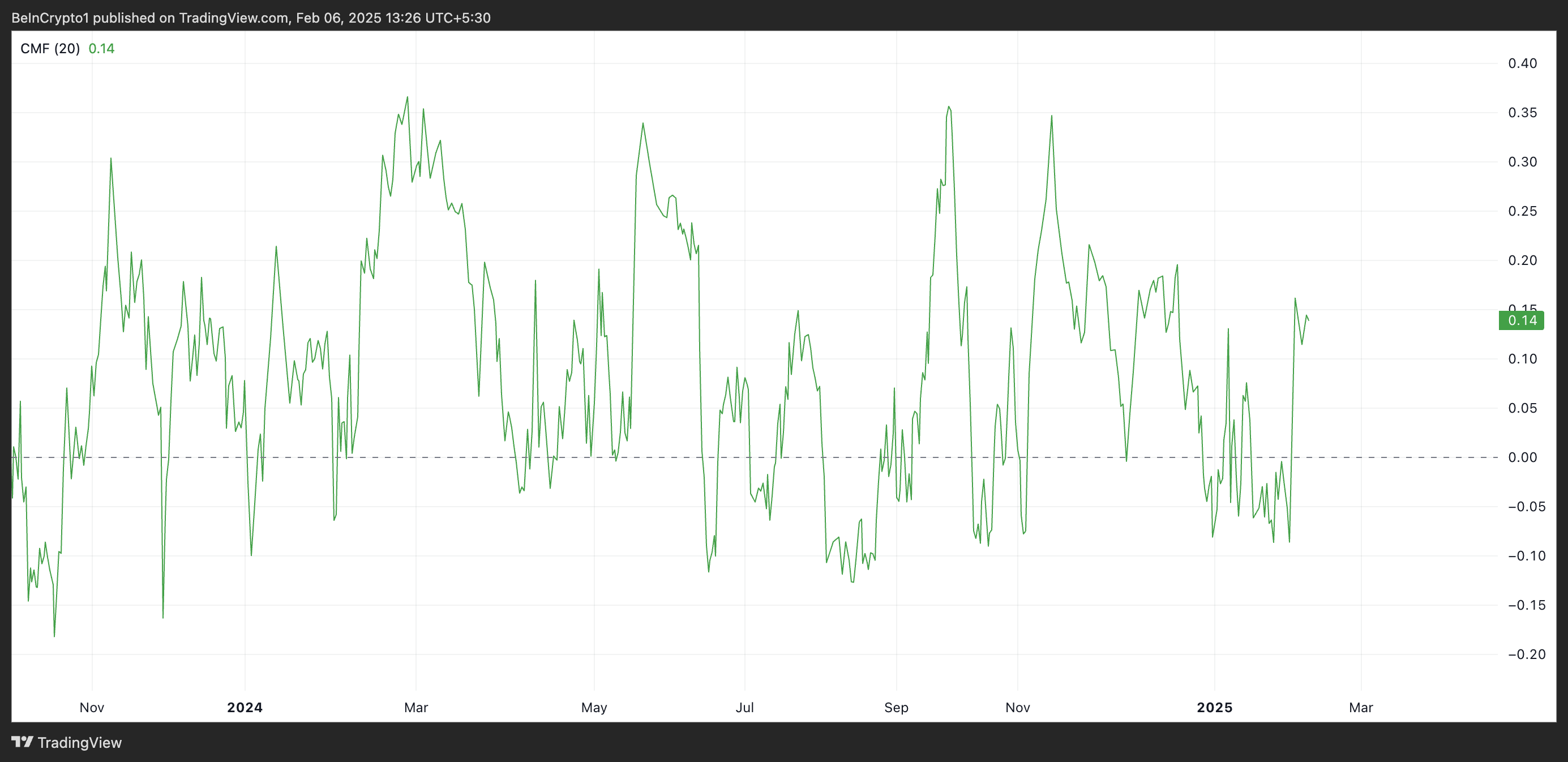

The ETH/USD single -day rating assessment shows that, despite the decrease in the prices of ETH over the past few days, its CHAIKIN (CMF) cash flow has retained the increase in the increase, forming a bull divergence. During the seal, CMF from ETH is based on the zero line on 0.14.

This indicator measures the pressure of the purchase and sale pressure by analyzing prices and volume for a certain period. When CMF rises, while the price of the asset decreases, this indicates that the purchase pressure increases, despite the descending trend.

This divergence indicates that ETH traders accumulate an asset at lower prices, potentially signaling the change. A sustainable increase in CMF ETH hints at the rebound of prices, as demand outweighs the pressure on the sale.

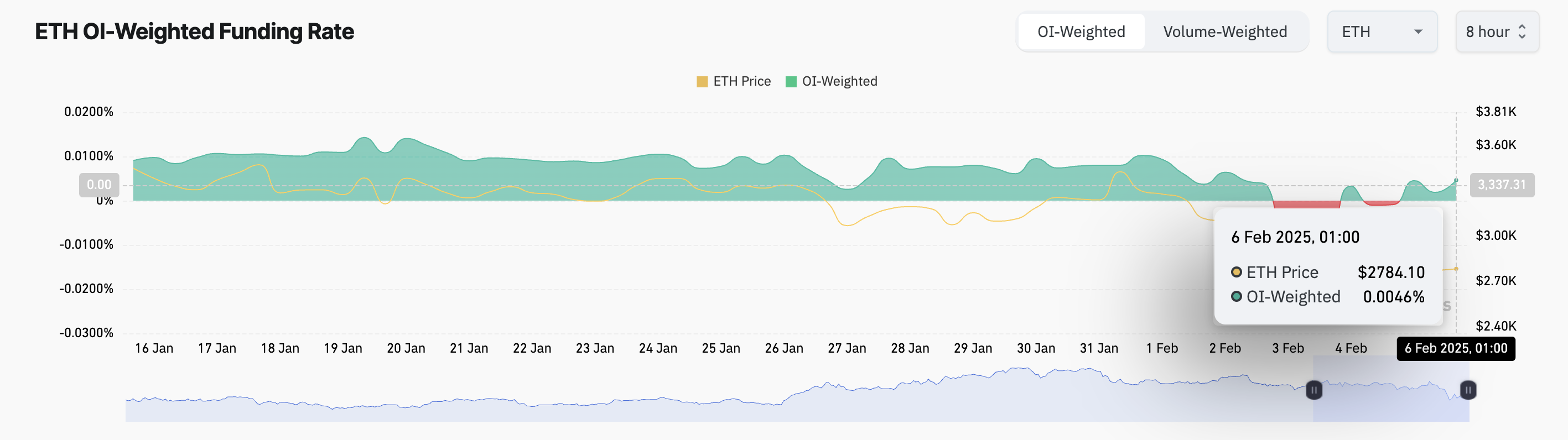

Moreover, after several days of negative values, the level of financing ETH again became positive. A shift in market mood suggests that futures traders are increasingly preferring long positions, which indicates a renewable confidence in the restoration of the price of ETH. During print, this is 0.0046%.

The financing rate is a periodic fee that exchange between long and short traders in permanent futures contracts. This guarantees that the price of the contract remains close to the spare price. When the financing rate is positive, this means that long traders pay short traders, which indicates a higher demand for long positions and the mood of the bull market.

Price Forecast: Reversion on the horizon?

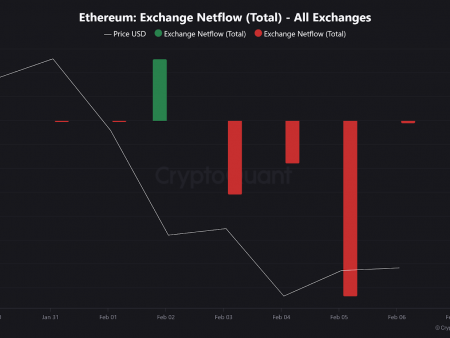

Over the past few weeks, Ethereum prices have forced him to trade in a descending channel. This template is formed when the price of the asset moves within the descending range, creating lower maximums and a decrease in minimums over time.

Usually this signals a bear’s trend, but a breakthrough above the channel may indicate a potential change. If the demand for Eth Soars, a potential breakthrough can lead to an increase in the price of a coin to $ 3249.

On the other hand, an unsuccessful breakthrough attempt can lead to a decrease in price towards the channel support of $ 2553.