Defai refers to the merger of Defi (decentralized finances) and AI (artificial intelligence). In 2025, many projects correspond to this definition; The constant growth of automation in the chain has begun, and applications operating on the market. That’s all you need to know about this nascent trend, and these are long -term consequences for decentralized technologies.

- What is Defai?

- How do Defai agents work?

- Defai market in 2025

- Will Defai create mass acceptance?

What is Defai?

Defai is a combination of decentralized finance (Defi) and artificial intelligence (AI). Daniela came up with the term.

Defai seeks to make life easier for both expert and crypto -crypto traders and users. One of the problems with the modern interaction of the blockchain is that the experience is tiring or extremely complex.

High -level problems

For the average user, some obstacles for the adoption or use of blockchain technology include:

- Creating and fixing the wallet.

- Navigation fees for transaction, liquidity, slipping, types of tokens, etc.

- Bridge, articles, lending, trade.

Low -level problems

Almost more advanced users usually rotate around the collection and analysis of blockchain data. This entails:

- Historical data transactions

- Metadata

- Tracing transaction

- Cross transactions

Defai uses Crypto AI agents to automate the interaction of blockchain, collect, analyze and recognize templates in blockchain data, as well as simplify the overall cryptographic experience of users. Many believe that the combination of Defi and AI is the next step towards the greater adoption of crypto.

How do Defai agents work?

The cornerstone of Defai is an agent Crypto ai. Many agents differ in their implementation, but you can classify them according to the four main tasks that they perform: collecting information, interpretation, making decisions and execution.

| Task | Definition |

|---|---|

| Collection of information | The process of collecting unprocessed blockchain data, market trends, user behavior and external financial news both from incoming and because of the source chain. |

| Interpretation | Analysis and contextualization of the collected data using AI methods, such as machine learning, processing a natural language (NLP) and statistical modeling. |

| Decision -making | The process in which AI models generate effective strategies based on interpreted data. |

| Execution | The implementation of decisions based on artificial intelligence in real time. |

Collection of information

The great value of both standard and crypto agents is their ability to collect and digest huge amounts of data.

Some information that agents can collect includes:

- Tokenomics (market capitalization, price, liquidation, open percentage, volume of DEX/CEX, etc.)

- Social networks of mood

- News messages

- Rules

Interpretation

The interpretation includes an understanding or recognition of patterns in the collected data. This task uses machine learning algorithms, such as neural networks or decisions.

To present this in the future, the Defai sales agent can look for templates in diagrams that are not immediately recognizable for the average person. These retail models can include flags, channels, lanes of a bellinger, RSI, detection of emissions or anomalies, etc.

Decision -making

As the name implies, making decisions includes a decision, what to do on the basis of interpretation of data. The difference between interpretation and making decisions is that interpretation makes sense of information, while the latter considers what to do with it.

By removing the previous example, the agent then used the information received from trading models to decide, buy or sell, where to install stops or make a profit, and much more.

Execution

The implementation primarily includes the implementation of the decision -making process, but may also include training on successful or unsuccessful strategies or adaptation to market conditions. This stage often includes automated agents or bots working within the framework of predetermined parameters.

Some of the actions that can perform these agents interact with intellectual contracts, fulfill transactions on DEXS, adjust the liquidity position, controlling the lending protocols or the automation of risk reduction strategies.

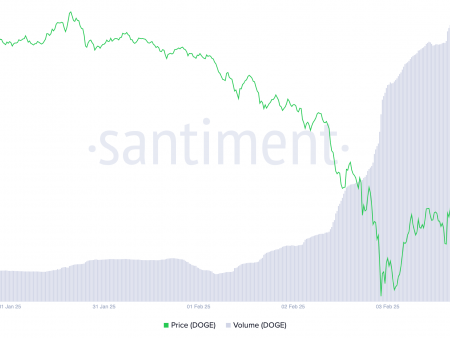

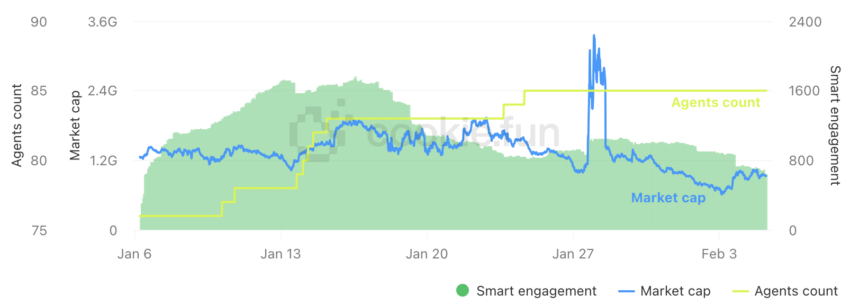

Defai market in 2025

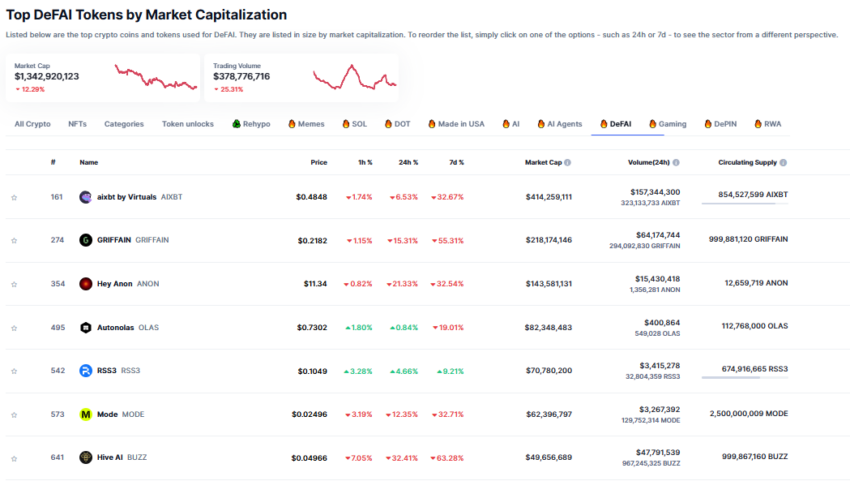

Both Crypto and AI are still relatively young markets. As of February 2025, market capitalization is a little less than $ 1 billion.

Defai projects, as a rule, vary from trade assistants to chat bots, analysis and trade terminals. Some of the most popular projects:

- AIXBT: Removes trending topics and moods from social networks and sources KOL, offering market intelligence in real time.

- Griffain: AI agent platform, which supports various blockchain operations, including portfolio queries, tokens, NFT trade and coin snipers.

- Hello anon: IT collects information about the project in several blockchain networks and uses Convelodational AI to help users manage Defi operations.

- Home Ai: Uses AI to automate the project planning, create tasks based on sentences, set the following steps from emails and generate various types of content.

Will Defai create mass acceptance?

It is likely that Defai will help in the fight against the next wave of Web3 users, abstracting many difficulties associated with the use of blockchain technology. However, Given that the sector is still in the early stages, Defai users should be careful. Many projects claim to be supported, just to ride in a hype; This will probably become more common, since Defai projects are increasingly occupying the central stage in Web3. If that the same token or project seems too good to be true, probably so.