- Hyperlikvid (hype) is traded at $ 27.46, having received 5.57% in 24 hours.

- The Golden Crossover hints at a potential continuation of up to $ 31.00.

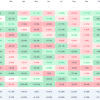

Hupevid is currently trading at $ 27.46, which reflects a profit of 5.57% over the past 24 hours. Token occupies a 20th position in the crypto -market ranking. With a total market capitalization of $ 9.16 billion. USA, it shows 5.57% of previous levels, which indicates steady growth.

The volume of trading over the past 24 hours reached $ 224.22 million. USA, which was a significant increase of 16.12%. The ratio of market capitalization is 2.45%, demonstrating solid liquidity. The fully diluted Hyperlique (FDV) rating is currently 27.45 billion dollars. USA, with 333.92 million tokens circulating from the maximum supply of 1 billion.

Technical indicators are hype

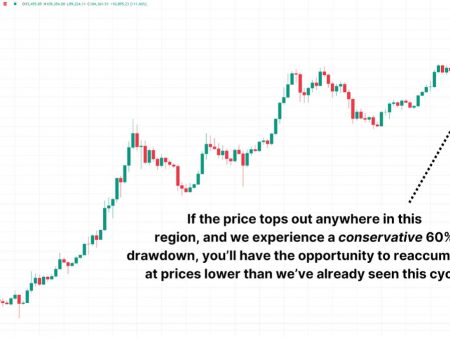

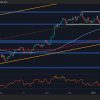

Based on the price schedule, Hyperlikvid demonstrates a strong price near critical resistance and support level. The main resistance is 28.50 US dollars, and $ 26.20 is critical support. If the price violates the resistance, it can aim at $ 30.00. Support for a break below can push the price of $ 25.50.

The relative force (RSI) index is 65, close to the territory of the bought -up, which indicates a bull impulse. The average RSI remains about 60, supporting stable upward movement. Keikinsky cash flow (CMF) displays positive trends, confirming a strong purchase.

Medium slides additionally confirm bull moods. The 50-day sliding average exceeded the 200-day sliding average, forming the golden pattern of the crossover. If the trend is held, Hyperlikvid can advance by 31.00 dollars in the coming days. The short-term price action also remains supported by a 20-day sliding medium, which acted as a key dynamic support line.

The market prospect remains optimistic. Strong volumes of trade and positive technical indicators suggest that hyperlikvid can support its bull impulse in the near future. However, traders must carefully monitor support and resistance levels for any potential changes.