Bitcoin is consolidated above the most important area of support, signaling the strong interest of customers and a potential breakthrough of bull.

If the BTC restores the resistance of 108 thousand dollars, this can cause a short liquidation cascade, which leads to an increase in the price of 115 thousand dollars.

Technical analysis

Shayan

Daily diagram

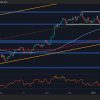

The price action of Bitcoin remains on the bull trajectory, when in recent months the middle line of the trend of the ascending channel acts as a strong support zone. This dynamic support has repeatedly held the price reduction, reflecting the customer’s trust and the revival of demand.

After this support test, Bitcoin rose to his record maximum of 108 thousand dollars, which is a key area of resistance with concentrated supply and sale pressure. Currently, assets are consolidated in a rigid range associated with the middle line of the channel trend and a static resistance of 108 thousand dollars.

Considering that the gripping liquidity has already occurred above $ 108 thousand. USA and below 90 thousand dollars. USA, a breakthrough seems inevitable. If the bull impulse intensifies, the restoration of $ 108 thousand. The United States can create a sharp rally caused by a short elimination and increased purchase pressure up to 115 thousand dollars. USA.

4-hour table

In the lower terms, BTC buyers intervened in support for 90 thousand dollars, preventing further decline. After cleaning liquidity below 90 thousand dollars, Bitcoin rose to the resistance zone in the amount of 108 thousand dollars, where the average boundary of the ascending channel is leveled with its ATH, strengthening this level as the main point of excess.

The ongoing consolidation of 108 thousand dollars reflects the battle between buyers and sellers, which makes this region the key price level. Breakthrough and consolidation above $ 108 thousand. The United States can signal a constant rally towards the new ATHS. Nevertheless, the rejection of this level can cause recovery to the lower border of the channel of 98 thousand dollars.

Analysis of moods

Shayan

In the recent rising trend of Bitcoin, traders carefully monitor whether he can break through above a high level of $ 108 thousand. USA. The key factor in this potential breakthrough is whether the market can generate a sufficient impulse to surpass this critical level of resistance.

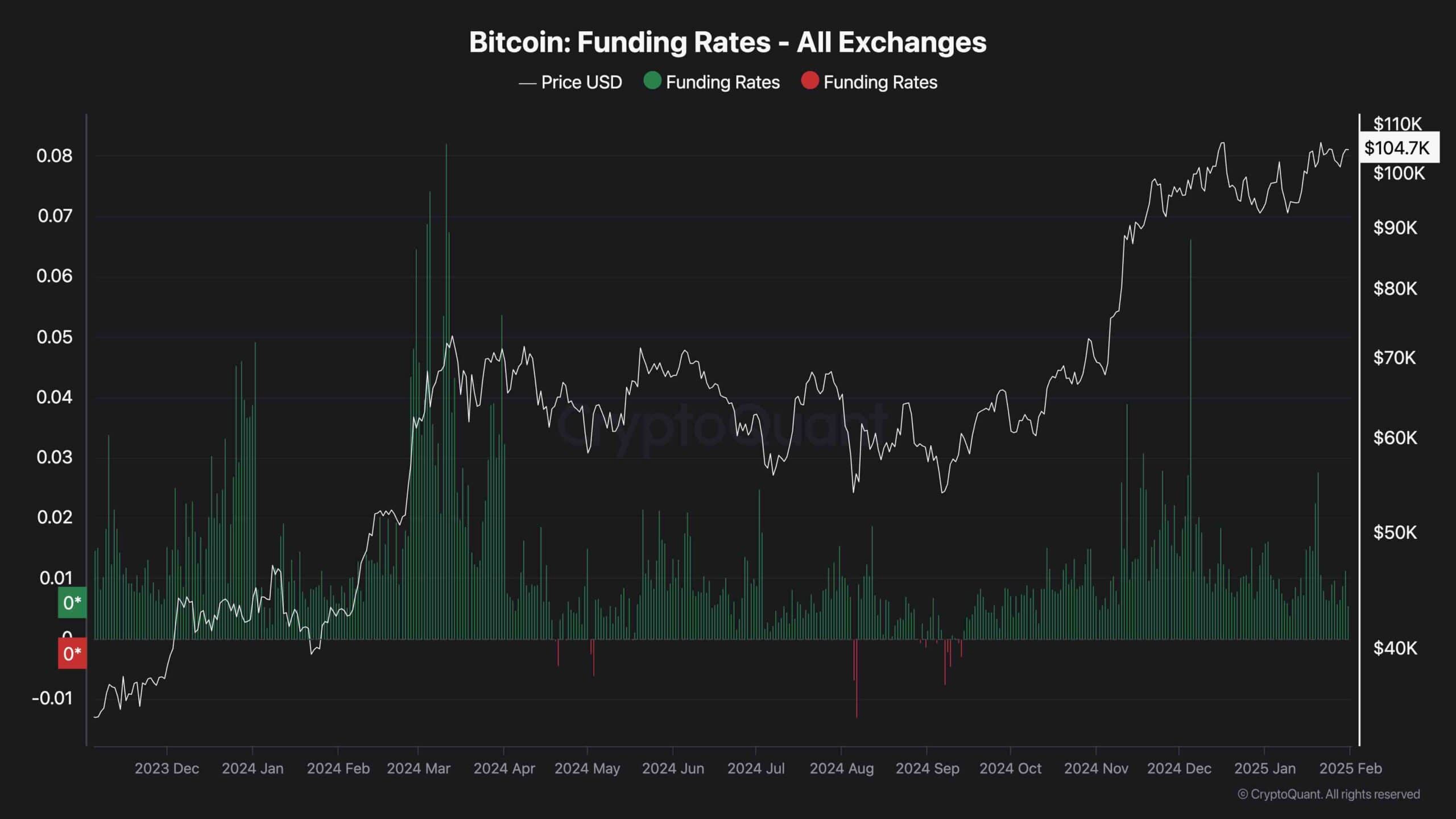

An important indicator in the chain, an indicator of financing, showed the bear’s divergence. While the price of Bitcoin increased towards ATH, financing rates decreased, which indicates a weak demand in eternal markets. This divergence indicates that a bull impulse may not be strong enough to support a breakthrough.

So that Bitcoin resolutely violated 108 thousand dollars. The United States, financing indicators should increase, signaling an increase in optimism and a larger influx of long positions. Without this market enthusiasm, a resistance of 108 thousand dollars can be held, which leads to potential consolidation or temporary refusal.