The crypto -market will witness 10.31 billion dollars as part of contracts for options on Bitcoin and Ethereum. This huge expiration can affect the short -term price action, especially when both assets have recently declined.

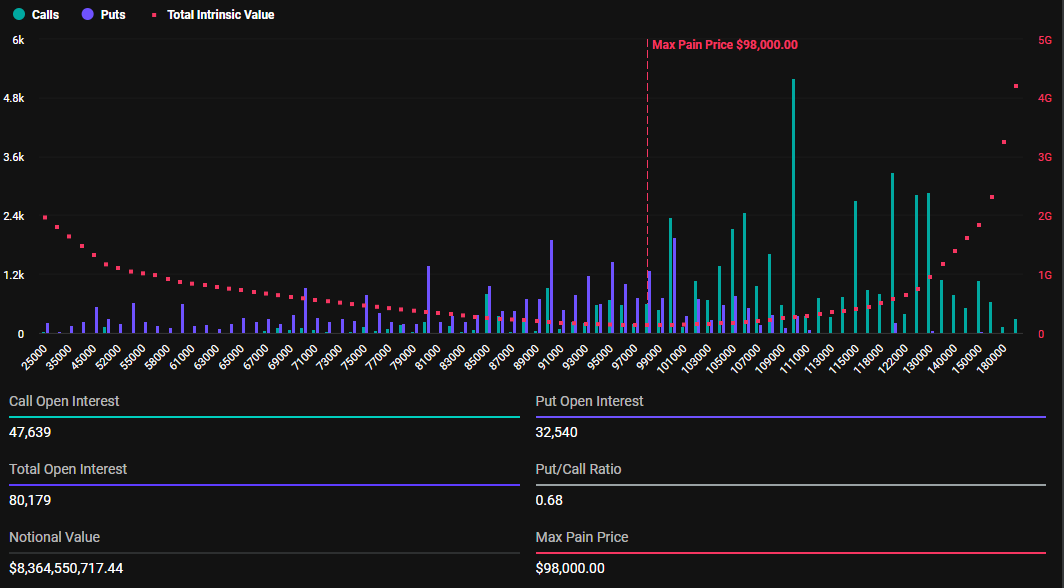

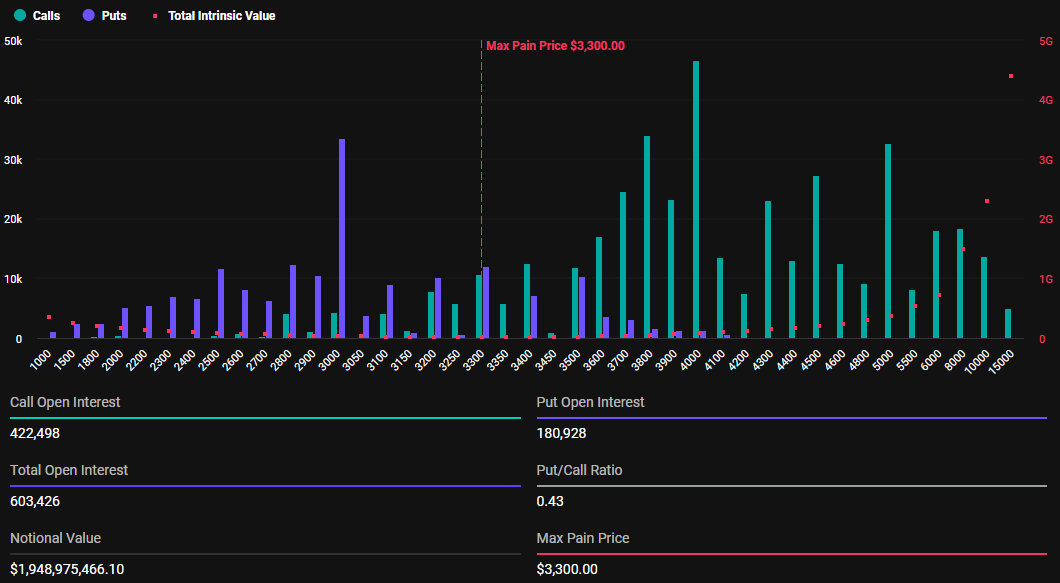

Thanks to the options of bitcoins worth 8.36 billion dollars. USA and Ethereum in $ 1.94 billion. USA, traders are preparing for potential volatility.

Consumable options with high rates: the fact that traders should watch today

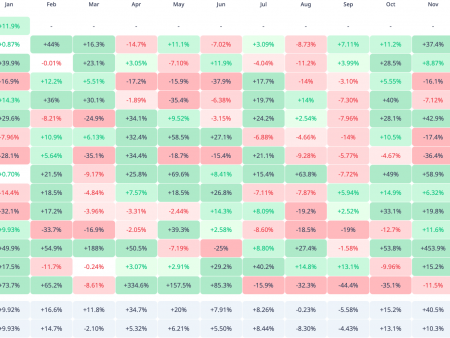

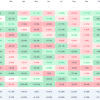

Today’s options for expiring terms of significant increase compared to last week, since the validity period expires at the end of the month. According to Deribit, the duration of the Bitcoin options includes 80 179 contracts compared with 30,645 contracts last week. Similarly, the output options for Ethereum are a total of 603,426 contracts compared with 173 830 contracts in the previous week.

These expiring options for bitcoins have a maximum pain price of $ 98,000 and a 0.68 call ratio. This indicates that in general, bull moods, despite the recent asset rollback. For comparison, their colleagues Ethereum have the maximum pain price of $ 3300, and the ratio is 0.43, which reflects similar market prospects.

The installation coefficients below 1 for bitcoins and Ethereum involve optimism in the market, and more and more traders make rates for raising prices. Nevertheless, analysts call for caution from the tendency to expire the validity of options that caused the volatility of the market.

“This can bring significant volatility in the market, since the traders are rebuilt before the expiration of the validity period, expect sudden prices of prices and potential liquidations,” warned Crypto DAD, a popular user X.

A warning occurs in case of validity period of options often causes short -term fluctuations in prices, creating the uncertainty of the market. Meanwhile, the data of Beincrypto show that Bitcoin’s trading value fell by 0.64% to $ 104,299. On the other hand, the price of Ethereum increased by a modest 1.04%, now bargaining by $ 3226.

The consequences of options expire on BTC and ETH

With their current prices, Bitcoin significantly exceeds the maximum pain level of $ 98,000, while Ethereum below the price of a blow of $ 3300. The maximum illness or price of a blow is an important metric that leads the market behavior. It is a price level at which most options expire are useless.

Based on the maximum theory of pain, BTC and ETH prices will probably approach their appropriate prices for defeat, therefore, the expected volatility. Here, the largest number of options (both calls and for delivery) expires uselessly, since these options are contracts with the expiration of the validity period.

Buyers of options who lose all the value of their options will feel “pain”. On the other hand, options sellers will benefit, as contracts expire due to money, and they prevent the received loan from the sale of options.

This is because the maximum theory of pain works on the assumption that the authors of the options, as a rule, are large institutions or professional traders, otherwise called smart money. Therefore, they have resources and market influence in order to summarize the price of closing shares to the maximum pain point per day of expiration.

“Traiders often control this level, as it can affect the movements of the approaches to the expiration of the validity period,” wrote one analyst according to X.

Based on this assumption, these market manufacturers will hedge their positions to maintain a neutral delta portfolio. As their positions almost expire, they compensate for their short positions by selling or buying a contract, affecting the price of a maximum pain point.

It should be noted that markets are usually stabilized shortly after traders adapt to a new price environment. With today, a large volume of traders and investors can expect a similar result, which potentially affects the trends of the crypto market on weekends.