Over the past 24 hours, the price of SOLANA (SOL) has increased by more than 5%, delivering its market capitalization to about 117 billion dollars, and the volume of bidding – $ 6 billion. Despite this short -term surge, technical indicators remain mixed, and the ICHIMOKU cloud demonstrates uncertainty, and BBTREND is still in a negative territory.

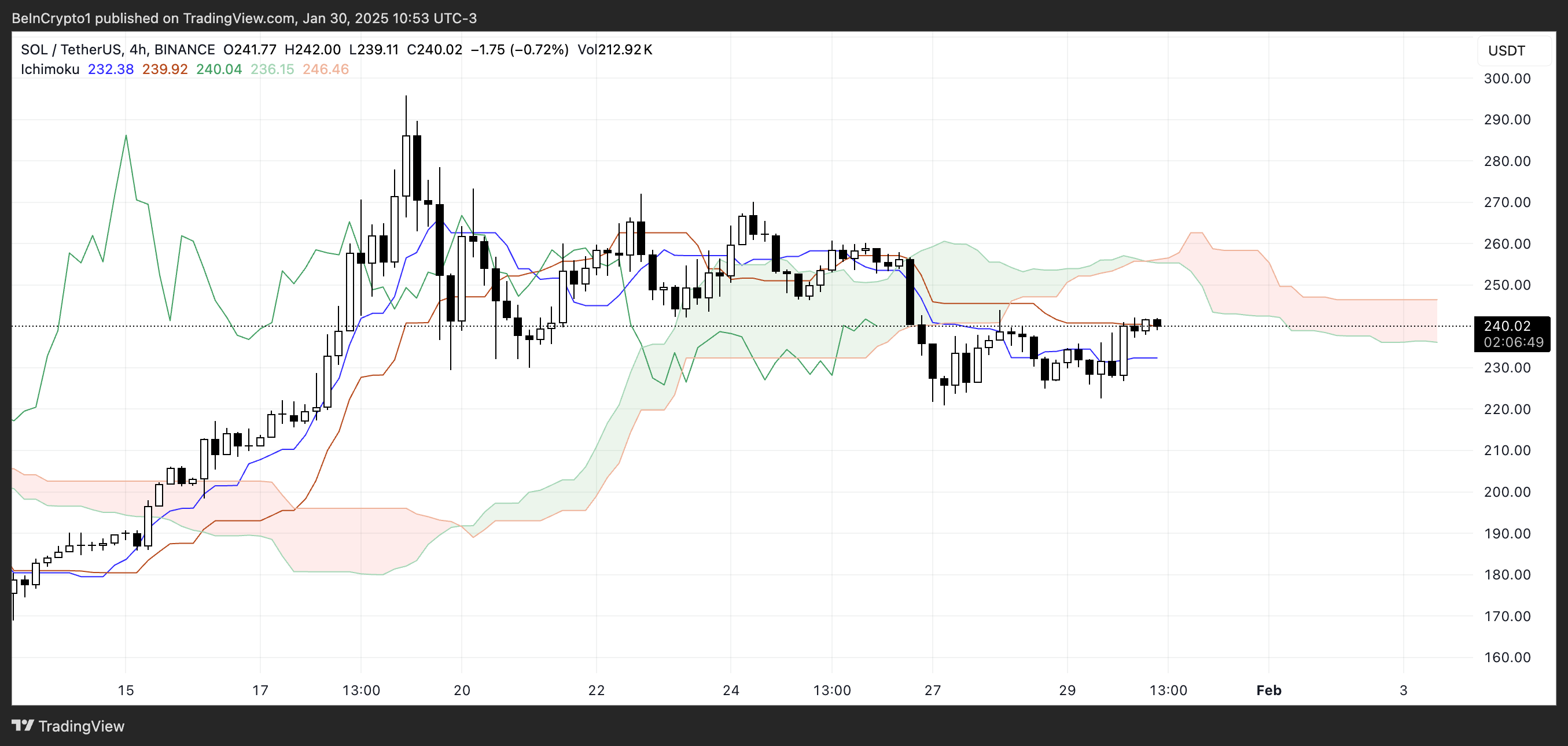

SOL consolidated from 225 to 239 dollars, and its EMA lines are located carefully, which indicates indecision in this trend. Regardless of whether Sol parted in the direction of $ 272 and more or more or more, will depend on key technical evidence in the coming days.

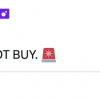

SOLANA ICHIMOKU CLOUD SIGNALS mixed market moods

Cloudy setting up SOLANA ICHIMOKU is a mixed look. The price currently ranges near the lines of Kijun-Sen (red) and tenkana-sen (blue). The cloud (kumo) ahead is red, which indicates potential bear feelings at the upcoming sessions. The price has recently been transferred to the cloud, assuming the period of indecision, when neither buyers nor sellers have complete control.

The span of Chikou (green) wakes up through the past price action, enhancing this uncertainty and alarm that SOL is still in the consolidation phase, and not a strong trend.

The thickness of the upcoming cloud suggests that volatility can increase, since a thicker cloud often is a stronger resistance or support zone. Tencan Sen remains below Kijun-Sen, which usually reflects a weaker short-term impulse.

However, if SOL Price continues to hold on these lines and moves further into the cloud, this may indicate a potential shift in the mood. On the other hand, if the price remains below both lines, and the cloud begins to expand down, this suggests that the bear is still dominated by.

SOL BBTREND remains negative

BBTREND (BOLLINGER BAND TREND) is an indicator that measures the price impulse based on the relationship between the price and stripes of Bollinger. This helps to determine the trends, analyzing whether prices for the upper or lower lane are inclined.

When the BBTrend is positive, this involves a bull impulse, since prices, as a rule, remain next to the upper strip. Conversely, the negative BBTrend indicates the bear’s impulse when prices gravitate to the lower lane. Large absolute values suggest higher trends, while almost zero values imply the lack of directional force.

SOLANA BBTREND is currently -9.8, yesterday, not negative and reaching a minimum -11.3 a few hours ago. This shift in a negative territory suggests that the impulse has recently intensified, and prices are approaching the lower lane of Bolinger.

While the BBTrend has recovered a little from its lowest point, it remains firmly negative, indicating that the pressure down is still present. If the BBTrend begins to rise back to zero, this may indicate a slowdown in a bear impulse or the beginning of the consolidation phase. However, if it continues to decline, this will increase the probability of a stable descending trend.

SOL price forecast: Solana will flare up in February?

Over the past few days, Solana Price has been consolidated from 225 to 239 dollars, and a clear tendency has not yet been established. Its EMA lines remain tightly packed, which indicates indecision, but soon a golden cross can form.

If this crossover occurs, Solan can gain an impulse and push to a resistance of $ 272. A successful breakthrough above this level can cause a rally up to $ 300, noting a potential growth of 25% and its highest price level.

However, if a decrease in the pressure down and SOL Price will not be able to maintain support of $ 229, a deeper correction may be followed. The fall below this level will be placed by 211 US dollars, and if the sale continues, Sol can slip below $ 200, checking $ 191.9.

The direction that Sle will accept in the coming days will largely depend on whether the EMA confirms the golden cross or begin to lean down, signaling further weakness.