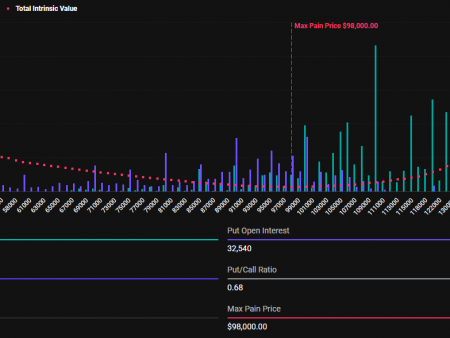

The price action of Litecoin (LTC) lagged behind two cycles, but ultimately became vertical to make up for the missed. The diagram confirmed repeated delayed jumps in front of huge breakthroughs.

In 2013, LTC grew from 2 to 50 US dollars after consolidation. In 2017, it grew from 4 to 410 dollars, again after the delay. The peak of 2021 at $ 410 did not reach previous cycles, but was still leveled with historical trends.

Currently, LTC is consolidated about 74 US dollars, signaling the accumulation before the breakthrough. If the story is repeated, LTC can first check $ 230, and then $ 760 before exceeding $ 2600 in the long run.

In the short term, prices were supposed to increase the impulse. The accumulation phase hinted at the upcoming strong rally.

If the cycles remained consistent, Litecoin surpasses expectations and is ahead of forecasts in the market in the next optimistic step.

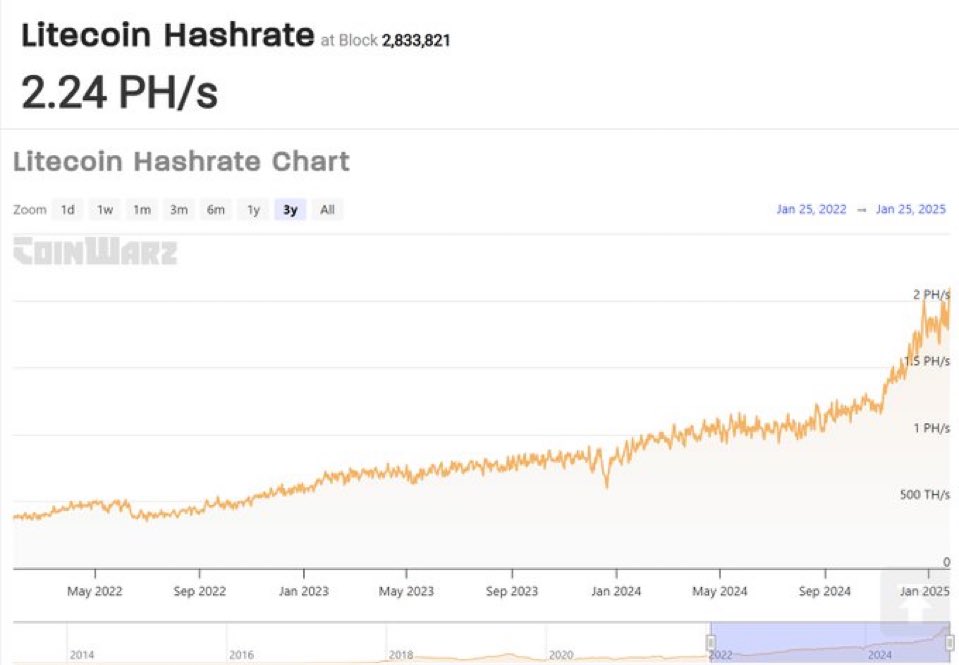

The price in Litecoin rolls out, as Hashrate is striking ath, increased ETF speculations

The Litecoin hashrat reached a peak at 2.24 ph/s, noting a record high level (ATH), which was demonstrating steady growth from the beginning of 2022, accelerating at the end of 2024.

Hashrat surpassed 1 ph/s by the middle of 2023, and then grew up 1.5 ph/s at the end of 2024.

This sharp increase showed a greater part in production production and network security along with an expanded attraction.

A higher hasrt often correlates with a price increase. LTC recently recently recovered after a decrease, and the growing hashrat signaling the trust of the miner.

ETF speculation fed bull sentiments. If the institutional percentage is growth, the price of LTC can be stabilized above the resistance levels.

The final statement of the ETF will lead to the immediate availability of the Litecoin market, which can maintain a constant increase in prices.

In the short term, the volatility of prices remains probable, since investors responded to ETF development. The long -term, steady growth of Gashrat assumed reliable health of the network, attracting investors.

If the impulse persists, LTC can benefit from the main adoption, pushing it to a stronger estimate of prices.

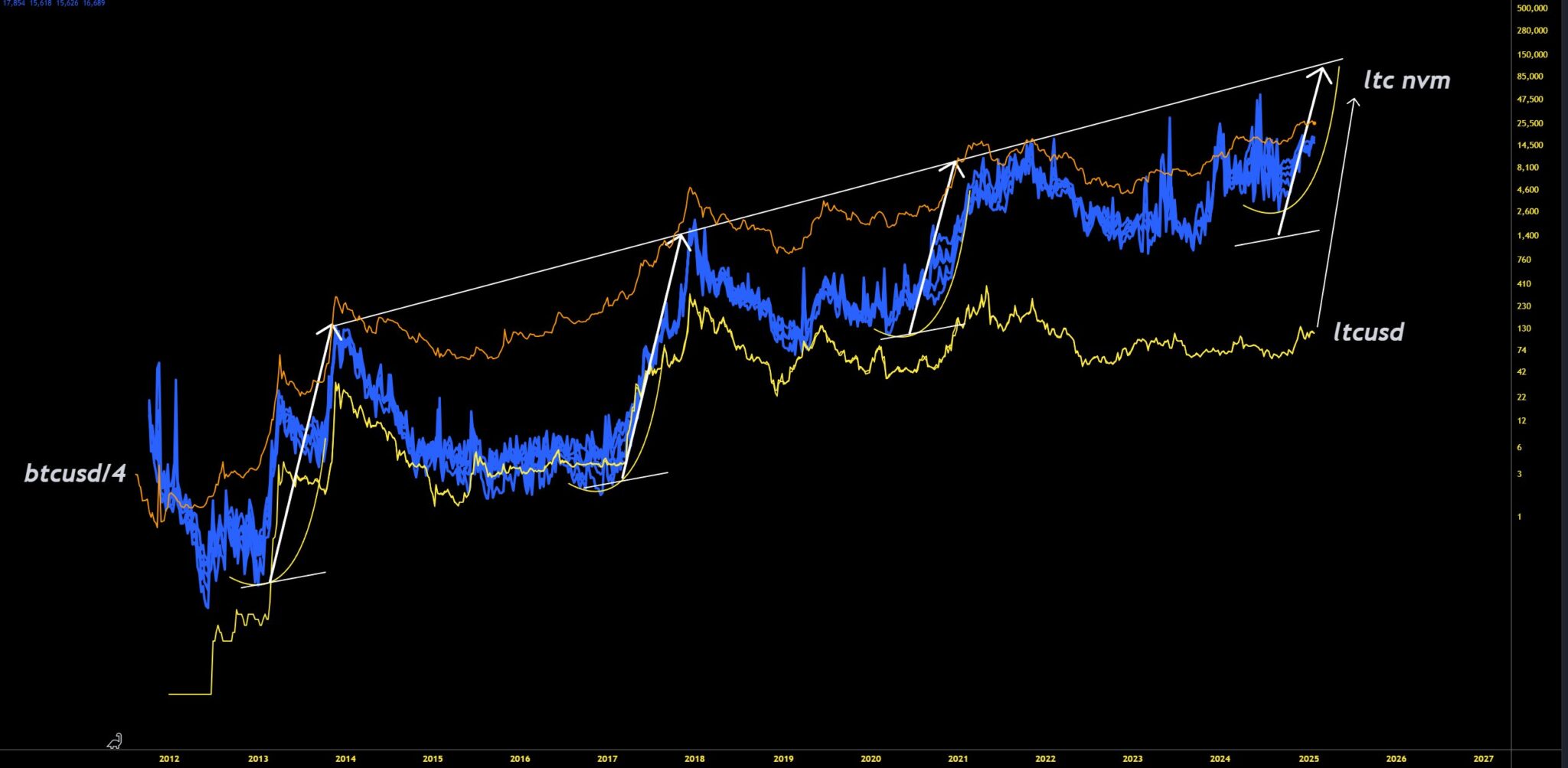

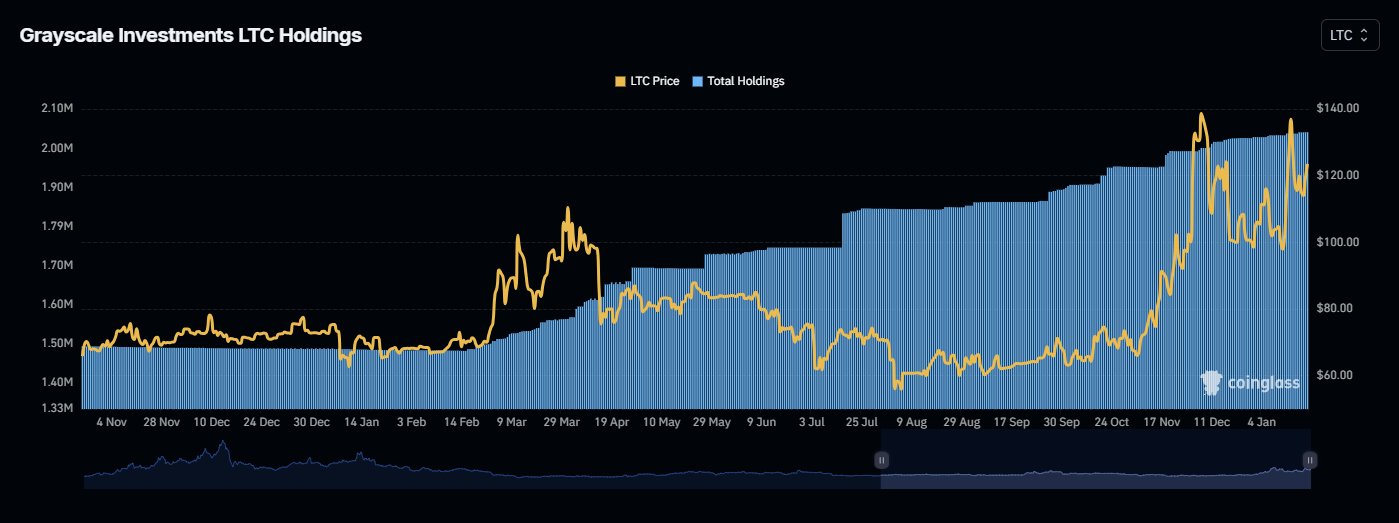

Graisscles LTC General possession increased sharply since February 2024

In February 2024, Greyscale Holdings increased from 1.4 m to more than 2.1 million until January 2025.

This accumulation signaled the strong institutional confidence in Litecoin. In March, the shares exceeded 1.6 m, reaching 1.9 million by mid -2024.

A sample purchase in Serom, followed the consistent stages of accumulation until the price spikes occurred.

The crowds steadily increased step by step in such a way that it resembled the institutional behavior of the purchase in previous periods.

The trend accelerated in October, which led to the record maximums in December. The price of Litecoin reacted positively, rising from $ 60 in September to $ 140 in December, before stabilizing about $ 120.

This sharp increase coincided with a growing institutional interest. In the short term, price fluctuations remained possible, since the ETF speculations influenced the mood of investors.

The successful launch of the ETF could put forward LTC above $ 140.

In the long run, prolonged accumulation of gray can strengthen Litecoin status as a key institutional asset.

If demand is preserved, LTC can achieve stable assessments and wider market acceptance, enhancing its relevance on crypto -markets.

This showed a direct relationship between an increase in the distribution and value assessment. Insufficient exams for accumulation showed the ability of Litecoin to maintain an increased price level.

Previous markets indicate that Litecoin prices will exceed $ 150, when demand retains its current levels.

Long -term institutional investors have demonstrated their confidence in the future of Litecoin by constant growth in their possessions.