When Bitcoin survived the US $ 100,000, wallets with long inactive are awakened, their mysterious microtransactions light the theories about whether the elusive parties are performed by trial runs or to disguise more grandiose financial maneuvers.

Bitcoin translations the size of dust sometimes precede hidden programs of wealth

Over the past few months, the blockchain data has been revealing a curious resuscitation of idle coins, which coincides with the violation of bitcoins in a six -digit stage. As a rule, these wallets move all their caches from addresses untouched for many years.

Nevertheless, recently a subset of the simple pieces of their vintage reserves of BTC has been replaced by a tactic that could offer efforts by a significant redistribution of capital or repeated transactional mechanics.

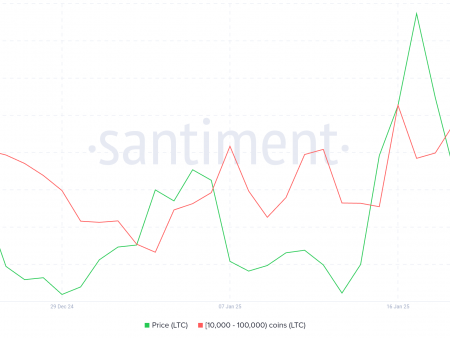

Over the past three months, the analytics emphasizes the amazing revival of the so -called “sleeping bitcoins” after the BTC scaled a historical assessment. Only in January 2025, 18 wallets, which since 2014 have not eliminated their assets for the first time.

Parallel numbers from BTCPARSER.com show 18 transactions associated with the wallets of the 2017 era this month. Among these aging storage facilities, a curious trend in surfaces: trivial translations of dust, in the visible one, are crowded with higher cash shifts.

Another plausible explanation? These fractional exchanges can serve as dry runs for fresh wallets. For example, last month, the user spent 0.50 BTC at the height of the block 873.138-Summa is unlikely to be insignificant, but the 2011 wallet fought a much larger section, ultimately moving 12.45 BTC ($ 1.2 million).

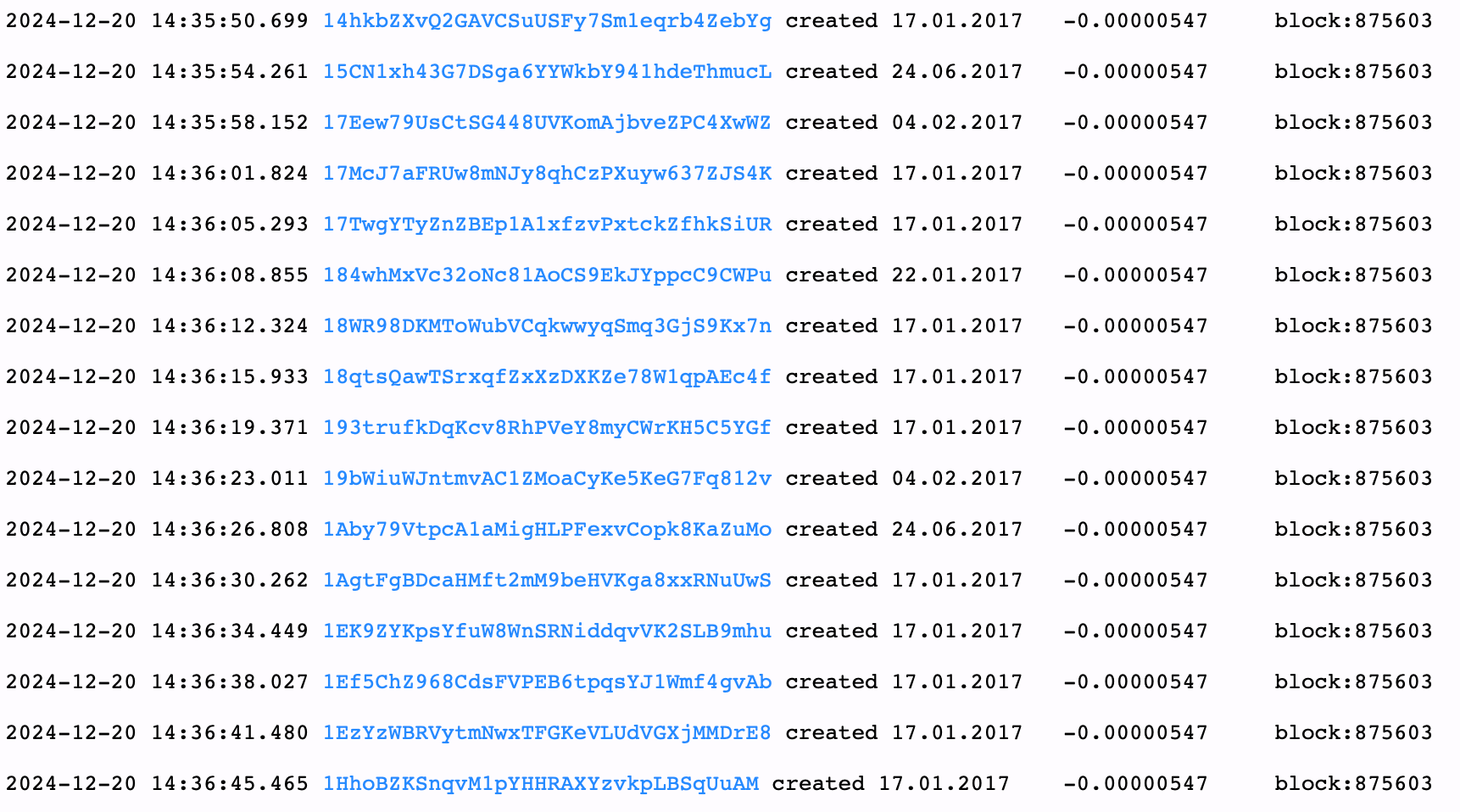

What is even more exciting? The address quietly accumulated 138.54 BTC from the moment of its creation. In the episode on December 20, 2024, an enterprise was shown at 0.00000547 BTC of 19 different wallets of 2017. While blockchain trackers noted 19 microtransactions, the actual shift of the capital was much more severe: 99.99 BTC.

This veiled transaction tactics spread in 2025, and minor translations mask the liquidation strategies. Consider December 12, 2013 a wallet, which completed the transaction 0.00101906 BTC on January 5, 2025 – only for genuine exchange included 19.99 BTC.

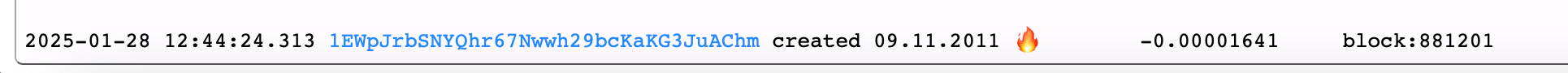

A few days later, the 2014 wallet is at 0.00106694 BTC publicly, but in total, it shuffled 48.7 BTC. By January 20, a set of four bitcoin -pots of 2014 in each sent microscopic amount, but in the aggregate transferred 40 BTC. Finally, on January 28, a wallet of the 2011 era initiated the BTC transaction 0.00001641, again masking a more voluminous financial ballet.

It is well known that trial runs can be preceded by serious transactions, ensuring seamless execution with minimization of exposure. As an alternative, these microflas can hide intentions, complicating the observation of the blockchain, mixing significant actions as a result of trivial noise. Fractional transactions strategically monitor fractures, mask larger capital redistributions or liquidation plans.

By disposing of activity in the framework of the size of dust, organizations can avoid the attention of the market, suspension of volatility or protect anonymity. This dexterity of the hands can also signal the encoded coordination between the interested parties, balancing caution with preparations for more careful, highly effective financial maneuvers.