The price of Cardano struck last week, falling by almost 10%. While the wider cryptocurrency market also has a decline, the price of ADA may largely be associated with a significant decrease in the activity of the whale.

With installation pressure of sales, the coin is on the way to reaching a 30-day minimum. This analysis describes in detail why.

Cardano whales reduce the purchase

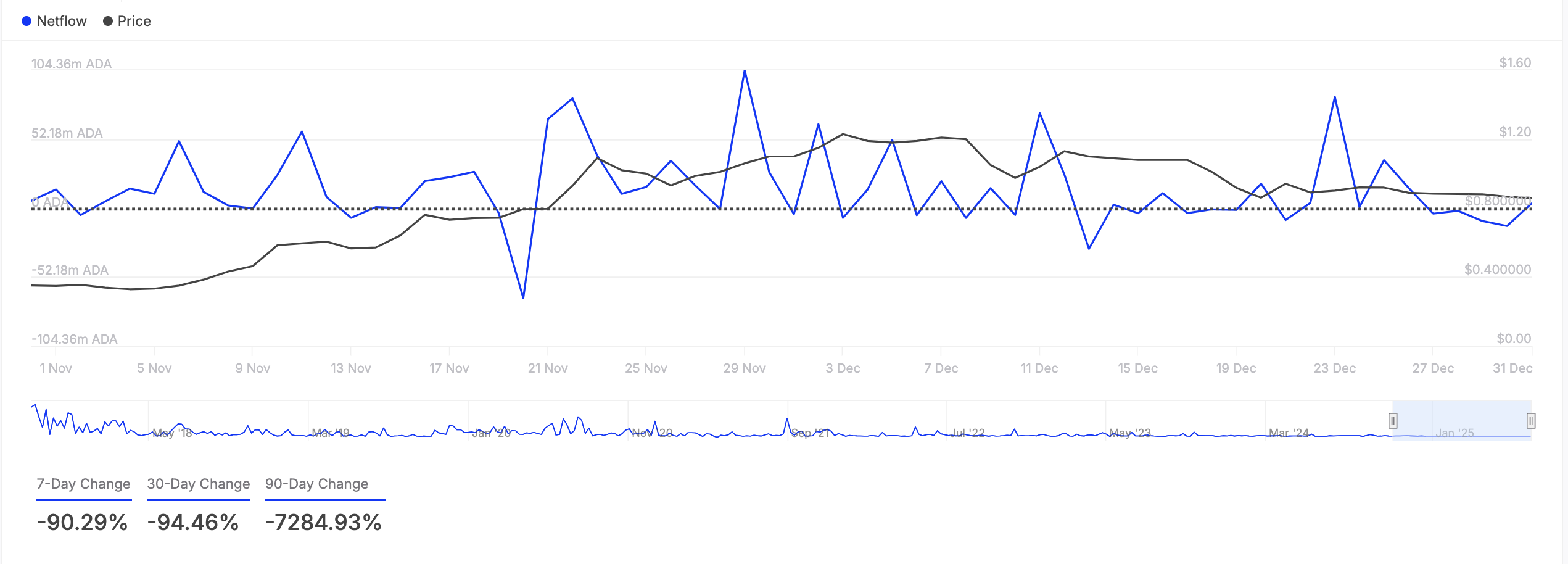

According to Intoleblock, over the past seven days, Netflow Cardano large Cardano holders dropped sharply by 90%. Large holders are the addresses of whales that contain more than 0.1% of the circulating asset supply.

Netflow large holders measures the balance between coins moving into wallets for whales and from it, which indicates their activities to buy or sell. When this indicator falls, this indicates that whales sell large parts of their assets, which leads to an increase in supply and potential reduced pressure on the price.

This decrease in Kitov Netflow can signal the weakening of trust for the ADA retail traders, prompting them to also sell their coins in anticipation of further losses or does not dare to buy against the backdrop of uncertainty. This can accelerate ADA price reduction, especially if feelings associated with profit are spreading on the market.

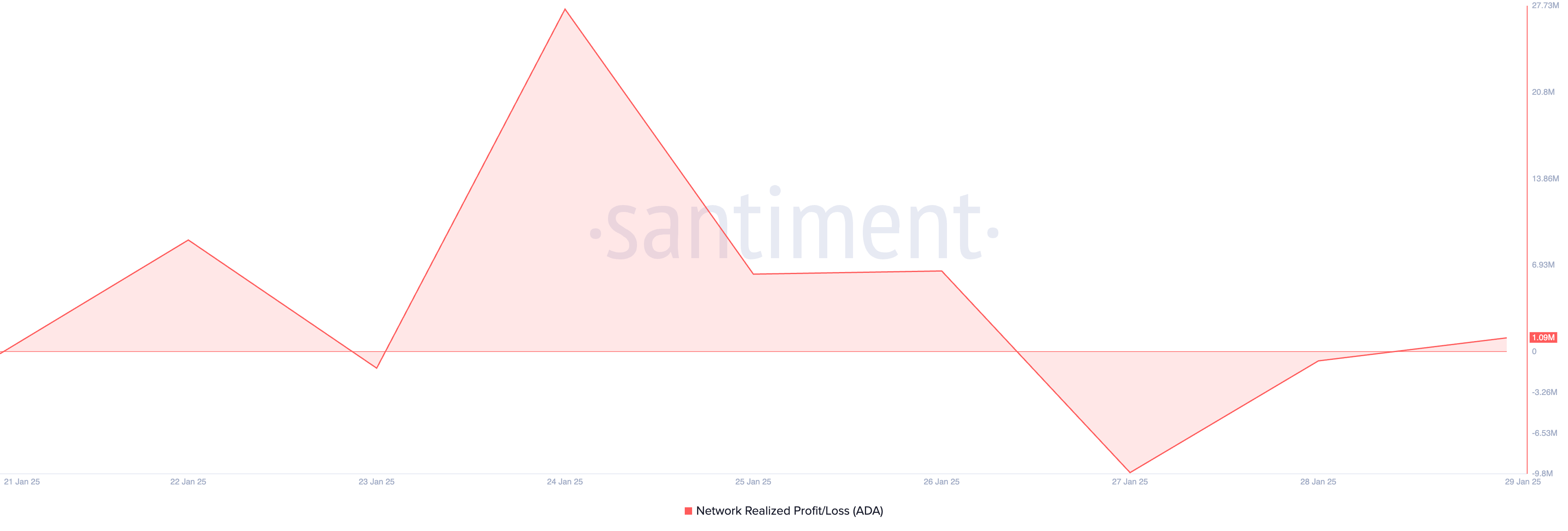

It is noteworthy that this sense of profit is not limited only by ADA whales. Indications on the network from the network of coins implemented a profit/loss (NPL) confirm the surge of the market in sales.

According to the centimepers, after several days of returning the negative values, ADA NPL published a positive value on Wednesday, which indicates that its owners are selling with profit.

The NPL coin measures the difference between the price at which the asset was last postponed or sold and the current market price. He tells us how profit or loss is “realized” by its owners.

When the NPL asset is positive, more investors are sold with profit than in losses. This sale can lead to an increase in the supply in the market, which can lead to a drop in the price of the asset if the demand does not correspond to the sale.

ADA price prediction: Can Altcoin reach a 30-day minimum?

The ADA lifted relative force index in the daily diagram confirms the surge in the sale of activities. During print, it costs below the line 50 centers of 45.49.

The pulse indicator measures the resold and overwhelmed market conditions of the asset. It ranges from 0 to 100, and the values of more than 70 indicate that the asset is overdue and the correction may be attested. Conversely, the values below 30 indicate that they are resold and are subject to rebound.

In 45.49 and down, RSI ADA suggests that the pressure on the sale increases, but the coin is not yet in the resold territory, leaving a place for further decrease.

If this price remains, ADA can fall to a 30-day minimum of $ 0.82. On the other hand, a shift in market trends in the accumulation of coins will deprive this bear projection. In this scenario, the price of Altcoin can be ascending above $ 1.