In recent days, SOLANA (SOL) Price has experienced significant volatility, since it is faced with key technical problems. After reaching a new record maximum on January 19, Sol retreated by 14.5%, although over the past seven days it retains 16.7%.

Technical indicators suggest that a strong upward trend loses the impulse, and the key levels of support and resistance can determine the following basic price movement. The growing number of addresses of whales occupying great positions SOL indicates a strong institutional interest, despite the recent price correction.

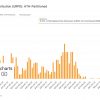

Sol-kits reach the level of all time

Solana -kits reached historical levels, and addresses that are held by more than 10,000 people reached a peak by 5137 three days ago, before slightly reduced to 5128.

The tracking of these large holders is crucial for the analysis of the market, since whales can significantly affect prices through their trading decisions and often represent institutional players whose actions can signal the wider market moods and potential price trends.

The current lifting number of whales, which jumped from 5,054 on January 17 to 5128 in just six days, implies strong institutional confidence in SOL, despite a slight recent decrease.

This quick accumulation of large holders can indicate a positive price impulse for Solana. Nevertheless, investors must still be aware that concentrated assets also risk increasing volatility if whales take coordinated steps.

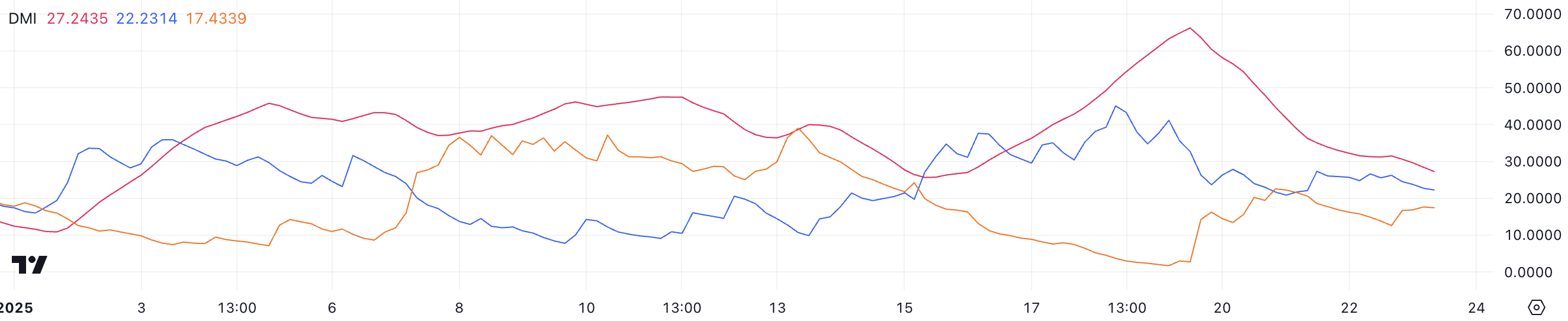

SOLANA DMI shows that the tendency loses its pair

Since Sol Price recently for the entire time, the average direction (ADX) for SOLANA has sharply decreased from 66.2 to 27.2 over the past four days.

ADX measures the strength of the trend, regardless of the direction, and the indications above 25 indicate a strong trend and below 20, which indicates a weak trend. The current 27.2 testimony shows that the trend is still strong, but significantly weakens from its recent extremely strong levels.

A decrease in +di (a positive directed indicator) from 26.2 to 22.2 along with an increase (negative direction indicator) from 12.5 to 17.4 suggests that the pulse is changing. While SOL remains in the upward trend, these DMI components indicate that the sale pressure increases when the purchase pressure decreases.

This technical setting often precedes the period of consolidation or potential changes in trends, although the current ADX readings above 25 indicates that the upward trend still remains some strength.

SOL price forecast: will SOLANA reach 300 dollars in January?

The narrowing distance between the EMA SOL lines, while maintaining their bulls alignment (short -term above long -term), usually signals a reduction in the pulse in the ascending trend.

This model often involves the potential period of consolidation or price correction, although the supported bull structure indicates that the general upward trend has not yet broken.

Technical analysis shows critical support and resistance levels that can determine the short -term SOL direction. A break below $ 223 can cause a cascade to 211 US dollars, and the further potential for reducing to 191.85 US dollars, if these supports fail.

And vice versa, the restoration of a bull impulse can lead to Solan Price to $ 295, with a potential breakthrough above $ 300 noting a historical milestone.