Analysts of cryptocurrency from the report of Coinidol.com, the price of bitcoins (BTC) increased above the lines of the sliding medium after a strong rebound.

Bitcoin price long -term forecast: bull

The largest cryptocurrency grew above the sliding medium lines and crossed the mark of $ 100,000. Nevertheless, up the impulse was stopped at 104,000 dollars. On January 20, the impulse continued to increase, exceeding the mark of 104,000 US dollars and reaching a maximum of $ 109,590. Nevertheless, the BTC price was again pushed back to a maximum of $ 109,590 and fell much higher than the support level of $ 100,000.

Today, bitcoin is trading above the lines of the sliding medium, but below the resistance level of $ 104,000. The largest cryptocurrency is currently growing up. If buyers overcome the resistance of the maximum of $ 116,000. However, if buyers cannot Ance level $ 104,960 and $ 108,000, Bitcoin can re -overcome resistance levels, Bitcoin will be forced to trade in the range above the lines of the sliding medium.

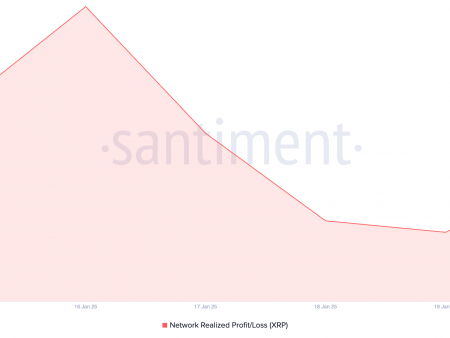

Reading the bitcoins indicator

Bitcoin is expected to grow, since the price rods exceed the sliding medium lines. Nevertheless, January 20, a long candlestick indicates a maximum of $ 109,000. A long background wick indicates significant pressure on sale in a maximum of $ 109,000. On the 4-hour diagram, Bitcoin gets between the lines of the sliding average, which indicates the movement in the range for cryptocurrency.

Technical indicators:

The resistance level of the key resistance is $ 90,000 and 110,000 US dollars

Key support levels – 70,000 US dollars and 50,000 US dollars

What is the next step for BTC/USD?

The 4-hour diagram shows that Bitcoin was trapped above 50-day SMA support, but below the 21-day SMA resistance. Bitcoin will fall if the bears break the 50-day SMA. Bitcoin will fall and re -test support of $ 90,000. On the other hand, Bitcoin will resume his ascending trend as soon as it breaks above the 21-day sliding average. Current vibrations will continue if the 21- and 50-day SMA remain continuous.

Refusal of responsibility. This analysis and forecast are the personal opinion of the author. They are not a recommendation to buy or sell cryptocurrency and should not be considered as approval of Coinidol.com. Readers must conduct a study before investing in the funds.