The price of Chainlink continued its upward trend, reaching its highest level since December 18 after the Donald Trump’s World Liberty Financial acquired more coins and the exchange balance reduced.

Chainlink (link) increased to $ 26.87, which is 46% compared to the lowest level this year, as a result of which its market estimate is up to 16.7 billion dollars. USA.

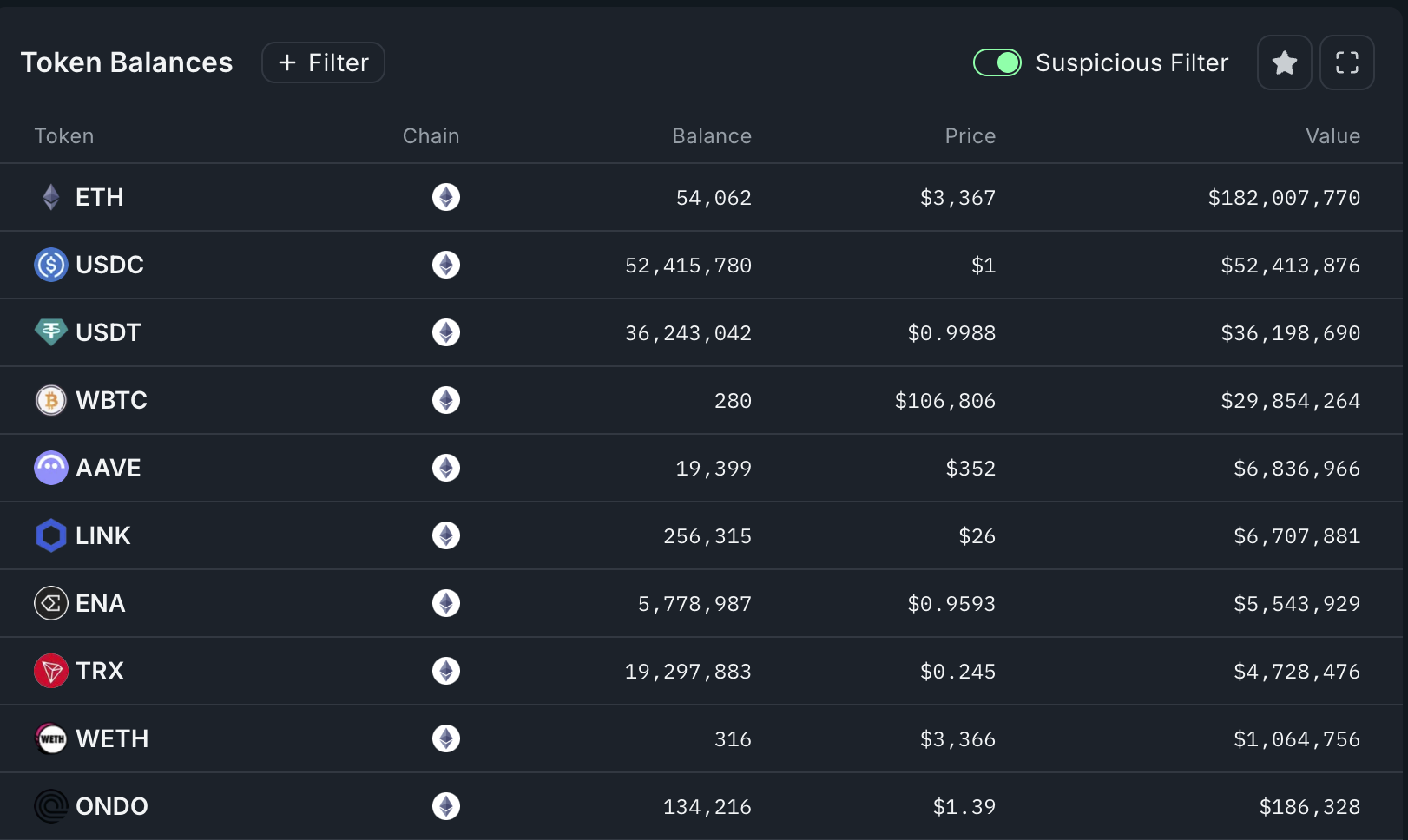

Nansen data showed that the World Liberty Financial, widely known as WLFI, acquired additional tokens of links in the amount of $ 4.6 million. Currently, WLFI owns ChainLink tokens in the amount of more than 6.6 million dollars. USA.

WLFI also owns Ethereum (ETH) tokens in the amount of $ 179 million, along with other assets such as USD, Tether, wrapped bitcoin, AAVE, ETHENA and Tron. The total cost of the WLFI portfolio exceeds $ 322 million.

Trump’s presidency can positively affect these tokens, since his administration will control the regulatory events. Trump has already created a crypto -consulting council and appointed Atkins Paul to head the securities and exchanges commission.

For example, the SEC can potentially approve the ETF Spot Link ETF if companies are applying for financial services.

The price of Chainlink also jumped after the founder of Cardano (ADA) Charles Hoskinson hinted at potential cooperation. In his statement, Hoskinson said that one of his goals for the year is to establish more partnerships and confirm that he ensured a meeting with a chain.

Cooperation could ensure that Cardano and Che Chainlink work together in sectors such as decentralized tokenization of real assets.

Now that we have management very well, this year I am going to focus on three large topics for Cardano:

1) Bitcoin Defi on Cardano (the market is 4 times larger than Ethereum and Solana combined)

2) 24/7 work on scalability, including leios

3) make a cardano …– Charles Hoskinson (@iohk_Charles) January 18, 2025

Meanwhile, there are signs of larger number of taxes that leave exchanges. Data from Coinglass show that the balance of chain line exchange continues to fall, reaching its lowest levels from December 20.

Price analysis

Daily schedule offers further growth in the coming weeks. Link broke above the decisive level of resistance in the amount of $ 22.87, maximum March 2024, and the upper boundary of the cup and the drawing of the pen.

Chainlink also rose above the upper part of both the falling wedge and the circuit of the bull flags, which are very optimistic indicators. Based on the C&N template, the coin will probably be aimed at $ 37. The goal of profit for this scheme is calculated by measuring the depth of the cup and projecting at the same distance up from the breakthrough point.