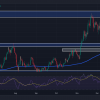

Native Token Cardano, ADA, shows the strong signs of a possible bull breakthrough in the near future, as evidenced by a detailed technical analysis of its market structure. The diagram emphasizes the clearly defined wave of Elliotta, starting with a five-wave impulse (1-5), followed by the adjusting phase ABC. Correction at the level of 0.76 US dollars, forming a reliable support base.

From this moment, ADA initiated a new bull -free wave cycle, and the wave 1 raised about 51% to $ 1.15, and the wave was processed 2 $ 0.87, which is closely related to the recovery level of 0.236 Fibonacci – 0.89497 Dol. USA. ADA cryptocurrency forms a wave 3 during printing, hinting at the upward movement.

Another vital feature in the analysis of the structure of the Cardano market is the formation of a bull penete, a template formed by converging trend linins, which occurs when the consolidation phase should be a sharp increase in prices. As a rule, after the price comes out of the formation of a pennant, this model hints to continue the previous upward trend.

With the cryptocurrency of the ADA, approaching the top of the extinct triangle, a breakthrough appears in the near future. Moreover, the predominant trend and strong structure of support from the Elliott wave and the pattern of Vympel prefer optimistic resolution. Nevertheless, the probability of a bear rupture below the support zone in the amount of $ 0.8947 remains risky.

Cardano (ADA) key resistance and support levels

According to the structure of the cardano market, token has a vital support zone marked by green in the range of 0.90 and 0.82 dollars, where customers constantly intervened to avoid further shortcomings. This area corresponds to the level of the recovery of Fibonacci 0.236, increasing its importance as a strong floor for the price of token.

On the other hand, the resistance zone is about $ 1.24 and $ 1.32, which coincides with the expansion of 1.0 Fibonacci, was identified as a key barrier. Historically, ADA cryptocurrency faces the pressure of sale at this level, which makes it a critical point of observation.

If the token breaks this resistance, the levels of the Fibonacci expansion at 1.272 ($ 1.4799) and $ 1.414 ($ 1,597) represent possible bull goals, which involves a profit by about 31% to 59% of the current levels. Nevertheless, in the bear scenario, the breakdown below the support zone for $ 0.8947 can push the token to revise a lower level of support at 0.76 US dollars, denying the prospects of the bull.

Metrics in the chain favors ADA Breakout optimism

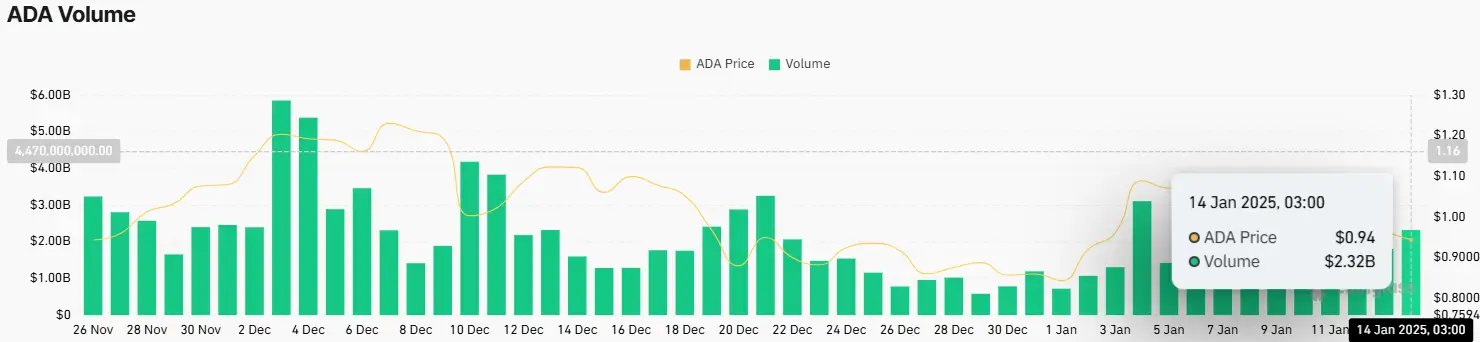

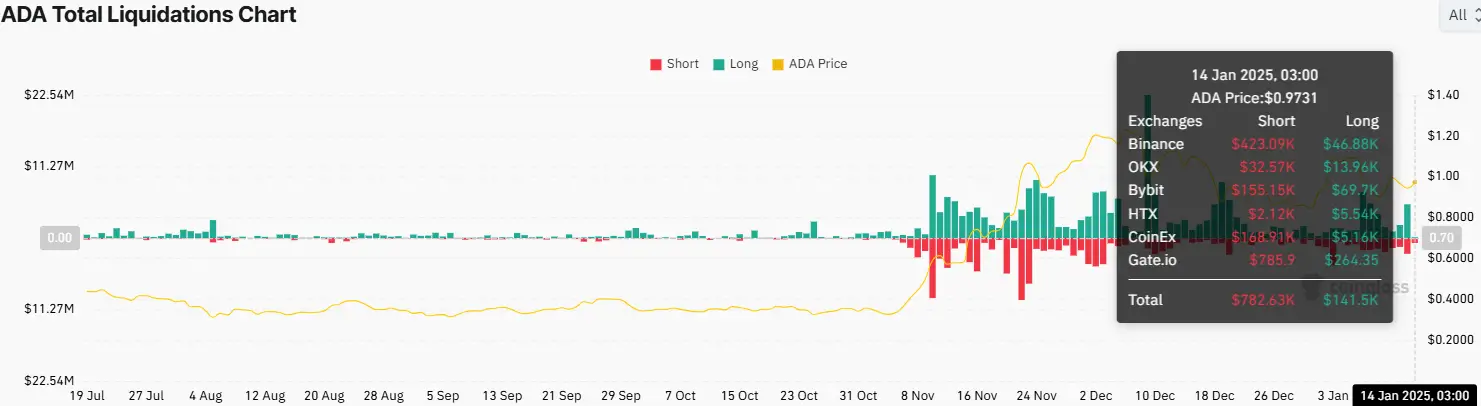

On the chain The data additionally strengthen the impending bull forecast. This is obvious, since the volume of cryptocurrency derivatives increased by almost 30% to the mark of 2.32 billion dollars. The USA, which indicates a rising percentage and the possibility of further prices. Data on liquidation additionally confirm the growing market impulse.

During the press, short positions liquidated on large exchanges, such as Binance, OKX and BYBIT, amounted to approximately $ 782,000, compared with only $ 141,500 during a long liquidation.

This imbalance suggests that bear traders are increasingly forced to get out of their positions, potentially contributing to increasing the pressure on the price of the ADA, since the market leans to optimistic.

Also read: Bitcoin price for Crossroads: Will Bulls ride a rally of 100 thousand dollars?