Can switching of ordinary income income convey your promises against the background of growing problems?

The income switch, a mechanism intended for the distribution of 100% of ordinary (conventional) revenues of the protocol for ordinary flocks, was launched by the usual token and the creators of the USD0 ecosystem. Although this initiative marks a significant step forward for decentralized finances, its debut is accompanied by constant community problems regarding recent changes to the protocol redemption function.

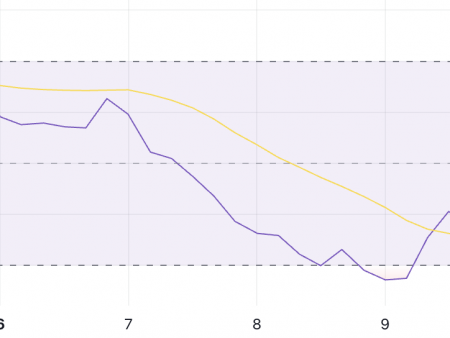

Activated on January 13, 2025, switching revenue allows the Rakualx Stakers to receive revenue received according to the protocol is estimated at 5 million dollars per month, directly in USD0. This mechanism connects the value of token with the actual income, trying to stimulate long -term disposal and maintain a steady growth of the protocol.

Starting from today UTC+0, the income switch was activated for ordinary holders. Those who occupy their usual positions during this week will have the right to distribute income last week.

More information here and on DAPP: https://t.co/syodywhxw5

1: 1 …– ordinary (@usualmoney) January 13, 2025

As of January 14, 2025, a conventional token is traded at $ 0.5319, with market capitalization of $ 275.68 million. USA and a 24-hour trade volume of 194.6 million US dollars. Approximately 36.53% of token proposals become steel, which offers an annual income of 275%, 42% in USD0 remuneration and 233% in the usual.

Despite the excitement associated with switching income, the protocol was criticized by his decision to update the repayment function for USD0 stablers. The new function provides a temporary suspension of redemption under certain conditions, such as periods of market volatility or liquidity restrictions. Although the usual explained that this change is intended to maintain stability in extreme scenarios, it caused concern about the concentration of control and potential consequences for decentralization.

The introduction of income switching and adjustment into the repayment function forms part of a wider strategy for conventional support for their position as a leading Defi protocol. The income switch is aimed at increasing the utility of conventional tokens, stabilization of income for flocks and provide a transparent mechanism for the distribution of income. The usual also indicated plans to clarify his model in the coming months, including the framework of expanded styling and management, inspired by the “Vemodel” used in other Defi projects.

As ordinary navigation on these events, the success of income switching can serve as evidence of the concept of tokenomics based on income, potentially affecting future practices in this sector. At the same time, the reaction of the protocol to the problems of the community will carefully monitor how it can affect trust and adoption in an increasingly competitive Defi ecosystem.