Bitcoin (BTC) began January 2025 with the perspective of the bull, which was subsequently turned into the bear, which brought uncertainty in the market. Then Finbold studied Bitcoin historical income and price models to predict a potential goal for January 31.

Earlier, BTC closed in December and November 2024 from loss of 2.85% and 37.29% of the profit, respectively, after the expected results.

In November, we published a BTC price forecast aimed at the monthly closure between 75,275 to $ 100,334, while the leading cryptocurrency is traded at 69,495 US dollars. Bitcoin closed on November 30 at the price of $ 96,451, confirming the method.

Nevertheless, the results in December became a little worse than predicted, missing our predictable range $ 94,782 and $ 101,273. The BTC closed at 2024 at $ 93,401, but still within the framework of the now adjusted historical median in a month.

Bitcoin Historical Profit in January since 2013

As January develops, Finbold again removed the data from CoinglassCalculation of the average and average historical yield of bitcoins for each month.

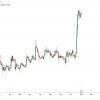

It is noteworthy that the monthly BTC performance in January, starting in 2013, scored an average of 3.06%. Nevertheless, with six negative years out of twelve, January also has an average yield minus 0.04%. These return are measured from the opening to the closure or from 1 to 31 January.

For example, the historical January Bitcoin was in 2013, increasing by 44.05%. Something similar also happened in 2023, from 39.63% of profit after 3.59% of the 2022 decap.

Conversely, 2015 was the worst year in January after one of the worst in December the annual performance in 2014, with -33.05% and -15.11%, respectively. In general, there is no noticeable correlation between historical income in December and January in December and January.

Price forecasting (BTC) until January 31, 2025

At the time of writing this article, Bitcoin is traded at 91,150 dollars, lower than the closing price of December 2024 and the opening of January 2025.

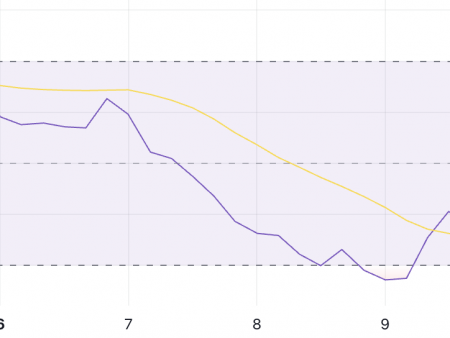

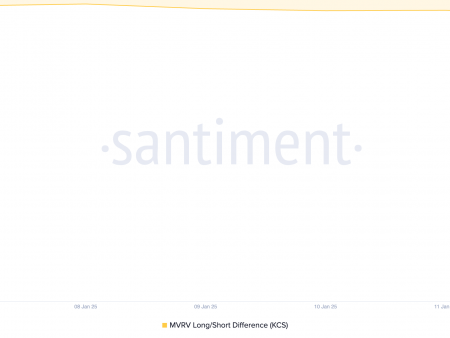

The leading cryptocurrency is currently experiencing significant short -term losses, bringing a bear mood to its traders, despite the impressive results in annual calculus.

Based on its historical profitability and January 1 in the amount of $ 93,401, BTC can be traded between 93 027 US dollars and $ 96,259 By January 31. The Bitcoin price forecast project from a monthly discovery using medium and average historical profitability if the BTC retains its scheme.

In the meantime, crypto and stock trader JelIndicates the testing of bitcoins, strong support for the seventh time, offering upward movement.

There we go – #Bitcoin re -test the key level for the seventh time.

Until now, it has been well protected.

Can bulls protect this again? pic.twitter.com/lzx7kjdjnn

– Jelle (@cryptojellenl) January 13, 2025

Nevertheless, forecasting the price of bitcoins is difficult, and even long -term historical results cannot guarantee convincing goals. The price action of the BTC will depend on the dynamics of the demand and supply market, which can affect the microeconomics.

Shown image from Shutterstock